Daily Cocoa Market Report (27 Nov 2025): London Cocoa Rallies as US Holiday Concentrates Liquidity in Europe

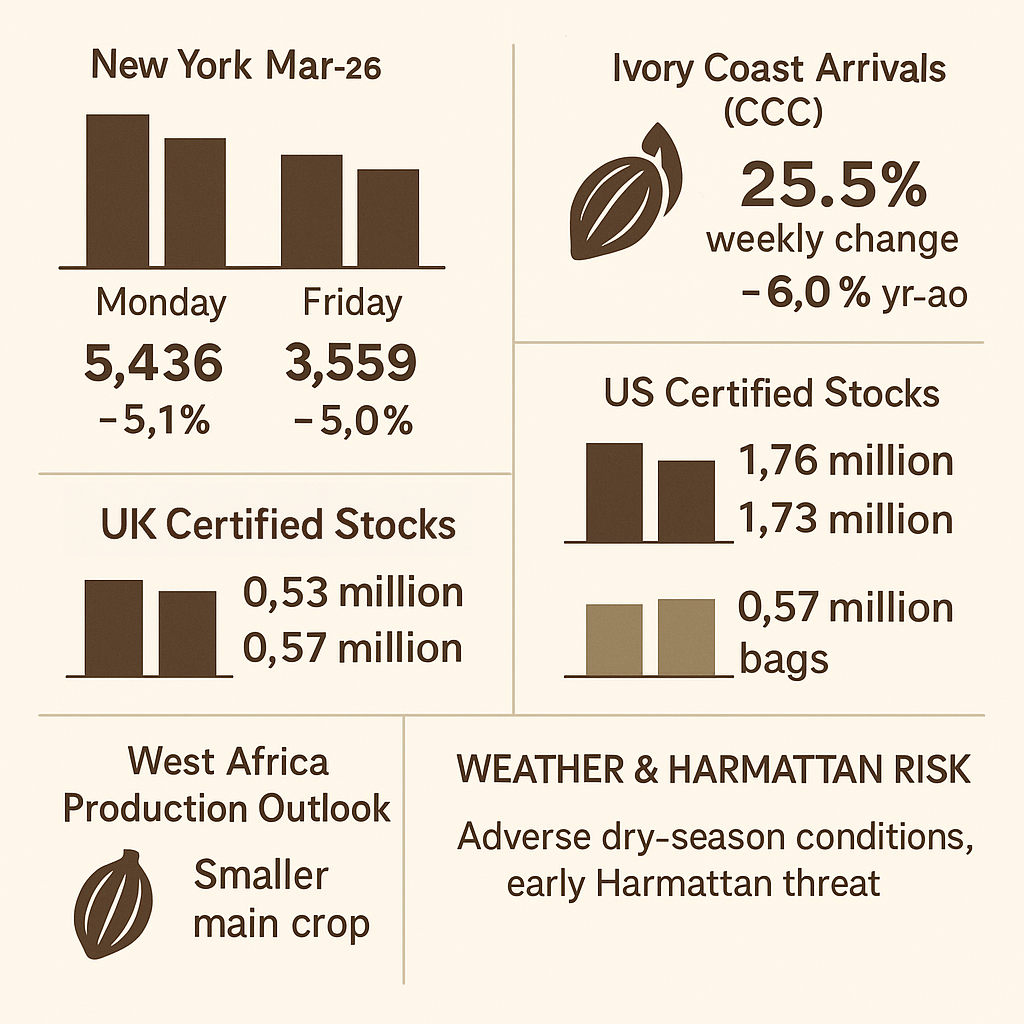

London cocoa rallied as all trading flowed into Europe during the US holiday, amplifying weather-driven supply fears. Weak arrivals, low inventories, delayed Harmattan, and limited producer hedging added support, keeping upward bias intact.

Market Summary

London cocoa rallied on Thursday because the US market was closed, leaving London as the only active price-setter and concentrating all liquidity and order-flow into a single venue. Weather-driven supply concerns intensified, with persistent rainfall across Ghana and eastern Côte d’Ivoire raising fears of delayed arrivals, muddy transport routes, and deteriorating bean quality. Weak arrivals earlier in the week reinforced the sense that the early main-crop flow is already behind seasonal norms. Critically low inventories in both Europe and the US kept underlying supply tight, giving the market little buffer against any additional harvest disruption. At the same time, a delayed Harmattan onset means pods remain vulnerable to fungal pressure, adding medium-term risk. Meanwhile, the ongoing 2026 Bloomberg Commodity Index re-inclusion narrative continues to discourage fresh short-selling, and producer liquidity stress across West Africa limits forward hedging, reducing commercial sell pressure. Together, these forces created an environment where even modest buying flowed straight into higher prices, driving London’s mild but broad-based rally.

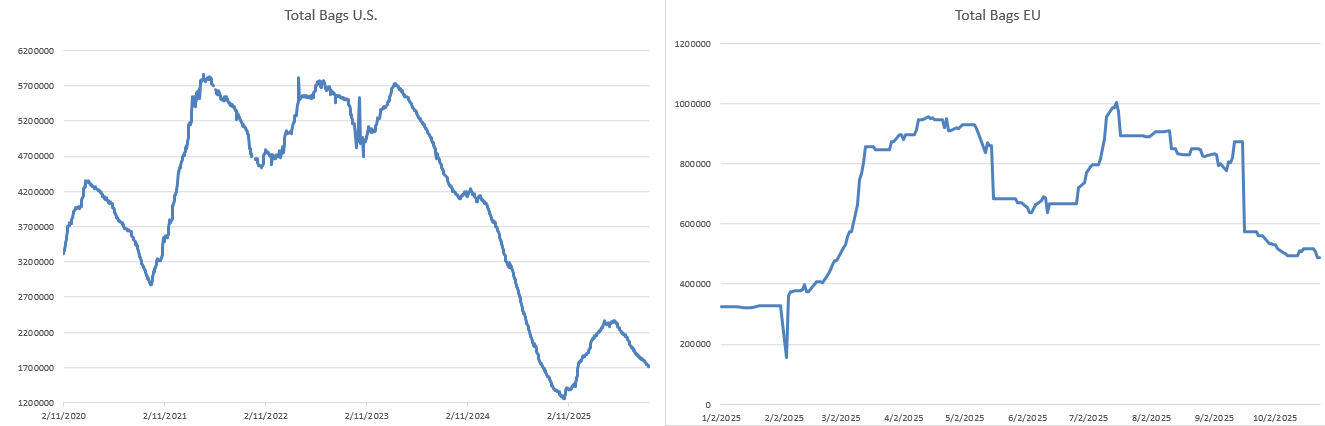

Certified Stock Position

| Region | 26 Nov 2025 | 27 Nov 2025 | Change |

|---|---|---|---|

| US | Market closed – no update | — | — |

| UK | 565,000 | 576,875 | +11,875 |

Assessment:

The moderate UK stock build of 11,875 bags adds slight short-term comfort but remains well within normal variation. With the US side closed, today’s stock picture is incomplete, but nothing here shifts the supply narrative.

Futures Performance — ICE Europe (London)

(US futures omitted — market closed for Thanksgiving)

| CONTRACT | CLOSE# | CHANGE VS 26 NOV | VOLUME |

|---|---|---|---|

| Dec-25 | 3,780 | +115 | 3,644 |

| Mar-26 | 3,910 | +102 | 5,461 |

| May-26 | 3,932 | +105 | 2,466 |

| Jul-26 | 3,961 | +105 | 1,576 |

| Sep-26 | 3,968 | +93 | 922 |

London didn’t “hold firm” — it rallied hard, with front contracts adding roughly £90–£115 versus Wednesday’s close levels. The move came on lower total volume (18,664 vs 25,211) and with today’s OI not yet reported, so this looks like a sharp holiday-thin repricing rather than a full-blooded trend shift. Weather nerves plus the absence of US trading amplified the squeeze, but the follow-through still needs to be proven once normal liquidity returns.

US–UK Spread (Based on Wednesday NY CLOSE)

GBP/USD = 1.324

- London Mar-26 today: 3,910 GBP

- USD equivalent: 3,910 × 1.324 ≈ $5,178

- NY Mar-26 (Wednesday CLOSE#): $5,151

Spread:

London (USD 5,178) – New York (USD 5,151)

→ ≈ +$27 London premium

Interpretation:

A very narrow spread. With NY closed, today’s movement is not trade-meaningful — spreads will normalize once US liquidity returns.

Volume & Open Interest

London

- Volume: 18,664 (down from 25,211)

- Open Interest: 175,486 (barely changed from 175,574)

Analysis:

London’s declining volume paired with stable OI indicates that shorts are maintaining positions rather than covering. The firmness in prices despite lower participation reinforces that supply-side weather concerns, not speculative flow, are supporting the curve. The market remains structurally bearish in positioning but temporarily buoyed by fundamentals.

US

- No trading due to the holiday

West Africa Supply Situation

Weather remains the dominant theme. Wet conditions continue across Ghana’s Western North and parts of eastern Côte d’Ivoire, slowing farm-to-depot movements and elevating bean moisture levels. Transport constraints and delayed collection are increasingly visible in early arrival trends. With no improvement expected over the next 48 hours, supply tightness remains the governing narrative.

Policy & Industry Developments

No new headlines today. Regulatory and macro drivers are unchanged. The market remains focused on weather, arrivals, and positioning.

Weather Conditions

Rainfall persisted across key cocoa belts in both Ghana and Côte d’Ivoire, reinforcing expectations of soft arrivals into early December. Roads remain muddy in several districts, causing logistical delays and inconsistent bean flow. These conditions continue to place upward pressure on London prices.

Harmattan Risk

No early Harmattan activity detected. A late and weak onset remains the base case — an unfriendly signal for flowering and early pod development.

Outlook

Expect directionless, low-liquidity trading until US markets reopen. London will remain the price driver in the short term, supported by weather-driven supply risks and cautious commercial activity. Fundamentals lean bullish, but without US participation, follow-through will be limited.

What to Expect Tomorrow

- Normalized liquidity as US markets reopen

- Watch London Mar-26 support at 3,880 and resistance at 3,950–3,970

- Weather remains the only real catalyst

- Monitor early arrival data for Côte d’Ivoire — any drop will add fuel to the upside

If you notice any discrepancies in these figures or have extra information, please email cocoatradeblog@gmail.com or leave a comment – corrections and additional insights are always welcome.