Daily Cocoa Market Report (25 Nov 2025): Cocoa Rebounds From Lows as Ecuador Expansion and Strong Arrivals Reshape Supply Outlook

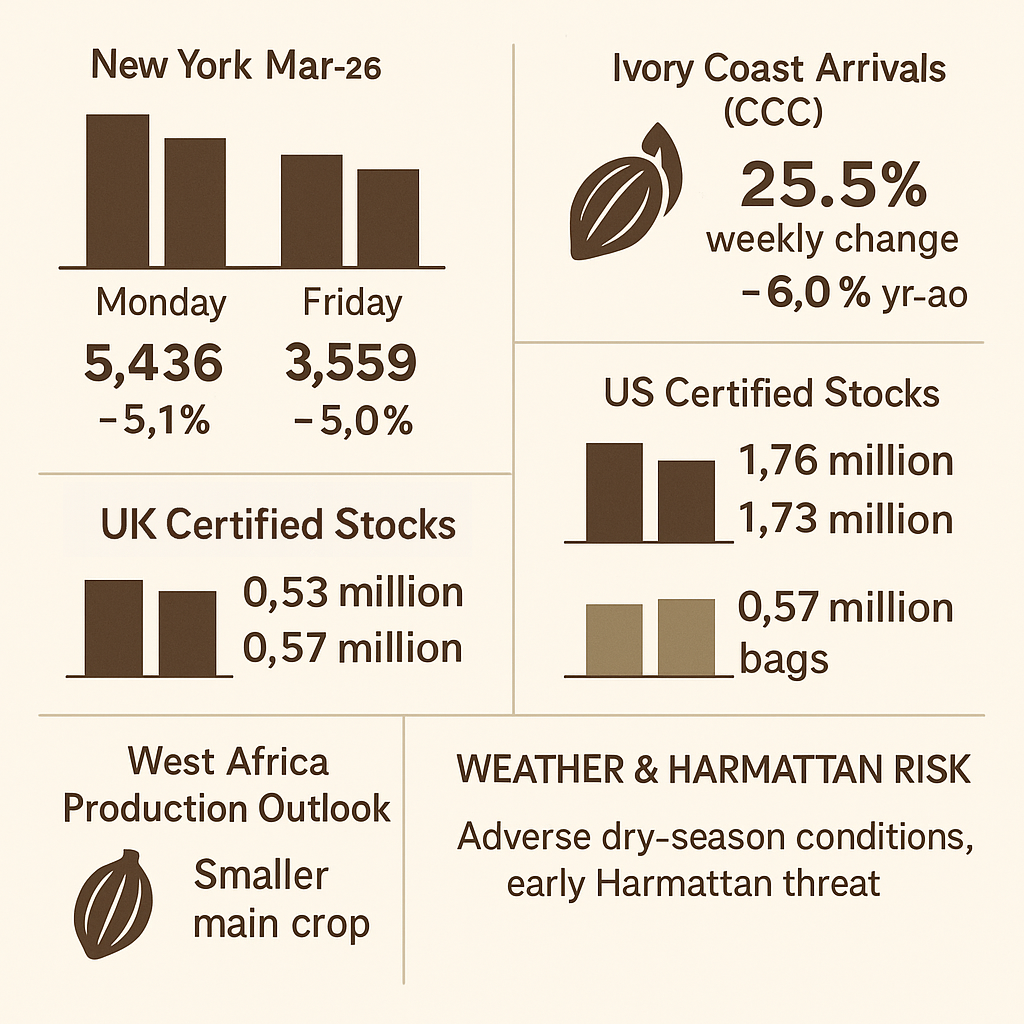

Cocoa futures spent most of yesterday retracing from early-session lows, with both New York and London staging intraday recoveries — but neither market managed a decisive breakout. In New York, March 2026 futures rebounded from the $5,000–$5,050 support zone and stabilized around $5,110, forming a short-term consolidation range. The rebound lacked strong participation, suggesting it was driven more by short-term covering than new directional conviction.

London displayed a similar pattern: prices rejected the £3,700 area and pushed toward £3,780–£3,820 before losing momentum into the close. The intraday rally improved structure — higher lows and a cleaner attempt at trend reversal — but it still sits below major breakdown levels from earlier in the month, keeping London in a broader bearish posture.

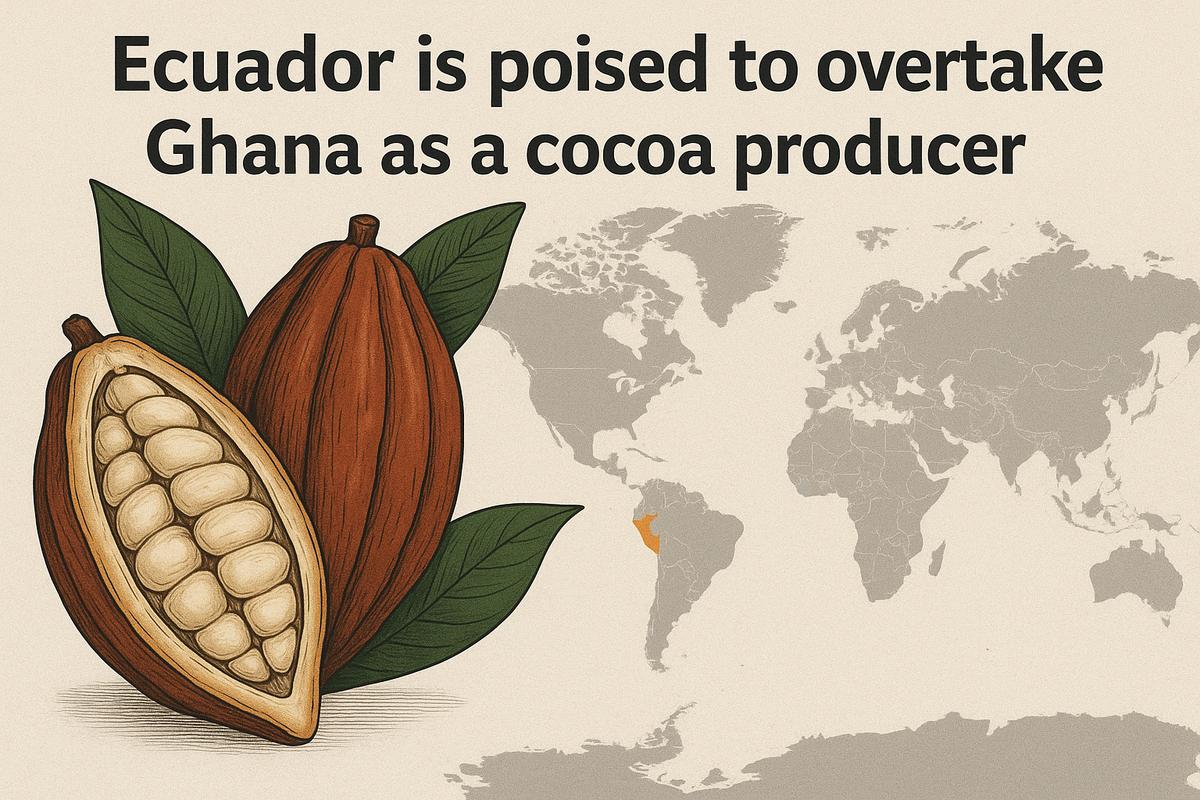

At the same time, the market continues to absorb a structural shift coming from Ecuador. New export projections now exceed 623,000 metric tons for 2026, positioning the country to overtake Ghana as the world’s second-largest cocoa producer.

Supply & Origin Developments

Strong port arrivals continue to dominate market psychology.

Ivory Coast cumulative arrivals reached 618,000 tons as of Nov 23, down 3.9% YoY — yet weekly deliveries remain strong, with 102,000 tons delivered last week, +8.5% YoY. This marks the third consecutive 100,000+ ton week, confirming that harvest flow remains uninterrupted.

Analysts attribute early-season strength to:

- carryover mid-crop stocks

- elevated farmgate pricing that accelerated deliveries

- ~110,000 tons redirected from neighboring origins

- logistics and transport improvements

Additional supply-side commentary from TRS and CRA adds nuance to the near-term outlook. TRS reports below-average canopy conditions and only average bloom development in Côte d’Ivoire — a combination that typically precedes weaker mid-season output. Exporters now expect a noticeable slowdown in Ivorian arrivals starting in December, reinforcing earlier CCC comments about a potential volume drop during Q1 2026. Officials also warned that the upcoming mid-season harvest may be smaller than last year’s, meaning the market cannot rely on a late-cycle production rebound. TRS highlights similar agronomic constraints in Ghana, where below-average canopy quality could limit yields, although the official 2025/26 production forecast remains unchanged at 519,000 tons. CRA, meanwhile, has flagged an unfavorable outlook for the start of Ghana’s mid-crop. Despite these cautionary signals, the market has not priced in tightening risk yet — because current arrivals remain strong, certified stocks are stable, and the Ecuadorian supply spread continues to widen, offsetting potential West African softness. If January–March arrivals confirm this projected slowdown, short positioning in London could become vulnerable. For now, it’s a risk to monitor, not one driving price.

Recent crop and market monitoring from Stonex reinforces expectations of a comfortable global cocoa balance heading into 2025/26.

Ecuador — Accelerating Toward Global Market Power

Ecuador continues to reshape the global cocoa landscape, and the latest Reuters update reinforces that shift. The country is now expected to export more than 623,000 metric tons in 2026, driven by improved farming practices, disease-resistant varieties, and favorable weather — a structural, not temporary, trend. Through October, exports were already up 33% year-on-year to 462,351 tons, and industry group Aneccacao projects 2025 exports above 570,000 tons. If realized, Ecuador will surpass Ghana in 2026, becoming the world’s second-largest cocoa producer, behind only Ivory Coast. Analysts note that Ecuador’s record harvest has helped break last season’s scarcity-driven pricing cycle, adding incremental supply that reduces market urgency for West African beans. For futures markets, this expanding, reliable, export-oriented production remains a bearish overhang — increasing competition, easing supply risk premiums, and strengthening the case for sustained speculative shorts, particularly in London.

Futures Performance — ICE US (New York)

| Contract | Close | Change vs 24 Nov | Volume |

|---|---|---|---|

| Mar-26 | 5,112 | -93 | 16,680 |

| May-26 | 5,137 | -85 | 6,804 |

| Jul-26 | 5,171 | -91 | 3,249 |

| Sep-26 | 5,168 | -102 | 2,128 |

Key takeaway: New York extended its pullback, with declines of 1.6%–2% across the curve.

Futures Performance — ICE Europe (London)

| Contract | Close | Change vs 24 Nov | Volume |

|---|---|---|---|

| Mar-26 | 3,800 | -17 | 11,011 |

| May-26 | 3,816 | -16 | 5,759 |

| Jul-26 | 3,837 | -14 | 4,649 |

| Sep-26 | 3,846 | -10 | 3,060 |

Key takeaway: London weakened modestly, but declines were controlled — suggesting orderly selling, not capitulation.

US–UK Futures Spread

Using GBP/USD 1.316, London’s Mar-26 equivalent price translates to roughly $5,001, narrowing the NY–London differential to about $110.

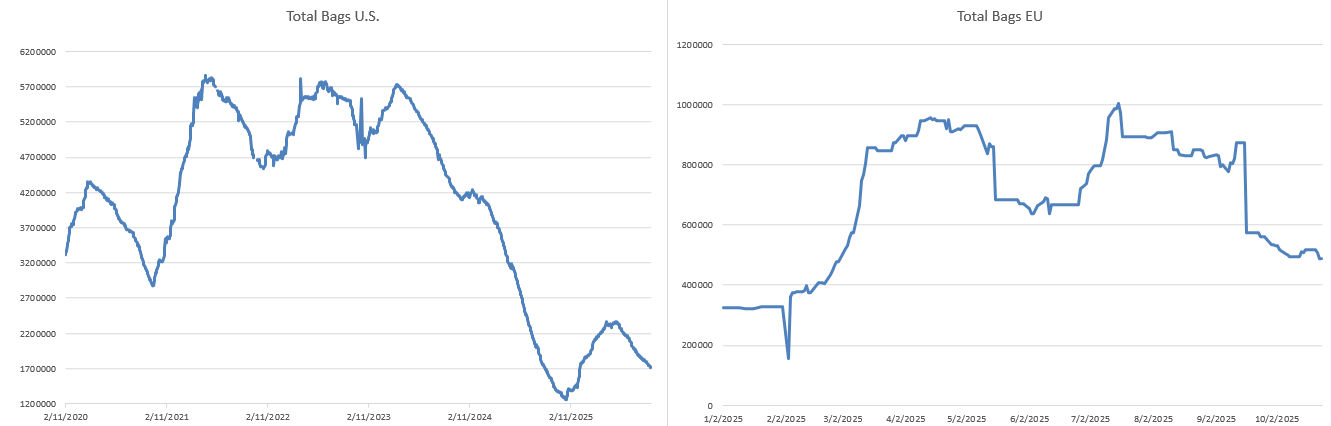

Volume & Open Interest

Trading activity increased across both exchanges, but the message beneath the numbers remains unmistakably split between regions.

New York

- Volume rose to 29,788, up from 24,711

- The prior session saw a 1,930-contract increase in open interest

This combination typically signals new positions being initiated, not just intraday churn or liquidation. Given price weakness, the most probable interpretation is value-oriented dip buying, systematic fund re-entry, or commercial hedging rather than aggressive speculative short buildup. Participation is returning — but without enough force to shift the market narrative.

London

- Volume climbed to 31,263, up from 23,712

- Open interest remains near record highs above 173,000 contracts

Rising volume without a decline in OI confirms that shorts are not covering — they’re holding or selectively adding. This reflects conviction, not hesitation. Funds see no urgency to unwind, consistent with strong arrivals, favorable weather, and comfortable certified stocks. London remains the market’s bearish anchor.

CFTC Positioning — ICE US Cocoa (Week of Oct 14, 2025)

Net Positioning

| Trader Group | Long | Short | Net |

|---|---|---|---|

| Non-Commercial (Funds) | 23,757 | 21,423 | +2,334 |

| Commercials | 70,797 | 72,817 | -2,020 |

| Non-Reportables | 11,063 | 11,377 | -314 |

| Total Market | 141,097 | 140,783 | +314 |

Week-over-Week Position Changes vs Oct 7

| Trader Group | Δ Longs | Δ Shorts | Δ Net |

|---|---|---|---|

| Non-Commercial | -324 | +3,511 | -3,835 |

| Commercials | +1,746 | -2,525 | +4,271 |

| Non-Reportables | +522 | +958 | -436 |

| Total | +850 | +414 | +436 |

CFTC positioning continues to confirm a bearish speculative regime. As of Oct. 14, money managers held a modest net long of just +2,334 contracts, well below the 5-year seasonal average near +16,000. The weekly shift was notably negative — non-commercials added 3,511 new shorts, widening their bearish stance, while commercials increased net longs by 4,271 contracts, signaling stronger origin and consumer hedging at lower prices.

Certified Stock Position

| Region | 24 Nov 2025 | 25 Nov 2025 | Change |

|---|---|---|---|

| US | 1,723,707 | 1,710,455 | -13,252 |

| UK | 565,000 | 565,000 | No change |

Assessment:

US certified stocks showed a moderate draw of 13,252 bags, but remain well within historical comfort ranges — not enough to indicate tightening or trigger bullish concern. UK inventories remain unchanged, reinforcing stable physical availability across both major delivery hubs.

Weather & Crop Outlook

(Reuters — Nov 24)

Ivory Coast growing regions continue receiving above-average rainfall, supporting pod growth and tree health into January. Temperatures ranging 26.4°C–30.5°C remain favorable, and harvesting activity has accelerated.

The key variable remains the Harmattan:

- forecast to arrive later than normal

- expected to be mild, not severe

- delayed onset supports bean size and flowering

Unless conditions shift abruptly, weather remains neutral-to-bearish for prices.

Harmattan

The Harmattan continues strengthening across the cocoa belts of Côte d’Ivoire and Ghana, with sustained northeasterly winds, falling relative humidity (mid-30s to low-40s), low dew points, elevated evapotranspiration, and little to no meaningful rainfall, keeping trees in a net moisture-loss environment. Dust transport is increasing, with AOD readings approaching 1.0–1.2 and PM10 levels entering the crop-sensitivity zone, while soil-moisture decline and early NDVI softening confirm emerging physiological stress. The Harmattan Severity Index now stands at 7.5 for Côte d’Ivoire and 6.7 for Ghana—both rising—indicating active and escalating crop-impact conditions, with Nigeria stable and Cameroon remaining safe. Light scattered showers may occur but are not sufficient to reverse drying or halt Harmattan momentum. If current conditions persist into December, elevated flower drop, cherelle abortion, smaller pod development, and reduced bean weight could lead to an 8–15% production downside risk, with higher losses possible under continued dryness. Despite this, cocoa futures are not yet pricing the developing weather threat, leaving the market vulnerable to a bullish repricing once supply signals or arrivals weaken.

| Region | Today | Trend | Risk Level |

|---|---|---|---|

| Côte d’Ivoire | 7.5 / 10 | 📈 Rising | 🔴 High |

| Ghana | 6.7 / 10 | 📈 Rising | 🟠 Elevated |

| Nigeria | 4.1 / 10 | ➖ Stable | 🟡 Watch |

| Cameroon | 2.0 / 10 | 📉 Falling | 🟢 Safe |

Market Outlook & What to Expect Tomorrow

With US markets closed Thursday for Thanksgiving:

- liquidity will fall sharply

- London will drive global cocoa price direction

- algorithmic trading likely dominates

- range-bound trade expected

Final Take

The cocoa market still isn’t signaling a bottom. Robust West African arrivals, favorable weather, steady certified warehouse stocks, and entrenched speculative shorts continue to cap upside momentum. Now, with Ecuador expected to surpass 623,000 tons of exports in 2026 — potentially overtaking Ghana as the world’s second-largest producer — the global supply picture has broadened. That additional, reliable non-West-African flow reduces the urgency for bullish positioning and reinforces the market’s confidence that physical availability will remain adequate.

Until fundamentals shift — weaker arrivals, a disruptive Harmattan, falling London open interest, or signs of tightening — rallies will continue to fade rather than build. The market remains bearishly balanced, not distressed, and certainly not yet preparing for a structural turn.

If you notice any discrepancies in these figures or have extra information, please email cocoatradeblog@gmail.com or leave a comment – corrections and additional insights are always welcome.