19.11.2025 - Daily Cocoa Market Report

Daily cocoa market analysis and news covering ICE futures, Ivory Coast & Ghana supply, weather outlook, certified stocks, Harmattan risk, and next-day trading expectations.

Cocoa futures extended their sharp decline on Wednesday, with the GBP 4,000 level in London acting as strong support through most of the morning session. However, that support collapsed in the afternoon when headlines broke confirming that EU member states would back a full one-year delay to the EUDR deforestation law. The news triggered an immediate wave of selling: within an hour, the March 26 London contract fell more than £250, hitting an intraday low near £3,842 before settling at £3,866, down £250 on the day. Buyers initially attempted to defend the sub-£4,000 area, but once the fundamental bids were withdrawn, sellers regained full control and liquidation accelerated.

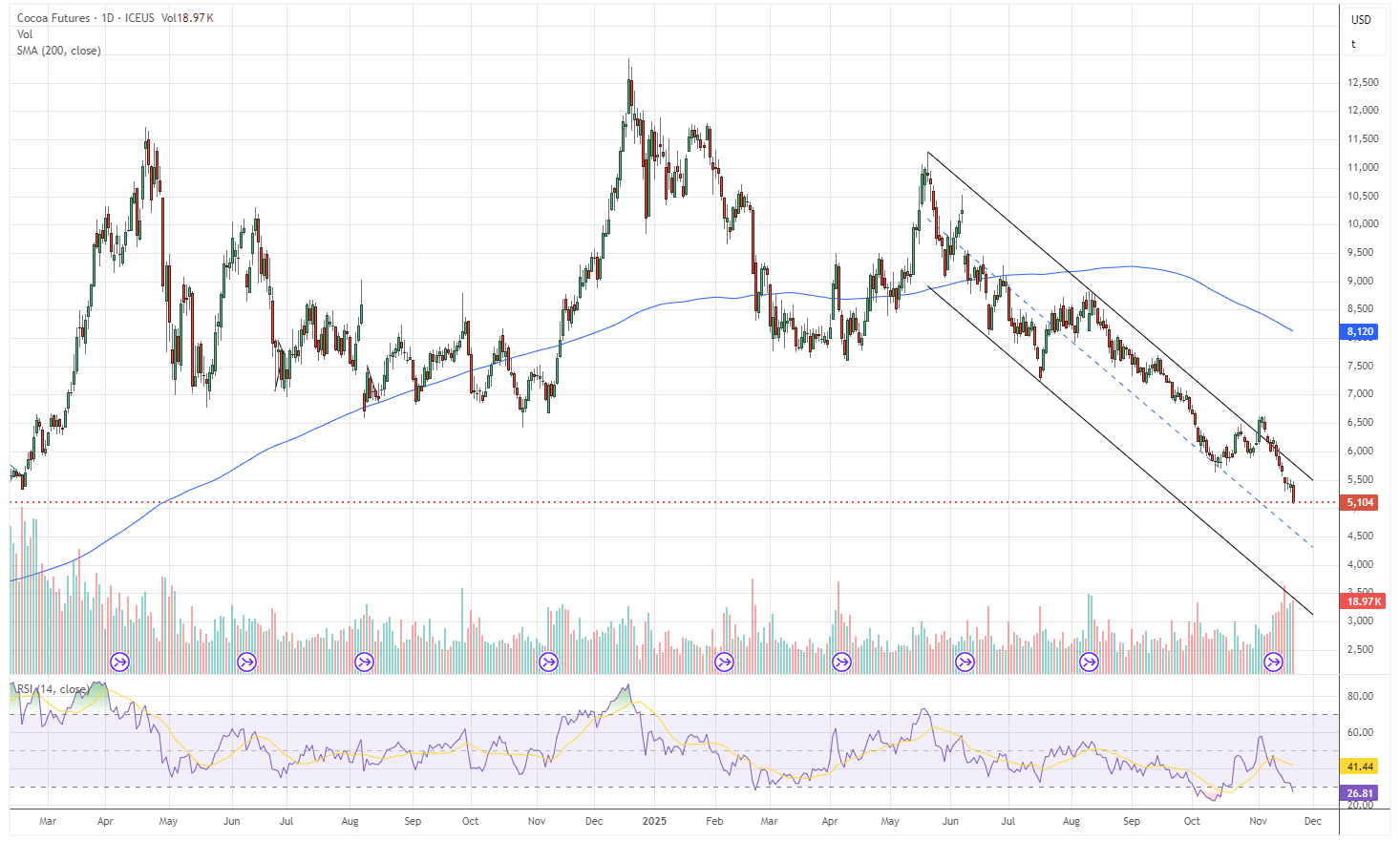

New York followed the same pattern, with March 26 settling at $5,104, down $324 (−5.97%) and breaking below the $5,300 technical floor. Early stabilisation attempts were overwhelmed by systematic selling and stop-loss cascades. Both exchanges briefly traded below their lower Bollinger Bands — a classic indicator of panic-driven flows rather than a fundamental reset.

The deeper issue is that the market remains in a forced-liquidation environment. Longs are still being flushed out in thin liquidity, particularly in the front months, while deferred contracts remain comparatively insulated. The EUDR delay was simply the catalyst that triggered the next wave of selling, but the actual fuel was positioning, not fundamentals. The question now is whether the postponement was already partially priced in, and whether Wednesday’s collapse was an overreaction driven by headline-chasing algorithms rather than a genuine shift in supply-demand dynamics.

Inventory / Certified Stocks

ICE certified stocks posted a modest daily adjustment:

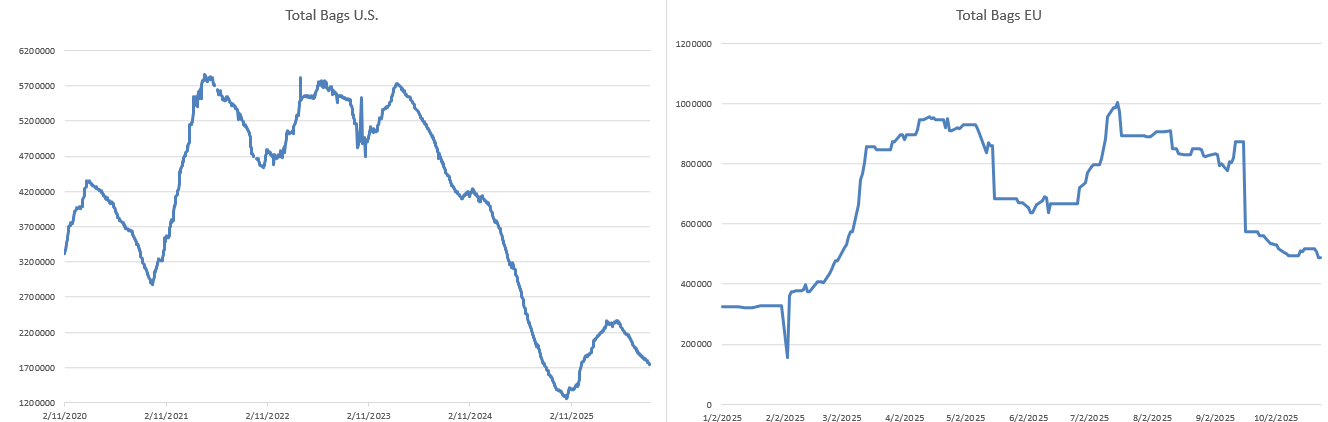

- US stocks: 1,740,127 bags (vs 1,747,459 yesterday)

- UK stocks: 562,344 bags (unchanged)

The decline of 7,332 bags in US stocks confirms the physical tightness that futures are ignoring. UK levels remain stable. Certified stocks remain historically low and continue to offer no justification for the ongoing futures collapse.

Futures / Market Metrics

New York (CC) – Settlement Prices & Volumes

| Contract | Close | Change | Total Volume |

|---|---|---|---|

| Dec-25 | 4,939 | −319 | 3,907 |

| Mar-26 | 5,099 | −324 | 20,745 |

| May-26 | 5,152 | −283 | 8,627 |

| Jul-26 | 5,222 | −266 | 3,360 |

Total volume reached 40,472 contracts, with heavy turnover concentrated in the March contract as funds continued unwinding.

London (C) – Settlement Prices & Volumes

| Contract | Close | Change | Total Volume |

|---|---|---|---|

| Dec-25 | 3,814 | −256 | 3,175 |

| Mar-26 | 3,826 | −250 | 15,674 |

| May-26 | 3,874 | −232 | 9,381 |

| Jul-26 | 3,888 | −223 | 6,947 |

Total London volume reached 44,615 contracts, with heavy Mar-26 flows revealing large-scale forced unwinds.

Although front-month pressure has dominated the session, the curve continues to show a mild contango in the outer months, reflecting the market’s attempt to re-normalise term structure as liquidation flows hit the nearby contracts disproportionately hard. This shape is not a sign of improving fundamentals — it is simply the result of heavy front-end selling pushing nearby prices below fair value while deferred months remain relatively untouched. In a tight physical market, such contango is artificial and typically short-lived; once liquidation pressure subsides, the curve is likely to re-tighten as commercial demand returns and the true supply deficit reasserts itself.

Ivory Coast & Ghana Supply Situation

Port data from Ivory Coast show arrivals of 516,000 tonnes by 16 November, which is 6% below the same point last season, even though weekly deliveries have accelerated to 105,000 tonnes versus 94,000 tonnes in the comparable week last year. The gap has narrowed from earlier in the season, when arrivals were around 16–17% behind, but that doesn’t mean the crop has magically recovered. What’s happening is that the early logistical and financing bottlenecks – high farmgate prices, lack of upfront funding and quality disputes – are slowly easing, allowing beans that were stuck in the interior to move to port. In other words, logistics are catching up; production is not suddenly booming.

A sustained 6% shortfall at this stage, in a country that supplies roughly 45% of global cocoa, still implies a significant deficit risk for the full 2025/26 season if the gap does not close further. Ghana, meanwhile, remains structurally weak after years of disease, under-investment and smuggling pressure. Even without fresh official numbers, the pattern is clear: Ghana is not in a position to offset Ivorian underperformance. When you combine slightly improving weekly arrivals with a still-lower cumulative total, the message is simple: the crop is better than the worst fears from early October, but still smaller than last year. In a normal market that would support prices; in today’s liquidation environment it is being ignored.

Ivory Coast Cocoa Grindings – Demand Signal vs Quality Problem

The 25.4% year-on-year drop in Ivory Coast’s October grind to 44,075 tonnes has been widely misread as a demand problem. It isn’t. This is primarily a bean-quality and margin issue, not a lack of cocoa or a collapse in chocolate demand. GEPEX data show that this is just the latest step in a longer pattern: in July, grindings were down 31.2% y/y, and grinders specifically blamed poor bean quality and low mid-crop volumes, rejecting beans for low fat content and high acidity. On top of that, exporters are operating under a record farmgate price that has already created a liquidity squeeze; earlier in the season, buyers told Reuters they were turning away trucks or slowing purchases because they simply could not finance large volumes of expensive, mediocre-quality beans.

Put bluntly: there is cocoa, but a lot of it is not good enough for efficient industrial grinding at current margins. Grinders are choosing to run plants below capacity rather than chew through high-priced, low-quality beans that produce less butter, more waste and inconsistent liquor. Some have also built stocks during the previous season and can temporarily run down inventories while they wait for better quality or a more attractive price structure. That’s why the October grind drop should not be read as the consumer walking away from chocolate – it’s the processing sector managing quality and profitability in the face of extremely tight, expensive, and often sub-standard raw material. If bean quality improves and price relationships normalise, grind can rebound quickly without any “new demand” appearing; it’s simply latent demand being held back by operational constraints.

Policy & Industry Developments

EU Members Support One-Year Delay to EUDR Enforcement

The one-year delay to the EU Deforestation Regulation (EUDR), pushing full application to 30 December 2026 with extra time for small operators, does not cancel the law – it simply stretches the runway.For the cocoa market this means two things. First, the risk of a sudden import shock into Europe is reduced. Grinders and traders no longer face a hard 2025 deadline where large volumes of beans could suddenly become “unusable” because geolocation data or farm-level documentation was incomplete. That removes a near-term tail-risk squeeze from the equation and gives the market time to reorganise flows more calmly.

Second, and more importantly, it creates a two-year window where uncertified or not-fully-traceable cocoa can still move into Europe at a discount. Big grinders will exploit this. They now have legal and political cover to keep buying cheaper “grey” beans that would have been hard to justify under strict 2025 enforcement, blending them with certified lots or allocating them to lower-tier product lines where marketing claims about sustainability are weaker. The premium for fully traceable, low-deforestation cocoa will still exist, but the discount on uncertified beans will widen, and grinders’ margins will benefit as long as they can manage reputational risk. Practically, this means: more pressure on farmers who cannot meet certification standards (their beans clear, but at a bigger discount), more time for multinationals to build mapping and monitoring systems at their own pace, and a slower but still inevitable shift toward deforestation-free supply. Price-wise, the delay is mildly bearish versus a hard-deadline shock scenario, but it’s bullish for grind demand stability in Europe over 2025–26: grinders will not have to cut throughput purely for regulatory reasons, and the market will not be forced into a sudden, chaotic reshuffling of flows.

Cocoa Re-Entering the Bloomberg Commodity Index (BCOM)

Cocoa’s inclusion in the Bloomberg Commodity Index (BCOM) from January 2026 is not a cosmetic headline; it brings real, mechanical buying. BCOM has roughly $100–110 billion of benchmarked assets tied to it.The official 2026 target weights give cocoa a 1.7137% share of the index. That translates into around $1.7–1.9 billion of notional cocoa exposure once the reweighting is fully in place, depending on where prices are when the roll happens.

To see how big that is in futures terms: ICE cocoa contracts are for 10 metric tons each. At a representative price around $5,000 per ton, each contract is roughly $50,000 notional. That means BCOM-related exposure could require on the order of 30,000–40,000 futures contracts to be held across the strip once the index is fully loaded. Current ICE cocoa open interest is roughly 120,000–125,000 contracts (around 124,251 on 14 November). So, on a simple ratio, BCOM’s cocoa weight alone could represent roughly 25–35% of today’s total open interest. Not all of that will be “new money” – some managers are already long cocoa via other indices or active mandates – but the reconstitution forces systematic, rules-based buying during the January roll and periodic rebalancing thereafter.

The impact on price is structural: every quarter, index products will have to maintain their cocoa weight regardless of short-term panic, which injects a permanent floor of passive demand into a market that currently has historically low participation and fragile liquidity. It also means that any future price spike will be amplified by index mechanics: if cocoa rallies versus other commodities, its weight drifts higher in value terms and some strategies will have to rebalance, creating feedback loops. Net result: more liquidity, but also larger, more reflexive moves in both directions. In a market where fundamental supply is already tight, this kind of size coming in against a depleted spec base is unambiguously bullish medium-term.

Origin Spotlight: Ecuador Sets New Export Record

Ecuadorian grain and derivative exports reached 71,125 tons in October, the highest monthly export total in the country’s history, up 31.9% (+17,201 tons) from September. Rumours indicate a slowdown may already be emerging for November.

Ecuador’s record October output has been one of the only counterweights to West African tightness. A November slowdown would significantly narrow global availability just as demand from grinders begins to pick up.

Weather Conditions

Weather trends across West Africa continue to shift toward early Harmattan patterns. Humidity levels are falling in northern Côte d’Ivoire, and drier winds are beginning to extend southward. Ghana’s Ashanti and Brong Ahafo regions are also seeing reduced rainfall. Pod development remains exposed, and no significant rainfall recovery is expected in the short term.

Harmattan Risk Forecast

The Harmattan outlook for December–January remains a major risk factor for the 2025/26 crop, with current indicators pointing toward a moderate-to-strong event. Soil moisture levels across central Côte d’Ivoire and Ghana are already below seasonal norms, meaning trees will enter the dry season with reduced resilience. Although flowering is heavy, that actually increases vulnerability: in low-humidity conditions, cocoa trees shed a high percentage of early pods, producing the familiar pattern of “many flowers, few survivors.” Early Harmattan pulses have shown high dust loads and lower visibility, both of which accelerate leaf desiccation and reduce pod-set efficiency. Night-time temperatures are also forecast to fall more sharply, a combination historically associated with smaller beans, thinner cherelles, and higher pod abortion. With the tree population already weakened by disease, under-fertilisation, and poor pruning, the same Harmattan intensity now causes more damage than in past years. Ghana is particularly exposed due to its degraded tree stock. In short, the market is not pricing the true weather risk: a moderate Harmattan would maintain the current deficit, while a strong event could sharply cut main-crop yields and trigger a violent price rebound once liquidation flows exhaust.

Seasonality Context (2000–2025)

Late November typically exhibits weakness before transitioning to a more supportive environment in early December. However, the scale and velocity of the current drop are far beyond historical norms and do not align with seasonal tendencies. Q1 remains the strongest seasonal window for cocoa, especially in Harmattan years.

Market Interpretation Note

Volume patterns across New York and London make it clear that the current selloff is a forced-liquidation event rather than a genuine shift in fundamentals. New York volume fell from Friday’s 55,524 to Tuesday’s 35,650 before rebounding to 40,472 on Wednesday — a classic exhaustion signature showing that sellers are not increasing; remaining longs are simply being flushed out in thin liquidity. London provides an even sharper signal: after two weak sessions, volume spiked to 44,615 on Wednesday, almost entirely driven by heavy unwinds in the March and May contracts where funds are most concentrated. This is systematic liquidation, not fresh bearish conviction, with stops being triggered down shallow order books, producing exaggerated intraday slippage. The market is falling into liquidity gaps rather than discovering a new equilibrium price. With both exchanges displaying narrowing participation and concentrated front-month flow, the selloff is mechanically driven and approaching its natural endpoint. Once liquidation exhausts, the dynamic flips: shorts are crowded, commercials re-enter, and thin liquidity amplifies upward moves. Based solely on this week’s volume structure, the next major price event is far more likely to be a violent upward snapback than continued orderly selling, because selling pressure is finite, while short-covering and commercial demand that emerge after a stabilisation near $5,150–$5,250 are not.

What to Expect Tomorrow

- Volatility will remain high.

- A short-covering bounce is possible if Mar-26 can reclaim the $5,250 area.

- Further confirmation of slowing Ecuador exports would add bullish momentum.

- Open interest is expected to continue falling as liquidation completes.

The market remains fragile, oversold, and fundamentally mispriced.

If you notice any discrepancies in these figures or have extra information, please email cocoatradeblog@gmail.com or leave a comment – corrections and additional insights are always welcome.