18.11.2025 - Daily Cocoa Market Report

Cocoa prices edged higher on Tuesday, breaking the sequence of heavy declines that followed the US decision to waive tariffs on cocoa imports. The move was modest in absolute terms, but important in signal: for the first time since the tariff announcement, both New York and London managed to close higher on the day, with buyers willing to absorb some of the recent speculative selling. The broader tone, however, remains cautious. The market is still trading near the lower end of the recent range, certified stocks are climbing in Europe, and the futures curve continues to flatten as traders price in a more comfortable supply outlook for 2025/26.

The balance of forces is clear: structurally bearish macro (tariffs, weak demand, rising stocks) against a market that is now technically stretched and heavily short. Tuesday’s session looked less like a trend reversal and more like a small pressure release inside a larger downtrend.

There are circulating rumours that Ivory Coast and Ghana may temporarily suspend cocoa sales due to low bulk prices.

This risk dramatically increases nearby volatility and is inherently bullish if confirmed.

The CFTC will not return to a normal reporting schedule until January 23, 2026, and if US government funding lapses after January 30, the delay could stretch even longer.

This creates a market that is essentially trading blind, with no reliable positioning data or visibility into fund flows. The result will be higher volatility, wider spreads, and a greater risk of technical dislocations over the next two months.

Market Overview

New York cocoa futures posted a small gain, with the March 2026 contract closing at $5,416, up from Monday’s $5,401. The contract traded between roughly $5,325 and $5,612, briefly testing lower support before recovering into the close. Prices are still trading below all major short- and medium-term moving averages, but Tuesday’s candle was a mild positive – a small green body after a string of red ones.

London followed in the same direction. March 2026 London cocoa settled at £4,108, up from £4,084 on Monday. The move was slightly stronger in percentage terms than New York, reflecting the fact that London has been less directly exposed to the US tariff shock and is starting from a relatively cheaper base on an FX-adjusted basis.

The key point is that prices rose, but only marginally, and from a deeply oversold position. This was not a bullish breakout; it was a pause.

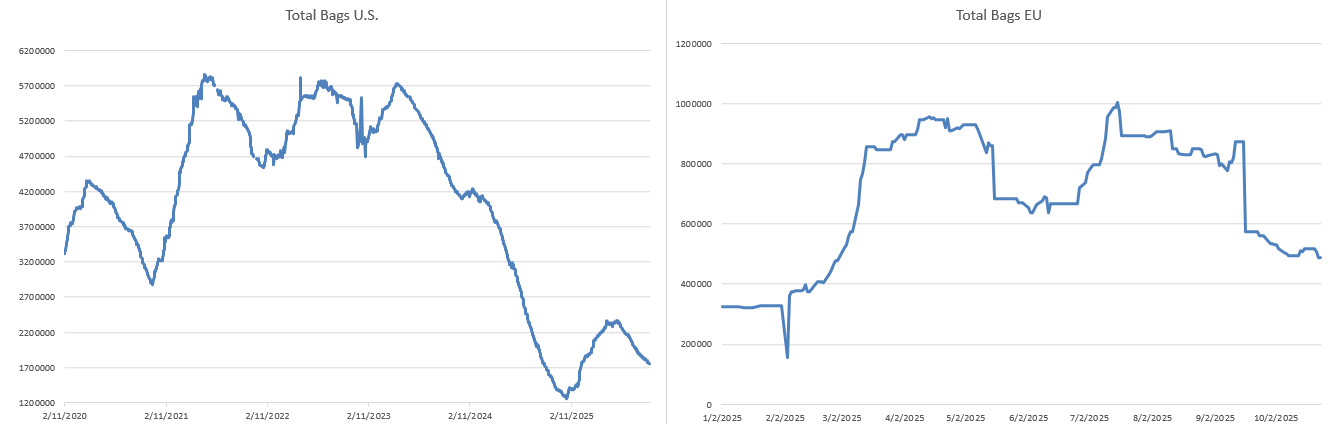

Certified Stocks

Certified stocks continue to shape sentiment by signalling that nearby supply remains comfortable.

| Date | US Stocks (tonnes) | UK Stocks (tonnes) |

|---|---|---|

| Today (18 Nov) | 1,747,459 | 562,344 |

| Yesterday (17 Nov) | 1,759,756 | 533,594 |

| Last Friday (14 Nov) | 1,766,644 | 533,594 |

Daily & Weekly Changes

| Period | US Change (tonnes) | UK Change (tonnes) |

|---|---|---|

| Daily (Mon → Tue) | –12,297 (draw) | +28,750 (build) |

| Weekly (Fri → Tue) | –19,185 | +28,750 |

The US draw is mild, and given the very high starting level, it does not meaningfully tighten the market. The UK build is large and clearly bearish: European warehouses are taking in more cocoa just as futures prices are trying to stabilise. That combination – rising stocks in London with only a small corrective bounce in price – tells you the market does not yet believe in a structural bottom.

The net inventory signal remains: no nearby shortage, especially in Europe. That caps the upside for now.

Futures & Market Metrics (Including Volume)

New York – ICE US (Mar 2026 Contract)

| Metric | Value |

|---|---|

| Close (18 Nov) | $5,416 (+$15 vs Monday) |

| Intraday Range | ~$5,325 – $5,612 |

| Volume | 35,650 lots |

| Open Interest | Edging higher (indicating fresh positions, not just short-covering) |

London – ICE Europe (Mar 2026 Contract)

| Metric | Value |

|---|---|

| Close (18 Nov) | £4,108 (+£24 vs Monday) |

| Intraday Range | ~£4,032 – £4,203 |

| Volume | 23,192 lots |

On a USD-adjusted basis, this puts the NY–London spread at roughly neutral to slightly negative, depending on the FX conversion used.

This is a major shift from earlier in the year, when New York carried a $700–$1,000 premium over London at the peak of the supply panic. The collapse of that premium confirms a structurally flatter, calmer market where regional price distortions have largely normalised.

West Africa Supply & Origin Developments

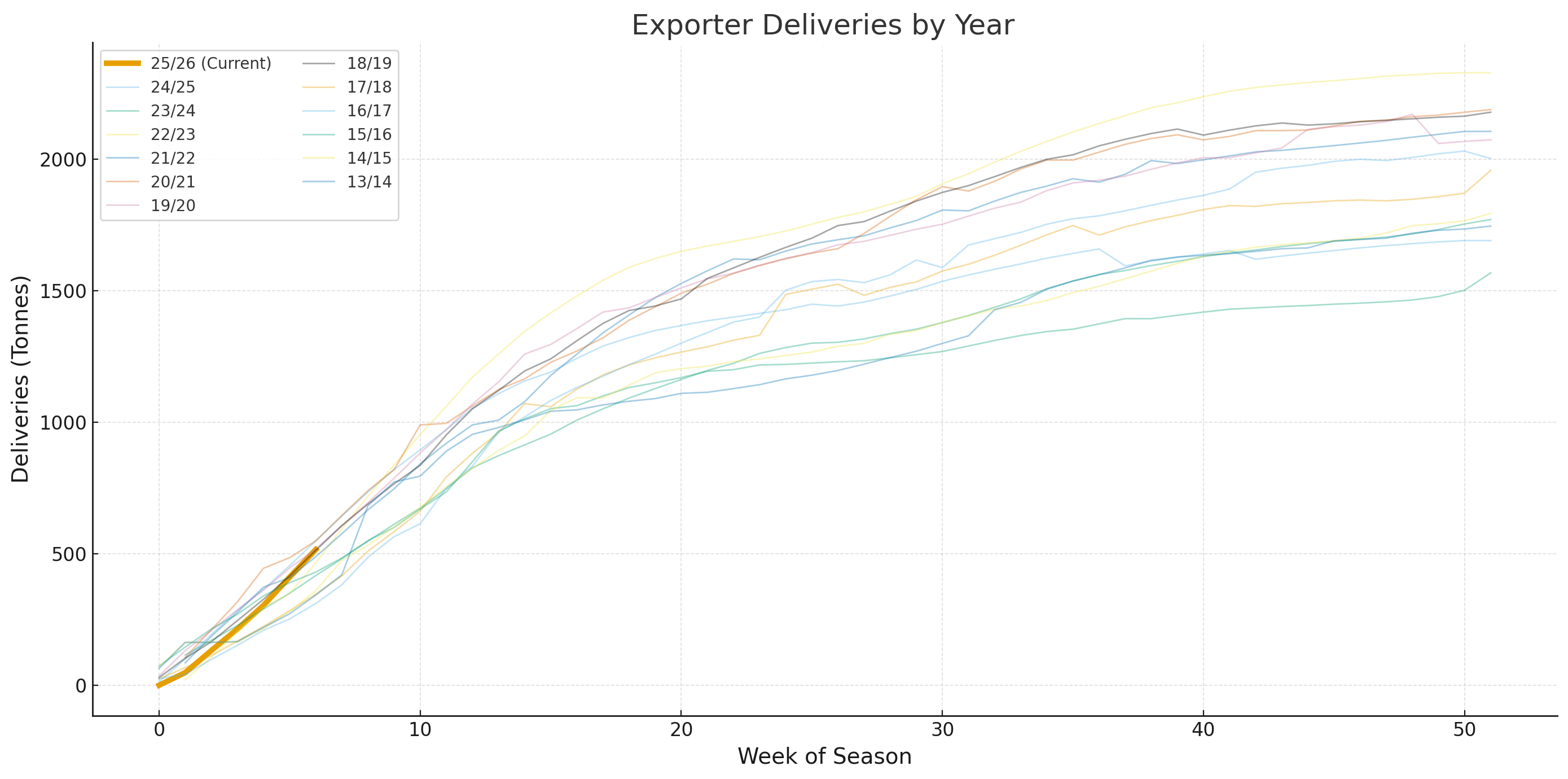

Ivory Coast arrivals remain seasonally solid. As of November 16, cumulative deliveries to Abidjan and San Pedro reached about 516,000 tonnes, around 6% below last season at the same point, but weekly arrivals of 105,000 tonnes show that the main crop is flowing.

The discrepancy between weekly strength and cumulative lag says a lot: the crop is not booming, but neither is it collapsing. The market is learning to live with a slightly smaller, but not disastrous, 2025/26 main crop.

In Ghana, the decision to move COCOBOD under the control of the Ministry of Finance continues to hang over the market as a medium-term governance risk. It signals financial stress and a recognition in Accra that the current model is not sustainable. In practice, that could mean changes in forward-selling policies, delayed payments, or tougher budget constraints – all factors that can affect Ghana’s ability to maintain output and farmgate prices.

Weather & Climate Assessment

Weather in West Africa remains broadly supportive of harvesting. Recent reports highlight above-normal rainfall in some regions of Ivory Coast, particularly in the southeast and southwest, which helped pod development going into November. As the calendar advances, rains are easing in line with seasonal norms, facilitating drying and transport of beans.

The Harmattan risk is beginning to move onto traders’ radar. For now, there is no evidence of an unusually early or severe Harmattan, but the critical window runs from late November through February. A strong Harmattan could still cut into bean size, raise defect levels, and slow exports, especially if it overlaps with periods of low soil moisture.

At this stage, the market is treating weather as neutral to slightly supportive for supply. That is another reason why the bounce in prices is so modest: there is no obvious weather trigger demanding a sharp repricing higher.

Macro & Policy Drivers

The US decision to waive tariffs on cocoa and cocoa products for most origins is still the central macro driver. It directly lowered the cost of importing cocoa into the US, stripping away the tariff premium that had been embedded in New York futures. That is why NY fell harder than London when the news broke.

Brazil remains the outlier, still facing a 40% surcharge, leaving it at a structural disadvantage relative to Ivory Coast, Ghana, Nigeria, Cameroon, and Ecuador.

Over the short term, the tariff waiver is clearly bearish for NY futures: it lowers the cost base and undermines the argument for a high-price floor. Over the long term, though, cheaper imported cocoa can stimulate demand in one of the world’s largest chocolate consumption markets. The market is not trading that longer-term demand story yet; it is still focused on the immediate price adjustment.

Technical Analysis

Technically, cocoa is still in a downtrend, but Tuesday’s session slightly eased the immediate pressure.

On the New York chart:

- March remains below the 10-, 20-, and 50-day moving averages.

- Price is still hugging the lower Bollinger Band, but Tuesday’s close is nudging back inside the band rather than sitting outside it.

- RSI and stochastics remain in oversold or near-oversold territory, but they have stopped falling sharply.

The small uptick in price combined with still-respectable volume suggests a mix of short-covering and tactical dip-buying, rather than an exhaustion spike. Volume is the key here:

- During last week’s plunge, prices fell on very heavy volume, with open interest rising. That was classic trend-extension behaviour: new shorts pressing the market lower.

- On Tuesday, prices rose on still decent but slightly reduced volume and with open interest not collapsing. That means shorts are starting to take some profits, but many are staying in the trade.

So the technical message from volume is subtle but important:

- The aggressive phase of the selloff is probably behind us – the straight-line panic leg is over.

- However, the market has not flipped to bullish. Bears are easing their foot off the accelerator, not slamming the car into reverse.

Until price can reclaim and hold above the 10- and 20-day moving averages, Tuesday’s move is nothing more than a small corrective bounce inside a larger downtrend.

Market Interpretation and What to Expect Next Session

Tuesday’s price action does not signal a clear bottom, but it does show that the vertical phase of the fall is over. The market is now entering a more tactical phase, where:

- shorts will sell into strength,

- dip buyers will test the water,

- and fundamentals (stocks, arrivals, weather headlines, and US policy noise) will matter more for incremental moves.

For the next session:

- Expect resistance in NY March around $5,500–$5,550, where the first cluster of moving averages and gap levels begins.

- London March is likely to meet selling interest into the £4,150–£4,200 zone.

- Any fresh build in UK certified stocks will reinforce the idea that rallies should be sold, not chased.

- Any negative surprise on weather (early Harmattan, dryness spikes) or arrivals could give the bulls their first real narrative in weeks – but there is nothing in the data yet that forces that repricing.

For now, cocoa remains a sell-the-rally market in a slowing downtrend, with Tuesday’s move best described as a controlled short-covering bounce rather than a change in trend.

If you notice any discrepancies in these figures or have extra information, please email cocoatradeblog@gmail.com or leave a comment – corrections and additional insights are always welcome.