20.11.2025 - Daily Cocoa Market Report

Daily cocoa market analysis and news covering ICE futures, Ivory Coast & Ghana supply, weather outlook, certified stocks, Harmattan risk, and next-day trading expectations.

Yesterday was the day the market finally acknowledged the real severity of the West African crop. New York March (Mar-26) closed $178 higher (+3.49%) at $5,282, the first positive session since 10 November and an inside-day reversal after the sharp selloff earlier in the week. London March (Mar-26) settled £102 higher at £3,958, recovering 2–3% after Wednesday’s capitulation below the psychological £4,000 level. Prices initially sold off intraday but recovered to close just above the midpoint, signalling that forced selling is fading. The key driver of the rebound was not speculative buying — it was the cessation of aggressive selling combined with a fundamental shock from Ivory Coast: CCC officials confirmed a sharp decline in production, a 30% drop in Jan–Mar arrivals, and smaller mid-crop expectations. Тhe market is finally repricing the truth about supply.

Adding to this, traders reported that Ivory Coast and Ghana have effectively stopped marketing beans at current prices due to low differentials and unacceptable quality. While technical damage remains, yesterday was the first day where price, volume, and fundamentals aligned to show that the downside narrative was overstretched and based on liquidation rather than reality.

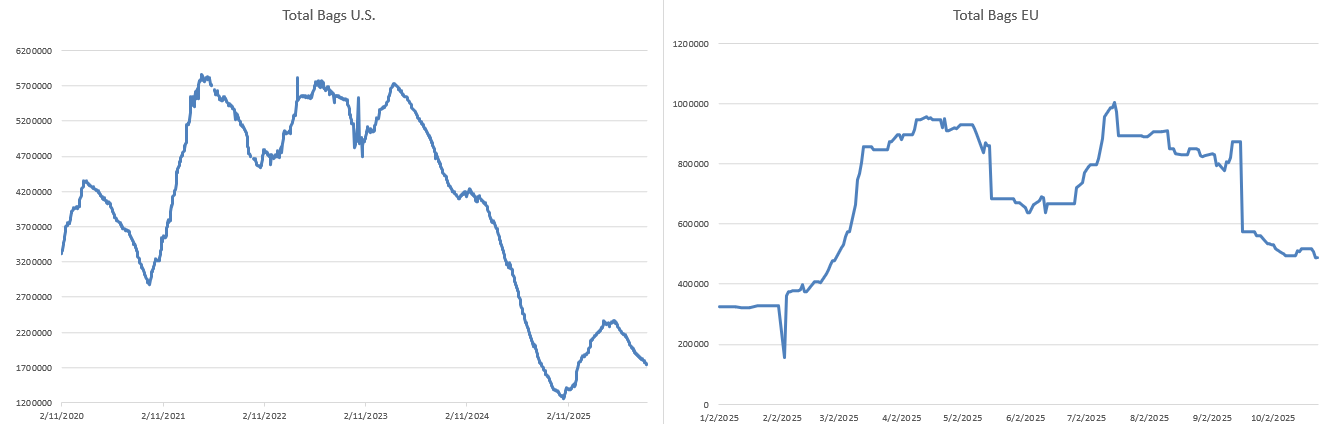

Inventory / Certified Stocks

- US certified stocks: 1,738,691 bags (–1,436 d/d)

- UK certified stocks: 546,719 bags (–15,625 d/d)

Both US and UK stocks declined, with the UK showing its sharpest daily drop in weeks. Falling certified stocks contradict the idea of a surplus. Stocks and futures are still diverging — a gap that cannot persist if West African supply continues tightening.

Futures / Market Metrics

New York (CC) – Settlement & Volume

|

Contract |

Close |

Change |

Volume |

|

Dec-25 |

5,108 |

+165 |

1,351 |

|

Mar-26 |

5,282 |

+178 |

17,254 |

|

May-26 |

5,326 |

+160 |

6,735 |

|

Jul-26 |

5,347 |

+151 |

3,042 |

Total NY volume: 30,868 contracts — the lowest of the week, confirming the selling exhaustion.

London (C) – Settlement & Volume

|

Contract |

Close |

Change |

Volume |

|

Dec-25 |

3,879 |

+83 |

2,299 |

|

Mar-26 |

3,958 |

+102 |

11,598 |

|

May-26 |

3,997 |

+101 |

5,646 |

|

Jul-26 |

4,009 |

+104 |

3,680 |

Total London volume: 26,727 — sharply lower than Wednesday’s 44,615.

A mild contango persists in deferred months, but this is artificial, caused by front-end liquidation. In a structurally tight market, contango will not survive once commercial buyers re-enter.

Options Expiration

Today’s NY options expiration can distort price action. Dealers hedging large open interest around key strikes — particularly $5,200 and $5,000 — may be short gamma, forcing them to buy dips and sell rallies to stay hedged. This can temporarily suppress volatility and “pin” prices near strike levels. Once expiry clears and hedges unwind, the market often breaks out sharply in the direction of the underlying fundamental trend. With liquidation exhausted and fundamentals bullish, the risk of a post-expiry upside release is high.

Technical & Volume Analysis

Yesterday produced a textbook inside-day bullish reversal:

- First green candle since November 10

- Bounce off the key $5,100–5,150 support zone

- Close above midpoint of the session

- Lowest NY and London volumes of the week → seller exhaustion

Low-volume up-days are not full trend reversals — but they are how reversals start. Price is now boxed between support at $5,100 and overhead resistance at $5,420–5,450, with the 20-day moving average near $5,975–6,000 acting as the structural cap. If prices hold above $5,100 on any pullback, a short-covering breakout becomes increasingly likely.

Ivory Coast & Ghana Supply Situation

Reuters’ exclusive confirmed that Ivory Coast has sold only 1.3 million tonnes of main-crop contracts for Oct-25 to Mar-26, down from 1.4 million tonnes last season, and that the Coffee and Cocoa Council now expects about a 30% year-on-year drop in port arrivals between January and March 2026. This would be the third consecutive sharply lower Ivorian crop. Officials cited insufficient investment by farmers, ageing trees, crop disease and erratic rainfall patterns as the core causes – all structural, not temporary. Smuggling from neighbouring countries has eased, which means the numbers are not being artificially depressed by cross-border flows; if anything, those flows are now helping Ivory Coast arrivals.

At the same time, CCC sources warned of a 25–30% decline in the intermediate crop (April–August) and admitted that quality remains a major concern. Trucks have been turned away earlier this season due to poor bean quality, and exporters continue to report problems with low fat content and high acidity. Importantly, traders also report that Ivory Coast and Ghana have essentially stopped marketing beans at current prices, unwilling to lock in deep discounts while the crop outlook is deteriorating. The story is brutally simple: deliveries are still picking up week-to-week, but the total crop is smaller, quality is worse, and origins refuse to sell at these price levels. Yesterday’s news made that impossible to ignore.

Officials noted that small quantities of cocoa from Liberia and Guinea do enter Ivory Coast because farmers fetch a slightly better price — but they stressed these volumes are marginal compared to what historically left the country. In other words: the supportive smuggling flow that once inflated Ivorian arrivals is gone. This makes the production decline even more alarming.

Cocoa Grindings

Ivory Coast’s grind was down 25.4% y/y in October (GEPEX). This is not demand destruction. It is a quality problem and a margin problem:

- Beans delivered early were substandard

- Grinders reduced throughput to avoid processing poor-quality, high-cost beans

- Several plants are drawing down inventories rather than buying fresh beans

The moment bean quality improves, grind will rebound without requiring new demand.

Brazil – Tariffs & Production

Trump’s removal of US tariffs on Brazilian agricultural imports—including cocoa—has triggered talk that Brazil might “solve” the cocoa shortage. It won’t. Brazil currently produces on the order of 200–220,000 tonnes of cocoa a year, against a global total around 4.8 million tonnes. Even if every extra ton of Brazilian beans went straight to the US, the scale is too small to offset a 30% drop in Ivorian arrivals plus structural weakness in Ghana. The tariff removal will make Brazilian beans more competitive into the US and may slightly increase flows, but it is essentially a margin boost for grinders and traders, not a fundamental game-changer for global balances.

Policy & Industry Developments

The equity market provided its own confirmation of the shifting fundamentals. Goldman Sachs initiated a buy rating on Barry Callebaut, sending the shares higher and signalling confidence that the world’s largest chocolate manufacturer will benefit from stabilising margins once the worst of the bean-quality problems and origin-price distortions pass. At the same time, Goldman initiated a sell rating on Lindt, even as Vontobel raised their target price to CHF 14,000 from CHF 12,500. The divergence highlights an important structural point: industrial grinders and bulk manufacturers stand to gain from the coming tightness and volatility, while premium-end chocolate companies face margin headwinds from expensive, inconsistent-quality beans. This aligns with trader commentary that Ivory Coast and Ghana have effectively stopped marketing beans at current prices due to poor quality and unworkable differentials. Together, the equity calls reinforce the narrative that the cocoa supply chain is tightening from the bottom up — and the companies closest to origin risk are the first to feel it.

The one-year delay to EUDR enforcement still removes the immediate risk of a regulatory shock to European imports, allowing grinders to keep running plants without suddenly excluding “grey” beans that lack full traceability. However, this also gives large grinders a two-year window to buy discounted, uncertified cocoa and blend it quietly, which will put additional price pressure on farmers who cannot meet certification standards. It is mildly bearish for highly certified premiums but supportive for grind stability.

Meanwhile, cocoa’s re-entry into the Bloomberg Commodity Index (BCOM) from January 2026 remains a major medium-term bullish factor. The index’s cocoa weight implies tens of thousands of contracts of systematic buying spread across the curve—potentially equivalent to a quarter or more of current open interest. That flow will not care about day-to-day noise: it will have to buy, rebalance and hold, providing a structural floor of passive demand once the reweighting starts.

Weather & Harmattan

Soil moisture in central Côte d’Ivoire and Ghana is already below seasonal norms as the region moves deeper into the dry season. Heavy flowering has been reported, but that increases vulnerability: in low-humidity Harmattan conditions, trees shed a high percentage of early pods, creating the “many flowers, few pods” pattern. Early dust-laden Harmattan pulses and cooler night-time temperatures raise the risk of smaller beans and higher pod abortion. With trees weakened by disease, low fertiliser use and poor pruning, a moderate-to-strong Harmattan would cut yields disproportionately. The market still has almost no Harmattan premium in the curve; in combination with CCC’s 30% arrivals warning, that is a serious mispricing.

Market Interpretation Note

Yesterday’s session mattered because fundamentals finally punched through the noise. For two weeks the market behaved as if West Africa had suddenly moved into surplus, driven by liquidation, CTA selling and technical breaks. Now, CCC itself is openly flagging a 30% drop in arrivals for Q1 and a smaller intermediate crop, while traders report that Ivory Coast and Ghana have stopped selling at these prices. At the same time, certified stocks are falling, not rising. Price action confirms that the liquidation phase is fading: New York and London both rallied on the lowest volumes of the week, which is exactly what you see when the last forced sellers finish and shorts begin to lose control of the direction. This is not yet a full trend reversal—volume is too low and the charts still look technically damaged—but it is a clear transition from panic selling to reluctant short-covering.

The structural picture is now brutally clear: three consecutive weak Ivorian crops, chronic problems in Ghana, questionable bean quality, negative grind signals driven by poor margins (not demand destruction), and a Harmattan season ahead that could easily push the balance into a severe deficit. Against that, the market is still pricing cocoa in the low $5,000s and allowing itself to be distracted by stories about Brazilian tariffs and temporary regulatory delays. That gap between futures pricing and physical reality will not stay open forever.

The outlook for the 2025/26 season is overwhelmingly deficit, not surplus. Even a conservative reading points to a several-hundred-thousand-tonne shortfall, with only minor gains elsewhere to soften it. Unless Ivory Coast and Ghana unexpectedly recover and the Harmattan is abnormally mild (both unlikely) the global balance will stay firmly in deficit, and the market will eventually have to reprice to reflect that structural tightness.

What to Expect Tomorrow

- Watch $5,100 as key support; losing it reopens panic.

- Resistance at $5,450, then 20-day MA (~$5,975).

- Option-expiry distortions should clear, allowing fundamentals to take over.

- Any confirmation of worsening arrivals or Harmattan intensification will be highly price-sensitive.

- Short-covering risk is rising fast; if prices hold, a violent bounce is increasingly likely.

If you notice any discrepancies in these figures or have extra information, please email cocoatradeblog@gmail.com or leave a comment – corrections and additional insights are always welcome.