24.11.2025 - Daily Cocoa Market Report

Cocoa futures opened the shortened US trading week quietly, but with a noticeable divergence between regions: the US March 2026 contract ended the session higher, while London futures continued to weaken. New York prices have repeatedly bounced between $5,000 and $5,200, a support band that has held over the past four sessions. Yet buyers still struggle to break through technical barriers — first at the 10-day moving average near $5,449, and then the 20-day moving average around $5,864.

With US markets closing Thursday for Thanksgiving, trading desks expect limited participation and muted price swings for the remainder of the week. That lack of urgency is visible in positioning — London financial funds recently increased bearish exposure by 3,737 contracts, leaving them with a short book of 22,748 contracts, the largest since August 2021. If fundamentals shift — for example, if port arrivals slow or weather risk intensifies — this deep short may become vulnerable to a fast reversal through short covering. But nothing in current supply data demands that yet.

For now, the market remains defensive, shaped by strong West African arrivals, stable crop expectations, and cautious end-user demand. Until those dynamics change, upside will struggle to sustain momentum.

Futures Performance — ICE US (New York)

CLOSE Prices — 24 Nov 2025

| Contract | Close | Change vs 21 Nov | Volume |

|---|---|---|---|

| Dec-25 | 5,090 | +8 | 0 |

| Mar-26 | 5,205 | +48 | 12,630 |

| May-26 | 5,222 | +21 | 6,781 |

| Jul-26 | 5,262 | +6 | 2,907 |

Futures Performance — ICE Europe (London)

CLOSE Prices — 24 Nov 2025

| Contract | Close | Change vs 21 Nov | Volume |

|---|---|---|---|

| Dec-25 | 3,699 | -95 | 2,537 |

| Mar-26 | 3,817 | -70 | 9,632 |

| May-26 | 3,832 | -52 | 5,072 |

| Jul-26 | 3,851 | -60 | 2,810 |

Volume and open interest continue to reinforce a market that is stabilizing, not turning. ICE US daily trading volume has steadily declined from the 40,000–55,000 contract range seen between Nov 10–14 to just 23,011 on Nov 21 and 24,711 on Nov 24, while London futures followed the same pattern, dropping from 48,988 on Nov 14 to 23,712 on Nov 24. This collapse in participation reflects holiday-driven disengagement rather than renewed confidence — meaning price movements lack validation.

Meanwhile, open interest tells a different but equally important story. In New York, open interest has fallen from 124,319 on Nov 12 to 115,855–116,076 by Nov 21, signaling that traders — particularly funds — have been closing positions rather than adding new exposure. That is consistent with light short covering and defensive repositioning ahead of the Thanksgiving break. London, however, shows the opposite dynamic: open interest climbed from 159,061 on Nov 7 to a peak of 173,719 on Nov 20, confirming continued buildup of speculative shorts, consistent with the Reuters report noting funds adding 3,737 contracts to reach 22,748 net shorts — the largest since August 2021.

The combination of falling volume + declining NY open interest + rising London open interest paints a clear technical sentiment picture:

- No aggressive buyers — rallies lack sponsorship

- London shorts remain committed — bearish conviction intact

- New York softness is positional, not structural

- Breakouts are unlikely until volume returns

Until activity normalizes — likely after the US holiday — the technical bias remains for sideways-to-lower price action, with rallies vulnerable to fading unless accompanied by materially higher volume and a reversal in London open interest.

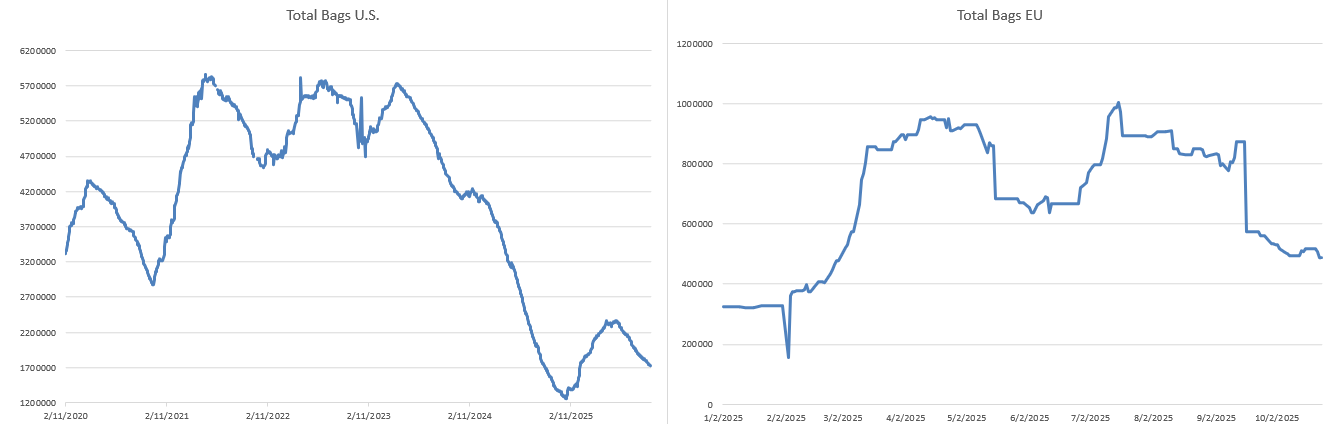

Certified Stock Position

| Region | Monday (Nov 24) — Bags | Monday — Tons | Friday (Nov 21) — Bags | Friday — Tons | Change (Bags) |

|---|---|---|---|---|---|

| US | 1,723,707 | 110,317 | 1,733,345 | 110,934 | -9,638 |

| UK | 565,000 | 36,160 | 565,000 | 36,160 | No change |

Assessment:

Inventories remain comfortable — no bullish tightening signals.

Supply & Origin Developments

Ivory Coast remains the central narrative shaping cocoa prices, and the latest port data reinforces why the market continues to trade defensively. As of November 23, cumulative arrivals since the start of the 2025/26 season on October 1 reached 618,000 metric tons, according to exporters — down 3.9% year-on-year from the same point last season. On the surface, that decline might appear supportive for prices, but weekly flows tell a different story: between November 17 and November 23, approximately 102,000 tons of beans reached Abidjan and San Pedro ports, up from 94,000 tons during the same week last year — a +8.5% increase. This marks the third straight week of 100,000-plus deliveries, confirming that harvest momentum is not weakening.

Traders widely expected this surge. Andrew Moriarty of Expana noted last week that the market has been anticipating a strong start to the season and that the current pace should gradually slow in the coming weeks, eventually aligning with last year’s cumulative arrivals by Q1 2026. In his view, the strength in arrivals does not necessarily reflect a significantly larger crop, but rather the release of carryover stocks from the previous mid-crop, encouraged by historically high farmgate prices earlier in the year. He also points to shifting intra-regional trade dynamics — an estimated 110,000 tons of cocoa that might previously have been recorded in neighboring countries is now flowing directly into Ivorian ports due to improved logistics and price incentives. That inflates early-season numbers without indicating a fundamentally bigger harvest.

Field surveys continue to show that the 2025/26 tree crop is not materially better than last year, and may even be slightly weaker, given earlier dry-season stress. For now, however, rainfall in November has helped stabilize pod development and maintain farmer confidence, delaying any bullish supply concerns.

Beyond West Africa, Ecuador continues to strengthen its role as the world’s fastest-growing cocoa exporter. Production expansion, investment in disease-resistant varieties, and sustained government support have increased exportable supply — reflected in Ecuador delivering the largest share of certified tons into the CCZ5 tender period, totaling 2,750 tons. Although Ecuador cannot match West Africa in scale, its rising market share helps diversify global supply and reduces reliance on Ghana and Ivory Coast. Importantly, Ecuadorian beans continue to capture premium demand from grinders seeking consistent quality and origin diversification, meaning their increased presence prevents New York futures from responding aggressively to West African fluctuations.

Meanwhile, Ghana received a notable policy boost. The United States has officially removed the 15% import tariff previously levied on Ghanaian cocoa and agricultural exports — a decision confirmed by Ghana’s foreign minister. This change immediately improves Ghana’s pricing competitiveness relative to Latin American suppliers, particularly for processors, chocolate manufacturers, and specialty buyers in the US. Over time, the removal of this cost barrier may encourage higher Ghana-to-US trade flows, reinforce export revenue stability, and support Cocobod’s financing capacity. However, from a futures-market perspective, it contributes to the broader theme of unrestricted supply access, further limiting near-term bullish arguments.

Taken together, origin fundamentals — steady Ivorian deliveries, Ecuador’s expanding export presence, logistical redirection of African supply, and improved tariff conditions for Ghana — continue to paint a picture of comfortable physical availability. This environment validates fund short positioning in London, keeps commercial buyers patient, and prevents speculative traders from attempting to force a bottom. Until arrivals materially slow or weather disrupts harvest flow, the supply side will remain the dominant weight suppressing cocoa prices.

Peru continues to emerge as a meaningful secondary contributor to the global cocoa balance. The 2024/25 season closed with a record 202,345 tons, an 11% year-on-year increase, reflecting productive maturity of orchards, improved agronomy, and favorable weather during critical pod-filling stages. The 2025 calendar year has already accumulated 182,708 tons through October, suggesting another historically strong output if current harvest conditions persist. Despite rising domestic consumption, only about 18% of national production remains in-country, meaning Peru exports more than 80% of its beans—primarily in processed derivatives such as butter, powder, and liquor. This export-oriented structure makes Peru a reliable incremental supplier at a time when traditional West African origins dominate headlines. While Peru cannot offset structural tightness in Ivory Coast or Ghana, consistent production growth—combined with quality premiums and disease-resistant varietal adoption—adds diversity to global sourcing and reduces supply vulnerability. In today’s market context, it reinforces the broader narrative of adequate physical availability, limiting the urgency for speculative buying and contributing marginally to downward pressure on futures pricing.

Weather & Crop Outlook

According to a Reuters report published on November 24 weather remains one of the most stabilizing factors in the cocoa market right now. Ivory Coast farmers report that above-average rainfall across most major growing regions last week has continued to support pod development and tree health during the critical October–March main crop phase. The rain has improved soil moisture, strengthened root systems, and increased farmer confidence that the crop will remain healthy at least through January, delaying any concerns about early-season stress.

Producers in key zones — including Daloa, Bongouanou, Yamoussoukro, Soubré, Agboville, and Divo — confirm that rainfall has been widespread and timely, supporting steady harvesting and uninterrupted deliveries. Several cooperatives noted that harvesting has accelerated as trees are well-hydrated, and weather conditions have created plenty of pods ready for picking, reducing the risk of bean size deterioration. Recent observed average temperatures ranging from 26.4°C to 30.5°C are within favorable agronomic ranges for optimal cocoa development.

The seasonal wildcard remains the Harmattan, which typically arrives from mid-November to March. But farmers and traders currently expect the winds to be mild and delayed, meaning humidity should remain higher, avoiding excessive pod dehydration and limiting disease risk. If correct, cocoa trees should sustain production into early 2026 without major quality or yield losses. A severe or early Harmattan, however, would quickly flip the narrative — lower humidity could shrink beans, stress trees, and reduce forward harvest volumes, particularly from February onward.

For now, the weather backdrop reinforces the market’s perception of comfortable near-term supply. Combined with steady port arrivals, supportive rainfall reduces fear-based buying, keeps funds confidently short, and limits the likelihood of a spontaneous price rally. Only a meaningful shift — such as a sudden, aggressive Harmattan or prolonged dryness — would trigger short covering or redraw the balance of risks.

Seasonality Context

Late November has historically been a transition period for cocoa — not a turning point. Over the past 20 years, ICE cocoa futures have posted an average -1.2% performance during the final two weeks of November, as main-crop arrivals peak, certified stocks rise, and end-of-year demand slows. December typically remains weak unless the Harmattan arrives early and aggressively. With steady rainfall, healthy field conditions, and no weather stress yet materializing, the current sideways-to-lower price action fits long-term seasonal behavior rather than signaling a market shift.

Currency Watch

Currency movements are quietly reinforcing downside bias. A firm U.S. dollar reduces purchasing power for non-USD importers, while a softer British pound makes London cocoa appear cheaper in international terms — encouraging speculative selling rather than commercial buying. Unless GBP strengthens or USD weakens materially, currency dynamics will continue to suppress bullish momentum and delay any breakout attempt in London futures.

Market Outlook & Trading Implications

Cocoa enters the remainder of this holiday-shortened week with low liquidity, a bearish fundamental backdrop, and no immediate catalyst to shift sentiment. The market continues to absorb steady Ivorian arrivals, supportive weather, expanding secondary-origin production, and comfortable certified stocks — all of which reinforce the expectation of near-term price softness or sideways drift rather than a sustained rebound. With funds holding their largest net short in London since 2021 and New York showing only mild short covering, upward movement remains vulnerable and likely temporary unless arrivals slow or weather turns hostile. Tomorrow’s session is expected to be quiet, driven mostly by algorithms and light commercial hedging, with price action confined within recent ranges. Until the Harmattan surprises, demand materially improves, or certified stocks begin drawing at scale, cocoa futures will struggle to build bullish momentum. The market isn’t signaling a structural bottom yet — it’s signaling patience.

If you notice any discrepancies in these figures or have extra information, please email cocoatradeblog@gmail.com or leave a comment – corrections and additional insights are always welcome.