14.11.2025 - Daily Cocoa Market Report

Daily cocoa market analysis and news covering ICE futures, Ivory Coast & Ghana supply, weather outlook, certified stocks, Harmattan risk, and next-day trading expectations.

Cocoa ended the week sharply lower on both exchanges as U.S. policy triggered a structural re-pricing in New York futures. The move was not technical drift, not liquidity noise, and not speculative panic — it was a fundamental adjustment in how the U.S. market values imported cocoa.

NY futures collapsed because the tariff premium disappeared.

London fell because sentiment is terrible, but without the tariff linkage, the drop was milder.

At the same time, physical market dynamics moved in the opposite direction:

- Ecuador differentials rose ~+$500/tonne this week.

- Terminal prices fell –$489 through Thursday and another –$179 Friday.

Tariff lifting is bullish origin and bearish terminal — and this week proved it.

Futures Performance

New York (ICE US)

Mar 2026: $5,430 (–179)

Dec 2025: $5,147

May 2026: $5,492

Jul 2026: $5,595

Weekly change:

Last Friday: $6,133

This Friday: $5,430

Weekly loss: –$703 (–11.5%)

The contract broke decisively below the support zone at $5,600–5,700 and briefly traded into the $5,29x area intraday. Bears controlled every bounce.

London (ICE EU)

Mar 2026: £4,093 (–39)

Dec 2025: £4,062

May 2026: £4,095

Weekly change:

Last Friday: £4,419

This Friday: £4,093

Weekly loss: –£326 (–7.4%)

London remains weaker technically, but not capitulating the way New York is.

NY–London Spread

- NY Mar: $5,430

- UK Mar: £4,093 ≈ $5,280 (FX ≈ 1.29)

NY premium: ~+$150

The brief inversion seen earlier this week was purely a tariff shock.

With the correct CLOSE# applied, structure is normal:

New York trades richer than London, as it should.

Technical Analysis

NY cocoa remains deeply oversold, but still in a strong downtrend:

- Price below 10/20/50/200-day MAs

- Below lower Bollinger Band

- RSI and stochastic pinned in oversold zones

- Curve in contango — no fear of nearby supply

- Every rally sold aggressively by funds

London mirrors the pattern but with less velocity, signaling that most macro pressure is concentrated in NY.

Volume & Positioning

The market sold off with size, not weakness.

Volume

- NY: 55,524 lots (highest of the month)

- London: 48,988 lots

COT (ICE Europe – 11 Nov)

Managed money:

- Long: 6,657

- Short: 24,270

- Net short: ~17,600

Specs remain heavily net short and continue to press momentum.

This is both bearish short-term and bullish medium-term because it increases the eventual short-covering potential.

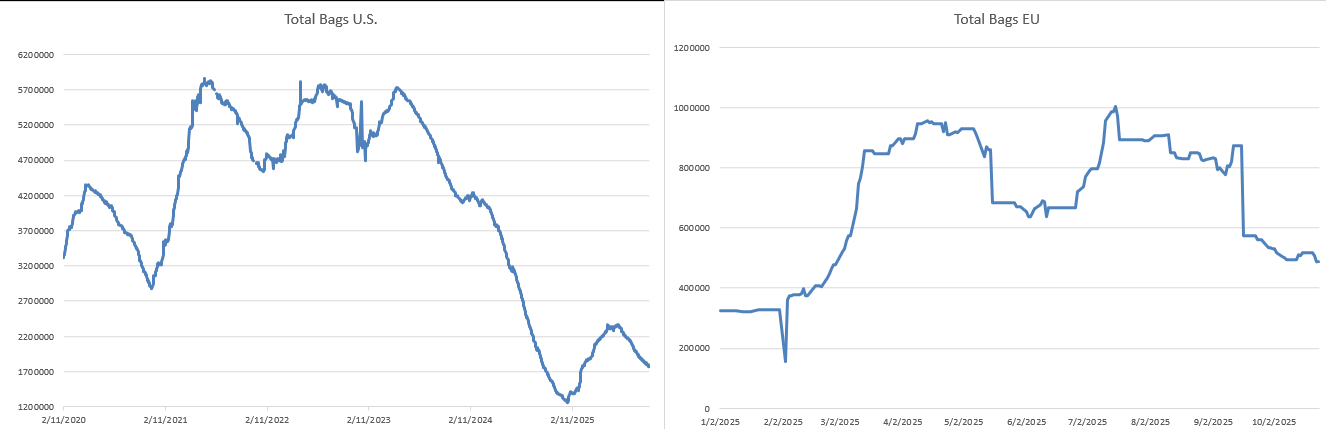

Certified Stocks

United States

- This Friday: 1,766,644

- Last Friday: 1,800,805

- Weekly change: –34,161 tonnes

A modest draw, but still extremely high.

No urgency in nearby supply.

United Kingdom

- This Friday: 532,500

- Last Friday: 500,313

- Weekly change: +32,187 tonnes

A substantial inflow — undeniably bearish.

Combined message:

Stocks paint a picture of comfort, not stress. The market is nowhere near a shortage.

Macro & Policy Drivers

The cocoa market spent the entire week reacting to one headline: Washington’s decision to roll out tariff exemptions for a group of Latin American exporters. It was not a minor regulatory adjustment. It effectively removed the long-standing premium New York cocoa futures carried to compensate for U.S. import tariffs, and traders instantly repriced the NY board to reflect a world where those taxes no longer exist.

Officials in the U.S. confirmed that products not produced domestically — explicitly including coffee, cocoa and bananas — would be exempted under new agreements with Argentina, Ecuador, Guatemala and El Salvador. The reaction in New York was immediate. The steepest part of cocoa's decline began the moment this policy shift hit the tape, and even experienced traders admitted the speed of the drop was sharper than expected. The logic is simple: New York no longer needs to trade above London if the tariff premium disappears. The relationship between the two markets snapped back accordingly, with NY falling harder and deeper, and London drifting lower in sympathy.

The policy change has also redrawn the competitive landscape among origins. Ecuador, already the world’s third-largest cocoa producer, is emerging as the largest beneficiary. With tariffs lifted, Ecuadorian beans suddenly become more attractive to U.S. importers, and that advantage showed up instantly in differentials. Ecuador’s country differential surged by roughly $500 per tonne this week — an enormous move in such a short period — while terminal prices sank by nearly the same amount. The market is now pricing in a world where Latin American supply gains relative ground while West Africa, excluded from these exemptions, loses pricing power.

For Ghana and Ivory Coast, the timing of this shift is brutal. Both are already dealing with small crops, debt-laden marketing boards and domestic political pressure to maintain high farmgate prices. The last thing either country needed was a structural discount applied to their principal export market. Yet that is the new reality: tariff relief makes Latin American beans relatively cheaper, and the futures market in New York must adjust downward to reflect that fact.

Speculators seized on this fracture and expanded their short positions aggressively. The combination of a regulatory shock, structurally bearish sentiment and comfortable certified stocks provided the perfect environment for funds to press volatility lower. This is no longer a technical drift downwards; it is a fundamental repricing of New York cocoa in a post-tariff world.

Policy Impact Brief – How U.S. Tariff Cuts Will Influence Cocoa Prices

The U.S. decision to remove tariffs on more than 200 food imports — including cocoa-related items — is now one of the most consequential policy moves for the cocoa market this year. Although the announcement was framed as an anti-inflation measure, the direct effect is a structural repricing of New York cocoa futures and a significant shift in global trade competitiveness.

The most immediate impact is the compression of the U.S. cocoa tariff premium. New York futures historically trade at a richer level than London in part because of the additional costs associated with importing cocoa into the U.S. Removing those tariffs eliminates one of the price cushions embedded in ICE US futures. The market reacted accordingly this week: New York fell harder and faster than London, realigning the cross-market relationship with astonishing speed.

Latin American exporters — particularly Ecuador — are positioned to gain the most. With tariff barriers lowered, Ecuadorian cocoa becomes more competitive into the U.S. market. That advantage emerged instantly in origin pricing: Ecuador’s country differential surged by roughly $500 per tonne this week, even as terminal prices fell sharply. This is a textbook example of how tariff changes split the market: origin prices rise; terminal futures fall.

For West Africa, the policy shift is poorly timed. Ghana and Côte d’Ivoire are already struggling with structurally high costs, shrinking production, and political pressure to maintain elevated farmgate prices. Being excluded from the new U.S. tariff exemptions means West African beans now enter the American market at a relative disadvantage, squeezing the boards’ ability to compete on price just as global arrivals begin to improve.

Speculative positioning amplified the adjustment. Funds added significantly to net shorts immediately after the policy announcement, interpreting the shift as a durable change in the cost structure of U.S.-denominated cocoa. With certified stocks still statistically comfortable and weather largely neutral in the short term, the path of least resistance for futures was lower.

The net effect is clear:

Tariff relief is structurally bearish for New York cocoa, modestly bearish for London, and bullish for Latin American differentials.

It lowers the long-term floor under U.S. futures prices, alters competitive hierarchies among origins, and forces traders to recalibrate spread relationships across the curve. Until either weather risk re-emerges or arrivals begin to disappoint materially, cocoa will continue to trade with a macro-policy anchor rather than a field-based one.

West Africa Supply & Origin Developments

Ghana Export Earnings Surge

Ghana’s cocoa export earnings rose 158% to US$2.56 billion, supported by last season’s price explosion.

But:

- Farmer costs remain high

- Tree mortality is rising

- Smuggling weakens domestic availability

- COCOBOD debt continues to grow

The revenue boom does not fix structural weakness.

EUDR & Forestry Support

The EU will help Ghana restore 5,000 hectares of forest.

This is long-term bullish for compliance, but irrelevant for near-term supply.

CRA Weather & Climate Assessment

While the market’s attention has been glued to Washington and the tariff-driven collapse in New York futures, the underlying weather story in West Africa continues to evolve quietly — and not entirely in reassuring ways. Cocoa-growing regions in Côte d’Ivoire have seen rainfall patterns that are neither alarming nor ideal. The southwest has received adequate moisture, even to the point of localized flooding in some pockets, but the north and central zones have trended toward lighter rainfall. As CRA notes, satellite-based ERA5 estimates often overstate rainfall relative to ground-level Veriground stations, meaning the official maps look wetter than farmers actually experience.

What matters more than total rainfall is what the latest crop survey revealed: pod setting, development and survival remain disappointing across much of the Ivorian belt. Even with a normal moisture profile, the underlying health and vigor of the trees appear weaker than models predicted earlier in the season. The main crop will not collapse, but the optimism some traders held in September and October has faded.

Ghana has followed a similar pattern. Rainfall over the past month has been close to seasonal averages, but again the ground-truth stations show slightly less moisture than satellite products suggest. Field reports from Ghana’s southern districts confirm that drying conditions are improving for harvested beans, yet the condition of developing pods remains a concern. Tree stress from last season’s poor rains and swollen shoot disease continues to cap potential. If arrivals improve in the coming weeks, it will reflect normal seasonal flow rather than any real recovery in underlying production strength.

The looming risk is the Harmattan. For much of the year, traders expected a relatively mild Harmattan season, supported by forecasts pointing toward neutral ENSO conditions. But CRA’s latest analysis challenges that assumption. The transition toward a weak La Niña increases the probability of a stronger, drier Harmattan — the kind that can shrivel pods, reduce bean size, and raise defect counts across both Ghana and Côte d’Ivoire. The market is not pricing this possibility at all. With prices collapsing on tariff news, traders have mentally parked weather as a secondary factor, but CRA’s assessment suggests the real supply risks lie in January through March, not today.

Elsewhere, regional conditions offer no major support for the bull case. Nigeria is experiencing the kind of seasonal drying that helps the harvest move cleanly. Ecuador is benefitting from renewed rainfall just as the country prepares for its next flowering cycle, reinforcing the longer-term view that Latin America’s share of global production will rise. Brazil remains a patchwork: Para has seen only about 30% of normal rainfall since September, while Bahia continues to struggle with inconsistent precipitation. Even so, none of these regional wrinkles outweigh the dominant impression that global supply is stabilizing, not tightening.

In summary, West African weather is not currently bullish — but it carries latent risk. If the Harmattan emerges stronger than forecast, the cocoa market will shift abruptly back toward supply anxiety. For now, the fear has been buried under tariff-driven selling, but the atmospheric setup for early 2026 is more fragile than the futures curve implies.

Index Rebalancing – The Hidden Bullish Catalyst

While the market has spent the past week fixated on tariff exemptions and the collapse of the New York premium, one of the most important structural forces brewing beneath the surface is the upcoming index rebalancing. This is not a trivial footnote. It has the potential to create a meaningful, mechanical, price-insensitive wave of cocoa buying in early January — potentially the first major bullish counterforce the market will encounter after months of relentless selling.

The mechanics are straightforward: cocoa is expected to re-enter the Bloomberg Commodity Index (BCOM) after being temporarily excluded due to liquidity and contract weight constraints. With open interest and trading volumes now consistently meeting eligibility thresholds, cocoa is poised to return to one of the world’s most influential benchmark indices. Historically, index rebalancing flows are predictable, rules-based and entirely agnostic to market fundamentals. They follow strict allocation formulas — which means that if cocoa re-enters BCOM, the funds must buy it whether they like the narrative or not.

How Big Are the Flows?

While precise numbers are only finalized in December, early estimates from traders and macro-commodity desks suggest that $800 million to $1.2 billion in total index-linked assets could need to purchase cocoa futures during the January rebalance window. Even a conservative 0.8%–1.0% weight in the index translates to:

➡️ 15,000–30,000 NY cocoa contracts of mandatory fund buying

➡️ Executed over a 5–10 trading day window

To put that into context, total daily NY cocoa volume in recent sessions has ranged from 35,000 to 55,000 lots, meaning index rebalancing alone could represent 30%–70% of daily turnover during the rebalance window.

In a thin holiday-liquidity environment, these flows matter — in January they can move markets dramatically.

Why It Could Matter More This Year Than Others

Three factors amplify the impact this time:

1. Funds Are Already Deeply Short

Managed money short positions have grown rapidly over the past two weeks as tariff news triggered algorithmic trend-followers to press the downside. If the market remains heavily short entering January, index-driven buying could collide directly with:

- Short covering

- Reduced liquidity

- Seasonal grind data releases

This creates the type of air-pocket rally cocoa is known for: a violent, mechanically driven burst higher despite bearish fundamentals.

2. Physical Supply Flows Are Front-Loaded

By January, arrivals are typically strongest, and certified stocks comfortable, causing speculators to maintain short exposure. This supply-heavy seasonal window tends to suppress natural buying just as index funds start to build long positions. That mismatch between commercial selling and forced index buying often creates asymmetric volatility.

3. January Is Historically a Reversal Month

Across the 2000–2025 seasonality dataset, cocoa has a habit of bottoming in December–January and rising into February–March, partly due to:

- Grind optimism early in Q1

- Harmattan-induced supply worries

- Post-holiday positioning resets

Add index inflows to this seasonal pattern, and the probability of a January squeeze becomes much higher.

What Happens If Prices Fall Further Before January?

If New York cocoa drops into the low $5,300s or even the $5,000–$5,200 zone, the notional weight of cocoa in commodity indices becomes even smaller relative to other components (energy, grains).

Under BCOM’s rules, the index must rebalance dollar exposure, not contract count, meaning:

➡️ the cheaper cocoa becomes, the more contracts funds must buy to meet weight allocation.

This is a counterintuitive but powerful mechanism:

the deeper cocoa sells off now, the sharper the mandatory buying later.

Could Rebalancing Alone Reverse the Downtrend?

On its own, no — not if fundamentals stay deeply bearish.

But it can absolutely:

- slow the decline,

- trigger short-term rallies,

- force short covering,

- or establish a short-term floor in early January.

Most importantly, it creates a period of forced buying in a market where virtually all recent flows have been forced selling.

The Market Is Not Pricing This In

Right now the market is trading as if:

- tariff relief is the only story,

- Latin American supply will flood the U.S.,

- certified stocks will stay high,

- managed money shorts can expand indefinitely.

But the index rebalancing window is a known future demand event — and futures curves are currently ignoring it completely.

If cocoa enters December oversold and heavily shorted, index rebalancing becomes the next major bullish catalyst capable of destabilizing the one-way bearish narrative.

Weekly Summary

- NY Mar: –$703 (–11.5%)

- London Mar: –£326 (–7.4%)

- NY premium: ~$150

- US stocks: –34,161 tonnes

- UK stocks: +32,187 tonnes

- Tariff exemptions: bearish NY terminal, bullish Ecuador differentials

- CRA weather: no immediate stress but elevated Harmattan risk

- Funds: aggressively net short

- Curve: contango, comfortable supply

The entire week was dominated by tariff-driven repricing, not crop fear.

Outlook for Monday

- Any bounce into $5,600–$5,700 on NY Mar is a sell zone

- No weather trigger imminent, but Harmattan risk rising quietly

- Watch for:

- Options expiry volatility

- U.S. tariff announcements

- West African arrival data

- Index-rebalancing front-running

- Funds still have room to expand shorts

- Bias remains lower unless Harmattan or arrivals shift tone

Short-term bias: lower

Medium-term: potential for sharp squeeze

Long-term: structurally bearish unless West African production collapses

If you notice any discrepancies or have additional insights, please feel free to contact me at cocoatradeblog@gmail.com or leave a comment. Cocoa markets move fast, and your feedback helps ensure the accuracy of these reports.