21.11.2025 - Daily Cocoa Market Report

Daily cocoa market analysis and news covering ICE futures, Ivory Coast & Ghana supply, weather outlook, certified stocks, Harmattan risk, and next-day trading expectations.

Friday was a classic expiration day: technically ugly, fundamentally bullish, and mechanically driven. March 26 New York cocoa (CCH26) closed down $123 (-2.33%) at $5,159, taking the weekly loss to about 5.5%. The contract traded in a relatively contained $5,098–$5,266 range and, despite breaking Thursday’s low, remained entirely inside Wednesday’s wider $5,070–$5,472 band. Intraday, prices briefly pushed towards $5,070 on the Trump tariff headlines, but the market failed to extend the sell-off as liquidity dried up and options-related flows started to dominate. Total New York volume was only 23,011 contracts, markedly below the weekly average, and the market drifted into the close around $5,150 as gamma hedging pinned prices near popular strike zones. London followed a similar pattern: March 26 LDN cocoa (CCH26) settled at £3,879, down £89 on the day, with all active months losing around £85–£95 but without the kind of panic extension you would expect if this move were fundamentally driven.

Inventory / Stocks

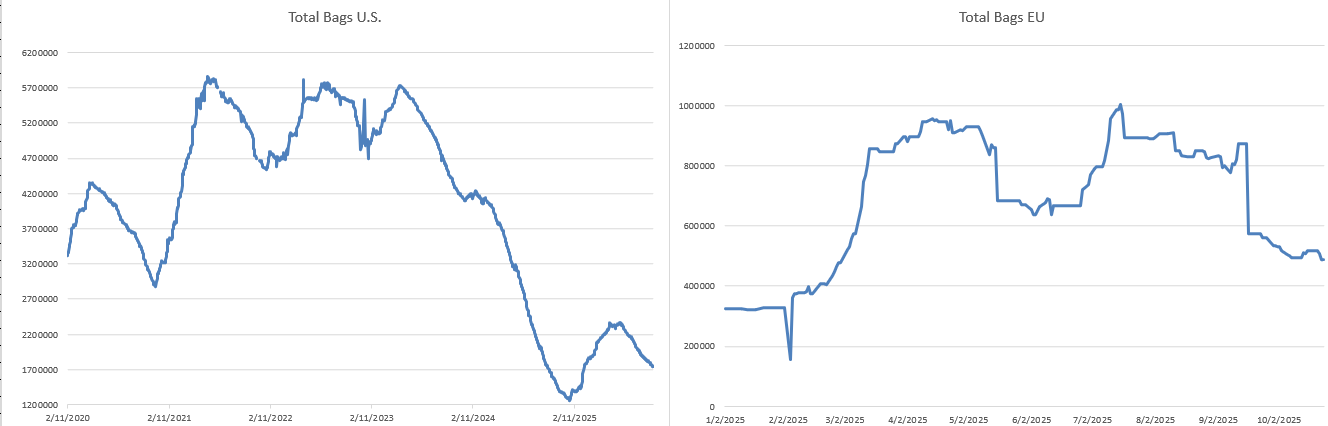

Certified stock movements were small but telling: U.S. certified stocks slipped again while London added beans.

| Exchange | Certified Stocks Today | Previous Day | Daily Change |

|---|---|---|---|

| US (NY) | 1,733,345 t | 1,738,691 t | -5,346 t |

| UK (LDN) | 565,000 t | 546,719 t | +18,281 t |

New York continues to bleed certified tonnage, while London registered a inflow. The net picture is still one of historically low and fragile cover rather than any meaningful rebuilding of safety stocks.

Futures / Market Metrics

New York (CC – ICE US)

| Contract | Settle | Change | Daily Range (Low–High) | Volume |

|---|---|---|---|---|

| Dec-25 | 5,084 | -24 | 5,082 – 5,130 | 29 |

| Mar-26 | 5,159 | -123 | 5,098 – 5,266 | 10,613 |

| May-26 | 5,198 | -128 | 5,147 – 5,307 | 5,748 |

| Jul-26 | 5,250 | -125 | 5,199 – 5,349 | 3,403 |

London (C – ICE Europe)

| Contract | Settle | Change | Daily Range (Low–High) | Volume |

|---|---|---|---|---|

| Dec-25 | 3,782 | -97 | 3,742 – 3,940 | 3,264 |

| Mar-26 | 3,879 | -89 | 3,850 – 4,020 | 10,333 |

| May-26 | 3,884 | -91 | 3,859 – 4,028 | 4,995 |

| Jul-26 | 3,900 | -92 | 3,878 – 4,045 | 3,319 |

The curve remains in mild contango in both markets: later months still carry a modest premium to the nearby contracts despite the sell-off, which tells you this move is being driven more by positioning and macro risk sentiment than by any sudden improvement in physical balance. The most striking feature is volume: New York turnover dropped from 30,868 contracts on Thursday to just 23,011 on Friday, a 25% fall and the lowest reading of the period, while London volume also eased from 26,727 to 25,624. Options expiry clearly pulled liquidity out of the outrights: dealers were more focused on managing delta and gamma around key strikes than on taking fresh directional views.

Calendar spreads continued to signal structural tightness despite the sharp decline in flat prices. The Mar/May and May/Jul spreads firmed relative to earlier in the week, with nearby contracts holding value better than deferred months. This pattern is characteristic of a market where physical supply remains tight even as speculative flows temporarily push the outright price lower. A tightening front spread into a falling flat price is usually a bullish structural signal: it means the selloff is driven by paper positioning rather than an improvement in real supply. The firmness in the front of the curve is consistent with weak Ivorian arrivals, limited certified stock growth, and persistent quality issues that limit the volume of beans eligible for delivery.

Another important development was the reduction in ICE New York margin requirements, lowering the initial margin to $5,920 per contract from the previous $7,470. This is a significant shift. Lower margin requirements usually increase trading participation, restore liquidity, and reduce forced selling driven purely by collateral constraints. During a period of sharp volatility and options-related flows, high margins often trigger mechanical deleveraging—accelerating selloffs that do not reflect fundamental value. Now that margin pressure is easing, funds that were forced out of long exposure may begin rebuilding positions, while short-term traders may increase intraday activity. Lower margins also reduce the barrier for new longs to enter the market at discounted prices, which can stabilize the market once expiration distortions fade.

Options Expiration

Friday’s expiration effectively “capped” both volatility and direction. After the initial Trump–Brazil tariff headline hit, New York cocoa fell as much as 6–7% intraday towards $5,070, according to several global softs summaries. Under normal circumstances, with Ivory Coast harvest fears and low stocks, that kind of break would invite trend-following selling and potentially a full technical washout. Instead, once the front-month options moved deep in-the-money or expired worthless, market-makers aggressively hedged their books around the 5,100–5,200 zone, buying dips and selling spikes to stay neutral. This gamma activity, combined with low speculative participation, pulled prices back into the middle of the recent range and kept the settlement inside Wednesday’s band. The result: a weak close, but not a capitulation. Price is lower because of option mechanics and macro noise, not because the physical market suddenly improved.

Ivory Coast & Ghana Supply

Fundamentals did not get any friendlier for shorts this week. Reuters reported on Thursday that Ivory Coast has pre-sold only 1.3 million tons for the October–March main crop, down from 1.4 million tons last season, and officials now expect a 30% drop in port arrivals between January and March 2026, plus a 25–30% fall in the intermediate crop if Harmattan and drought risks persist.This is the third consecutive year of declining main crop output, driven by chronic under-investment, ageing trees, disease and erratic rainfall. Smuggling flows have also reversed: less cocoa is coming in from Guinea and Liberia and the CCC is tightening stock checks and limiting exporter purchases, effectively rationing supply.

On the statistical side, the ICCO’s October 2025 Cocoa Market Report confirmed that cumulative arrivals at Ivorian ports reached about 411,000 tons, 9.7% below last year, even as prices fell during October. Ghana, meanwhile, is still officially talking about a recovery above 650,000 tons for 2025/26 on the back of better yields and some improvement in disease control, but that optimism has not yet translated into visible surplus beans on the export side. Taken together, West Africa is nowhere near a comfortable surplus; it is managing scarcity with higher prices and administrative controls.

Policy and Industry Developments

The main macro headline on Friday was Trump’s decision to remove tariffs on a broad basket of Brazilian agricultural imports, including cocoa, part of a wider rollback of his earlier tariff shock designed to calm U.S. food inflation and shore up approval ratings. Coffee reacted violently: arabica futures dropped more than 4–6% on the day as the market repriced cheaper Brazilian flows. Cocoa was pulled down in sympathy, with risk-off selling spreading across the softs complex even though Brazil is a relatively small player in cocoa compared with West Africa. Several market round-ups noted New York cocoa down around 0.8–2% on the day and trading at its lowest levels since early 2024, clearly linking the move to the tariff story rather than to any new crop data.

At the same time, the ICCO formally released its October 2025 market report, highlighting how prices have fallen since the start of the new season due to a mix of weaker grindings and slower-than-feared arrivals, and stressing that uncertainties around EUDR implementation, Harmattan and seasonal factors could still flip the balance back to tightness as the season advances. The official narrative is “bearish October, uncertain future”; the CCC narrative is “third year of shrinking harvests and 30% fewer beans at ports in early 2026.” Put bluntly, the policy and statistics are out of sync: headlines may look less dramatic, but the underlying crop reality has not improved.

Weather Conditions

Weather in Ivory Coast remains seasonally dry as the country moves further into the core main-crop harvest window. Earlier in the week, local reports still described last week’s light rains as broadly supportive for pod filling and short-term bean quality, but the CCC is already pointing to the December–April Harmattan period as the key risk. In Ghana, conditions remain mixed: improved flowering in some regions, but continued vulnerability to heat and moisture stress and the ever-present threat of black pod and swollen shoot. There is nothing in the current weather set-up that suggests a surprise rebound big enough to cancel out the structural problems described by the CCC.

Harmattan Risk Forecast

The market continues to discount Harmattan risk far more than it should. The CCC’s own projections of a 25–30% drop in the intermediate crop and a 30% decline in arrivals between January and March are explicitly linked to the potential strength of the Harmattan and ongoing dry-season drought pressure. If the winds arrive early and strong, the already stressed main crop could be cut back further and bean size and quality will suffer, limiting the usable portion of whatever is harvested. Options and futures pricing on Friday, however, traded as if the only thing that mattered was cheaper Brazilian cocoa in U.S. import statistics. That disconnect is exactly what you want to see if you are building a medium-term bullish book.

Volume and Open Interest

Volume told the story better than price. New York turnover slid to 23,011 contracts, not only down 25% from Thursday but also well below recent daily averages. London volume eased slightly to 25,624. Open interest in the expiring December contract dropped further as 134 additional delivery notices were posted, leaving just over 1,500 contracts still open according to the StoneX cocoa desk. The combination of falling volume and decaying open interest into option and futures expiry is textbook: the move is being driven by position clean-up, not by fresh conviction. Dealers were reducing risk, not pressing shorts. When the market breaks support on low volume during expiry week, it usually means that once the options and notice-period noise passes, the underlying trend (in this case, tight supply and low stocks) will reassert itself.

COT Analysis

Although Friday’s selloff appeared heavy, the latest COT data from ICE Europe (London cocoa) does not show any significant long liquidation by speculators nor a notable increase in producer hedging. Open interest rose by more than 8,000 contracts week-on-week, indicating new market participation rather than positions being closed. Managed Money added only a modest number of shorts, confirming that much of the downward pressure came from spread-unwinding and options-related flows around expiration, not a fundamental shift in sentiment. Producer and merchant positioning remains balanced, reflecting limited availability of forward-sellable beans in West Africa. Non-reportable traders sharply increased shorts—a historically contrarian indicator—while swap dealers expanded spreading positions consistent with ongoing nearby tightness.

It is important to note that this COT data reflects UK (London) cocoa only. The U.S. COT report for ICE New York cocoa is temporarily unavailable, because the CFTC has not yet completed the post-migration data reconciliation. The report will take approximately two months to readjust. This means U.S. positioning data will remain outdated until the CFTC finishes the adjustment process.

Futures & Options — London Cocoa (ICE Futures Europe)

| Category | 11 Nov Long | 11 Nov Short | 18 Nov Long | 18 Nov Short | Weekly Change (Net) |

|---|---|---|---|---|---|

| Producers / Merchants | 86,562 | 89,292 | 90,506 | 90,158 | + (90,506−86,562) − (90,158−89,292) = +3,602 net long shift |

| Swap Dealers | 37,933 | 15,208 | 39,636 | 14,056 | +1,643 net long |

| Managed Money | 5,559 | 24,570 | 5,593 | 28,341 | −3,717 net (spec shorts added) |

| Other Reportables | 1,549 | 565 | 1,183 | 1,062 | −(net long reduced) |

| Non-Reportables | 2,145 | 4,113 | 2,254 | 5,555 | −1,333 net (retail heavily short) |

| Total OI | 213,828 | — | 222,172 | — | +8,344 contracts |

Market Interpretation Note

Friday’s price action looks bearish on the surface – new lows for the week, another red candle, and a close near $5,150 – but structurally it is more a mechanical repricing to short-term news and option flows than a genuine shift in fundamentals. Trump’s tariff rollback gave funds a macro excuse to sell softs as a basket; options expiry amplified the move and pinned settlement near key strikes; and low volume ensured there was no cascade. Against that, the CCC is openly guiding for a third consecutive smaller Ivorian main crop and a potential 30% hole in early-2026 arrivals, ICCO data still show arrivals running nearly 10% behind last year, and certified stocks remain depressed, with the U.S. register leaking beans again on Friday. In other words: the tape is weak, the story is still tight. This is exactly the kind of disconnect that eventually fuels violent short-covering rallies once the options dust settles and the physical market starts bidding for real beans again.

What to Expect on Monday

With options expiry out of the way and U.S. traders coming back on Monday without the same gamma constraints, the market has room to show its real hand. If New York holds the $5,070–$5,100 support band, a corrective bounce toward $5,300–$5,400 is entirely realistic as short-term shorts take profit and some hedges are unwound. A clean break and daily close below $5,070, on the other hand, would confirm that macro and demand worries are temporarily overpowering the supply story and open a deeper test of the $4,800–$4,900 zone. Given the size of the projected West African production shortfall and the ongoing bleed in certified stocks, the more rational expectation is for choppy, headline-driven trade early next week with a bias for short-covering rather than fresh aggressive selling, unless genuinely new bearish fundamental news emerges.

If you notice any discrepancies in these figures or have extra information, please email cocoatradeblog@gmail.com or leave a comment – corrections and additional insights are always welcome.