Daily Cocoa Market Report (26 Nov 2025): Cocoa Holds Steady as Wet Weather Delays Harvest and EUDR Delay Eases Export Risk

Cocoa held steady as rain-driven harvest delays clash with weak liquidity. Low inventories and stalled arrivals keep the market tight, but momentum is stuck. The European Parliament formally backed a one-year postponement and simplification of the EU Deforestation Regulation

Cocoa markets spent Wednesday chopping sideways in a low-volume, low-conviction environment. Price action was dominated by thin liquidity, algorithmic noise, and an early-session fade followed by a late minor recovery. Nothing about the day showed real commitment — just markets drifting while waiting for a narrative driver.

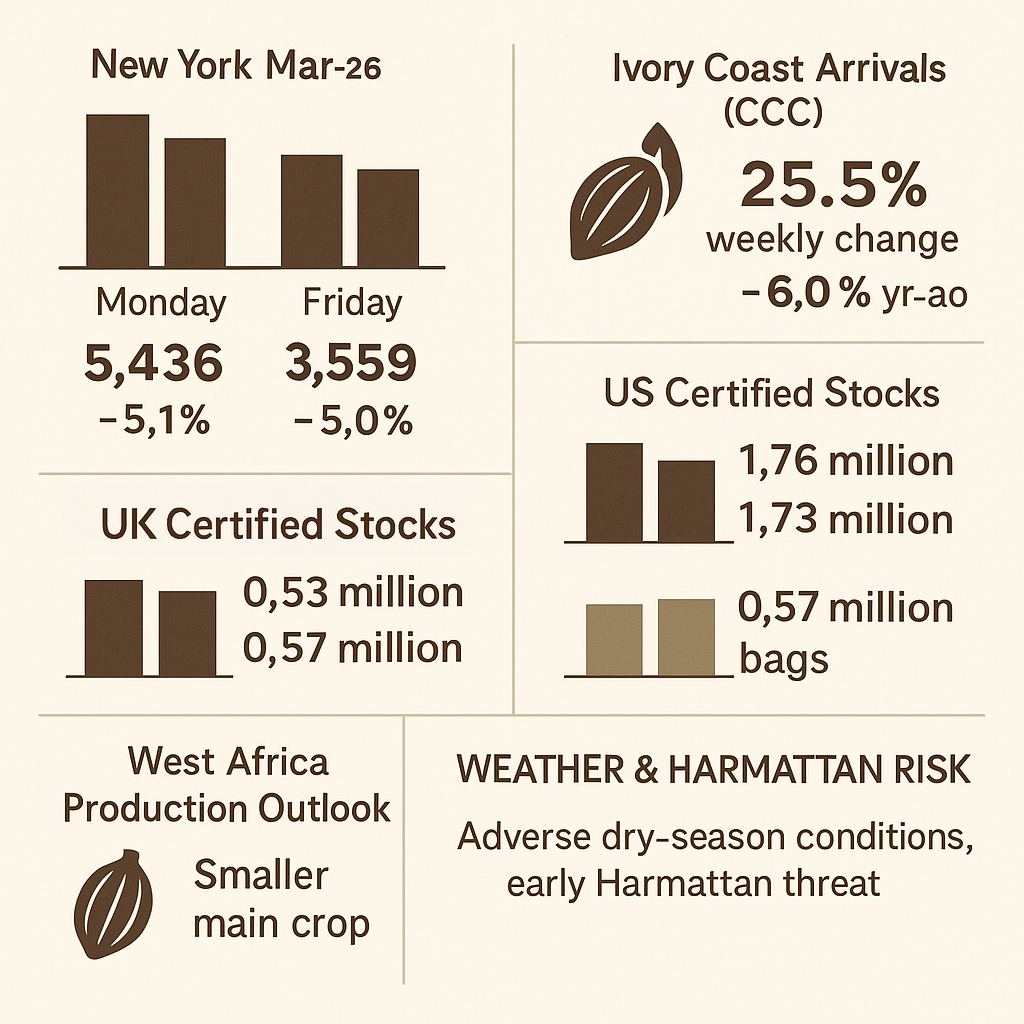

London outperformed New York, continuing the recent pattern where European contracts pull ahead on any weather-related supply worries. New York was flat to mildly higher, but still looks stuck inside a broader consolidation channel.

The two forces defining the market:

1. LSEG warning: wet weather delaying harvest in Ghana + eastern Côte d’Ivoire

This matters. Muddy roads + swollen rivers = slower deliveries. The market pays attention to this.

2. European Parliament supports a full one-year delay to the upcoming deforestation law

This removes a potential Q1 export bottleneck. Slightly bearish medium-term, but irrelevant near-term because supply remains structurally tight.

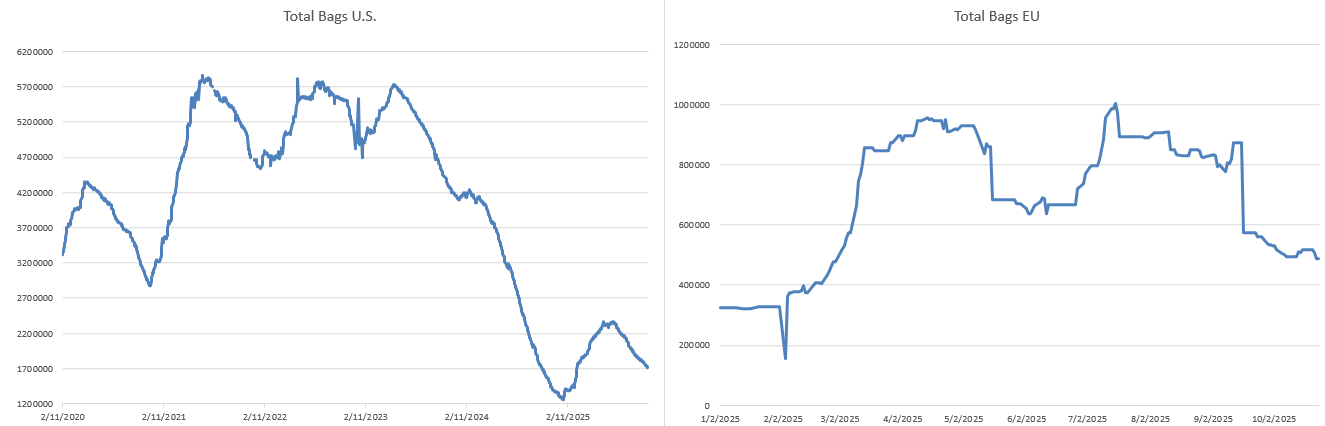

Certified Stock Position

| REGION | 25 NOV 2025 | 26 NOV 2025 | CHANGE |

|---|---|---|---|

| US | 1,710,455 | 1,709,185 | -1,270 |

| UK | 565,000 | 565,000 | No change |

A microscopic US draw of 1,270 bags — irrelevant. Stocks remain firmly inside historical comfort ranges and provide zero useful signal. UK unchanged, meaning physical availability is stable.

Net impact: neutral.

Futures Performance — ICE US (New York)

| CONTRACT | CLOSE | CHANGE VS 25 NOV | VOLUME |

|---|---|---|---|

| Mar-26 | 5,151 | +39 | 10,773 |

| May-26 | 5,177 | +40 | 5,552 |

| Jul-26 | 5,215 | +44 | 1,886 |

| Sep-26 | 5,224 | +56 | 1,220 |

New York bounced modestly, but the move was driven by thin trading — not by fundamentals. Real money is still waiting on arrivals and weather confirmation. Liquidity continues to be the problem.

Futures Performance — ICE Europe (London)

| CONTRACT | CLOSE | CHANGE VS 25 NOV | VOLUME |

|---|---|---|---|

| Mar-26 | 3,808 | +8 | 9,782 |

| May-26 | 3,827 | +11 | 5,603 |

| Jul-26 | 3,856 | +19 | 3,090 |

| Sep-26 | 3,875 | +29 | 1,974 |

London clearly led the day — consistent with weather-driven West Africa concerns. But again: it’s still weak volume, not strong conviction.

US–UK Futures Spread

Using GBP/USD 1.324, London’s Mar-26 equivalent price converts to roughly $5,017, putting it almost level with New York’s Mar-26 close at $5,151. This narrows the NY–London differential to about $134, a tighter spread than earlier in the month. The contraction reflects firmer relative strength in London, supported by slightly better volume and more persistent commercial participation. The spread remains within a neutral band, offering no clear arbitrage signal, but it highlights how London continues to anchor the market whenever New York hesitates.

Volume & Open Interest

Trading activity diverged again between New York and London, but the underlying signals from both markets point to the same conclusion: participation is returning, though conviction is still weak and heavily dependent on weather-driven sentiment.

- Volume fell to 19,775, down sharply from 29,788

- Open interest 119,337 (prior day)

Despite lower volume, the price recovery in New York came without evidence of fresh speculative pressure or large liquidation. The decline in participation suggests traders stepped to the sidelines rather than actively repositioning, consistent with the market’s choppy, indecisive tone. With no updated OI figures, it’s impossible to confirm whether commercial hedging resumed — but the lack of downside follow-through implies sellers were passive rather than aggressive.

- Volume dropped to 25,211, down from 31,263

- Open interest near record highs above 175,574 (prior day)

London’s performance stands in stark contrast to New York: prices rose solidly across the curve despite softer volume, while OI remains pinned near historic highs. This combination signals that shorts are not covering. Instead, they are holding or selectively adding into strength, reflecting conviction rather than stress. Funds see no immediate catalyst to unwind short positions, consistent with relatively stable arrivals, better weather pockets in some regions, and comfortable UK certified stock levels. London remains the market’s bearish anchor, even on up-days.

West Africa Supply Situation

Persistent wet weather continues to disrupt the early-season flow of beans, with LSEG warning that ongoing rainfall is delaying harvesting across Ghana and eastern Côte d’Ivoire. This is the only fundamentally meaningful development today, and its effects are already visible across the supply chain: pod collection is slowing, transport routes are becoming muddy and difficult to navigate, deliveries to buying centers are being pushed back, bean moisture levels remain elevated, and fermentation capacity is tightening as wet beans pile up. The longer the rains persist, the deeper these bottlenecks become, directly threatening the pace and quality of early main-crop arrivals.

Policy & Industry Developments

The regulatory backdrop shifted materially this week after the European Parliament formally backed a one-year postponement and simplification of the EU Deforestation Regulation. Under the revised timeline, large operators and traders must comply with deforestation-free sourcing and due-diligence requirements from 30 December 2026, while micro- and small-enterprises have until 30 June 2027. Lawmakers justified the extension by arguing that the EU’s traceability and information systems are nowhere near operational, and that a rushed implementation would cause severe logistical disruption across global agricultural supply chains.

For cocoa, this matters. The delay temporarily removes immediate compliance pressure from West African exporters, many of whom were unprepared for a 2025 rollout and facing potential shipment bottlenecks. In market terms, this produces a slightly bearish near-term effect, as the feared Q1–Q2 export disruptions that might have tightened available supply will now likely not materialize. At the same time, the postponement is neutral in the medium term: traceability expectations remain fully intact, structural enforcement is still coming, and West African governments will still be forced to modernize supply chain documentation before 2026.

The bottom line: the market did not react dramatically to the announcement today because the supply deficit and weather-driven tightness remain far more important drivers than regulatory timelines. The delay simply buys exporters more time; it does not fix the underlying production shortfall or the chronic fragility of West Africa’s cocoa supply chain.

Weather Conditions

Weather across West Africa remains unfavorable for harvesting and bean movement. In Côte d’Ivoire, heavy rainfall in the east, cloudy and storm-interrupted conditions in the central belt, and seasonal showers in the west have further deteriorated transport conditions in several cocoa-producing areas. Ghana is experiencing similar challenges, with extensive rainfall across Ashanti and the Eastern regions and persistent humidity and wet ground conditions in Western North. Roads in multiple districts are turning muddy, slowing or temporarily halting collection activities. These patterns reinforce the developing expectation that arrivals will underperform the seasonal pace for at least the next one to two weeks, keeping near-term supply tight and maintaining upward pressure on prices.

Harmattan Risk Forecast

Still weak to moderate, with no early surge.

This is not a bullish scenario — a late Harmattan means flowering and early pod formation stay exposed to fungal pressure from ongoing rains.

The mid-crop outlook takes a hit if this continues through mid-December.

Outlook

The market remains stuck in a tightening–but–directionless trap, pulled between a cluster of bullish and bearish forces that effectively cancel each other out. On the bullish side, persistent weather delays, weak early-season arrivals, critically low inventories, a delayed Harmattan onset, the 2026 index re-inclusion narrative, and ongoing liquidity stress for West African producers all continue to underpin the structural deficit story. But the bearish side of the ledger is equally stubborn: liquidity remains abysmal, there is no fresh panic catalyst, the EU’s regulation delay removes a medium-term supply risk, commercial hedging flows are still missing, and technical momentum offers nothing convincing. Net conclusion: the market has the ingredients for a rally but lacks the psychological spark — expect continued choppy consolidation until a real fundamental shock forces direction.

What to Expect Tomorrow (27 Nov 2025)

Expect another session of sideways, low-conviction trading, with London likely to outperform again given stronger structure and firmer technicals. New York will be inactive as the US market is closed, removing one side of the order flow and reducing volatility. Key technical levels remain unchanged: NY Mar-26 support sits at 5,120, while London Mar-26 faces resistance at 3,825–3,840. The only data that matters is weather — watch rainfall forecasts for Ghana’s Western North region for any escalation in delays, and monitor for the first hints of Harmattan; an early shift in winds changes the narrative instantly. Arrivals data is the market’s trigger, and sensitivity will be high. If rains persist for another 48–72 hours, traders will start pricing in a materially larger supply disruption.

If you notice any discrepancies in these figures or have extra information, please email cocoatradeblog@gmail.com or leave a comment – corrections and additional insights are always welcome.