17.11.2025 - Daily Cocoa Market Report

Daily cocoa market analysis and news covering ICE futures, Ivory Coast & Ghana supply, weather outlook, certified stocks, Harmattan risk, and next-day trading expectations.

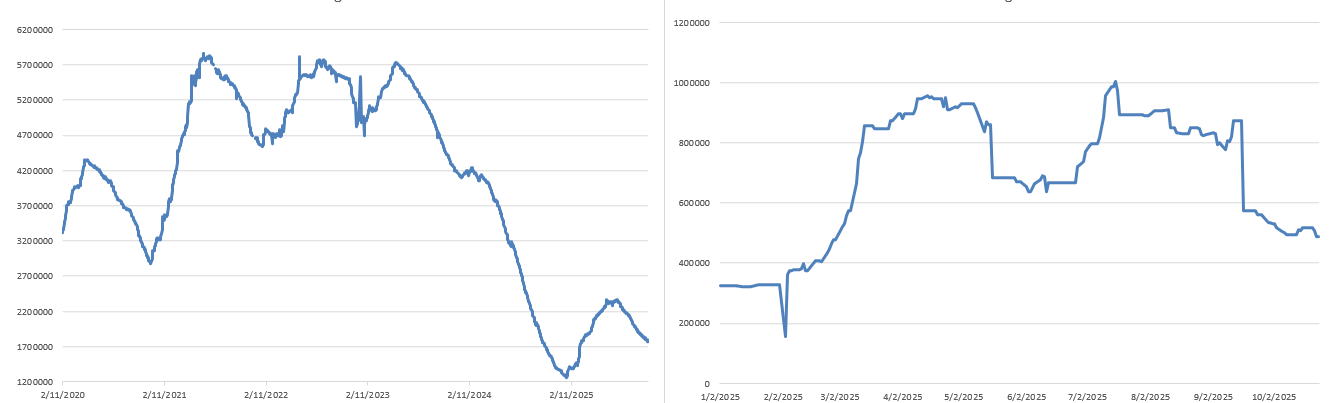

Cocoa prices extended their downward slide on Monday, with the market still digesting the shockwaves created by the United States’ decision to waive import tariffs on cocoa and cocoa products. The policy shift, announced late last week, has triggered one of the sharpest short-term declines in terminal prices seen since mid-2024, intensifying bearish sentiment across both New York and London. At the same time, fresh supply data from West Africa, rapidly changing weather conditions, and new developments in industry demand added additional layers of complexity to an already overloaded market narrative.

Despite the weakness, the fundamental picture remains fluid. Supply indicators out of Ivory Coast show mixed signals, climate risks persist beneath the surface, and the broader curve continues to restructure as traders reassess the balance between near-term availability and long-term scarcity. Below is the detailed breakdown of today’s market conditions.

Market Overview – New York & London

New York cocoa futures closed the session under continued pressure, with the March 2026 contract settling at $5,436, barely stabilising after last week’s steep losses. The market traded within a narrow band between $5,290 and $5,550, with price action sluggish and dominated by algorithmic selling. The slow stochastic oscillator has flattened in deeply oversold territory, and prices are hugging the lower Bollinger Band near $5,439, hinting that momentum has softened — but not reversed.

In London, the March 2026 contract finished at £4,084, echoing New York’s direction but with slightly less intensity. The US policy announcement has disproportionately hurt the dollar-denominated contract, widening the recent divergence in performance. London is effectively absorbing secondary effects from New York rather than reflecting local fundamentals.

Volume was modest compared with the volatility of recent sessions. ICE-US cocoa traded 45,298 lots, down from Friday’s heavy 55,524. London was lighter at 24,976 lots, following last week’s 48,988 surge. Despite lower turnover, open interest in both markets remains historically elevated, consistent with aggressive trend-following engagement and continued buildup in managed-money short exposure.

Exchange Stocks

Certified inventories continue to provide the market with a sense of near-term comfort.

US stocks stand at 1,759,756 tonnes, while UK exchange inventories increased slightly to 533,594 tonnes.

The steady, ample stock levels reinforce the prevailing narrative of a market that is no longer concerned about immediate tightness. Delivered stocks are stable, port arrivals remain healthy, and the new crop continues to trickle in at a pace aligned with seasonal expectations. These dynamics limit the market’s ability to respond to short-term weather rallies and keep the broader structure weighted to the downside.

Futures Curve & Spread Behaviour

The cocoa futures curve continues its pronounced flattening, a structural shift that began in September and has accelerated following the US tariff announcement. After nearly two years of extreme backwardation driven by chronic supply deficits, the nearest maturities are now only marginally above — and in some cases already below — the outer contracts.

This change in curvature is significant. It signals that traders are beginning to price a gradual rebalancing of global supply, alongside confidence that the 2025/26 season will see at least a partial recovery in inventories. While the curve remains inverted, the steep panic-premium that defined 2024–2025 has faded.

The spread between London and New York has also contracted sharply. The premium that New York once carried due to US-specific import costs has nearly evaporated, falling from a peak of $1,000/ton in July to roughly $150 last Friday. With tariffs now removed for all major origins except Brazil, New York is structurally cheaper, exerting a direct pull on London prices as well.

Macro & Policy Drivers

The most consequential development remains the United States’ decision to eliminate import tariffs on cocoa and cocoa products for nearly all origins, including Ivory Coast, Ghana, Ecuador, Nigeria, and Cameroon. The measure immediately reduces the landed cost of cocoa into the US market and removes a key distortion that had been artificially inflating New York futures.

In practical terms, the tariff waiver:

- lowers import costs for US buyers,

- reduces demand for hedging at elevated prices,

- and introduces a “deflationary shock” into cocoa futures.

This is why terminal prices collapsed by 11.2% in New York and 7.1% in London between November 7–14.

The White House framed the decision as part of a broader anti-inflation package aimed at reducing consumer prices. Treasury Secretary Scott Bessent flagged the move earlier in the week, but confirmation came late Friday, triggering a wave of liquidation that carried into Monday.

Brazil remains the only major origin excluded, still facing a 40% surcharge due to legal and political frictions. This leaves Brazilian cocoa products at a competitive disadvantage compared with West African and Latin American origins.

Despite the policy-induced bearish shock, the long-term interpretation is more nuanced. Lower tariffs should, over time, stimulate US demand, particularly for butter and powder. If that demand materialises in 2026–27, the price impact could eventually shift from bearish to mildly bullish. For now, however, the market is only trading the immediate downward pressure.

West Africa – Supply, Logistics & Field Reports

Fresh port arrival data from Ivory Coast showed that 516,000 tonnes of cocoa had reached Abidjan and San Pedro by November 16, representing a 6% decline compared with the same period of the previous season. Weekly arrivals, however, accelerated to 105,000 tonnes, up from 94,000 tonnes in the comparable week last year.

Farmers report that harvesting is intensifying ahead of the seasonal Harmattan and that pod counts remain healthy. Quality appears strong, and exporters are confident that December arrivals will exceed November’s totals.

Market sentiment is thus caught between two conflicting narratives:

the cumulative shortfall remains intact, but near-term arrivals look firm enough to alleviate immediate concerns about scarcity.

CRA Weather & Climate Assessment

Weather conditions across West Africa are transitioning as expected into the early dry season. CRA reports note that rainfall in both Ivory Coast and Ghana has decreased, consistent with the seasonal norm for mid-November. However, there are pockets of heavy rain in the southeast and southwest of Ivory Coast, where full river systems and localised flooding have been observed.

Reuters corroborated these findings, reporting that last week’s rains were above average in several growing regions, supporting pod development before the Harmattan begins to dominate the climate pattern in December and January. Farmers express optimism about bean size and quality, and many expect December harvest volumes to exceed those of November.

The key risk is still the Harmattan. A stronger-than-normal onset could reduce bean size, accelerate drying, and cause quality issues — especially in the northern belt. For now, conditions remain benign, though the next two weeks will determine whether weather becomes a stabilising or destabilising factor in the market.

Industry Developments

Barry Callebaut announced a partnership with Chilean start-up NotCo AI to reduce cocoa usage in industrial chocolate formulations by optimising ingredient blends through artificial intelligence. The initiative underscores the persistent pressure on manufacturers to cut costs in the face of historically high cocoa prices.

This move follows similar efforts from Mondelez and Unilever, both of which are actively exploring ways to reduce cocoa intensity in finished products. While such initiatives can diminish long-term demand, implementation remains slow and commercially limited. For now, the effect is more psychological than material.

Separately, Berenberg raised its target price for Barry Callebaut to CHF 1,418 from CHF 1,200, reflecting improved margins and resilience despite volatile raw material costs.

What to Expect Tomorrow

Market conditions remain fragile, with sentiment overwhelmingly bearish. Any intraday rallies are likely to meet selling pressure until prices carve out a base above support levels.

Key areas to monitor include:

- The behaviour of March NY around $5,300–$5,400

- Updated port arrival data from Ivory Coast

- Any new policy communication regarding tariffs or trade preferences

- Weather conditions as the Harmattan window approaches

- Fund positioning as liquidity rebuilds following last week’s volatility

Unless weather turns sharply unfavourable or arrivals unexpectedly weaken, the bias remains tilted to the downside.

If you notice any discrepancies, missing data, or conflicting figures, feel free to email cocoatradeblog@gmail.com or leave a comment so the data can be corrected promptly.