3.11.2025 - Daily Cocoa Market Report

Market Overview

The December contract in New York closed up $408 (+6.63%) at $6,559, marking the highest close since October 1. Friday’s rally had been accompanied by a decline in open interest, indicating short covering in New York, and today’s advance likely continued that trend. With assets tracking the BCOM valued at roughly $109 billion, cocoa’s new 1.7 % weighting could generate significant passive inflows.

Peak Trading Research estimates funds will need to buy about $1.9 billion in cocoa futures over the next 80 days, while Citi projected potential inflows of $2.1 billion.

New York December settled at $6,559, up $408 (+6.6 %), and London December closed at £4,709, up £285 (+6.4 %). Buying interest was concentrated in front-month contracts, with sharp upward gaps at the open. Prices reached intraday highs of $6,596 and £4,723 before consolidating modestly. The rally extended Friday’s strength as speculative shorts scrambled to cover amid expectations of sustained fund demand through the end of the year.

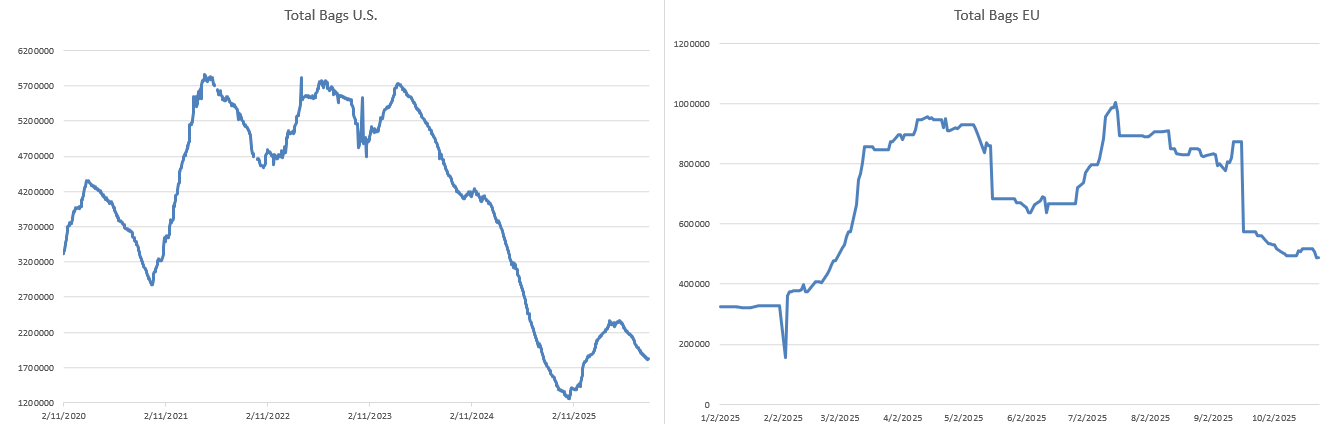

Inventory / Certified Stocks

Certified stocks rose modestly in both markets after the previous week’s declines.

- US certified stocks: 1,820,247 bags (+4,620 day-on-day)

- UK certified stocks: 489,219 tonnes (+15,469 day-on-day)

The small rebound suggests some logistical normalization in certified warehouses, although the overall trend remains historically low for this period.

Futures / Market Metrics

Trading activity was extremely strong. Total volume reached 39,946 contracts in New York and 28,244 contracts in London, more than double the typical Monday average. Open interest data for US futures was not yet available due to the government shutdown delay, but traders report heavy turnover between funds and commercials.

Both markets remain in contango, though spreads narrowed slightly as nearby buying pressure intensified. March 2026 contracts are now trading around $105 and £77 above December, indicating firm near-term demand and tightening front-month liquidity.

London Dec settled £4,709. At GBP/USD 1.315, that’s about $6,192. New York Dec at $6,559 leaves a US premium near $367. The premium widened alongside the NY-led short-covering burst while London lagged slightly.

Ivory Coast and Ghana Supply Situation

Exporters reported that cocoa arrivals in Côte d’Ivoire improved modestly last week after a slow start to the main crop. About 98,000 tons were delivered to ports between 27 October and 2 November, up from 88,000 tons during the same period last year. Farmers in western and central regions confirmed that bean quality remains good, aided by well-distributed rainfall and sunny intervals.

In Ghana, the main-crop harvest is gaining momentum, though arrivals remain behind last year’s pace. Traders continue to monitor the consistency of bean grading and the effect of intermittent rainfall on drying conditions.

Policy and Industry Developments

The sharp rally in cocoa futures followed the BCOM inclusion announcement, which reignited institutional interest across commodity funds. This structural change could significantly deepen cocoa market liquidity and may support higher baseline pricing through passive allocation flows.

Separately, attention turned to the upcoming Barry Callebaut earnings release on Wednesday. Analysts expect confirmation of weaker sales volumes due to high raw-material costs and slower global chocolate consumption. Nonetheless, investors anticipate that improved futures liquidity and easing price volatility could stabilize grinder margins into early 2026.

Barry Callebaut – what to watch and why it matters

- Street setup. Ahead of Wednesday’s results, several desks expect a weak volume print for the Jun–Aug quarter (BC’s fiscal Q4), with estimates centered around a 9% y/y volume decline for the quarter and a full-year organic sales decline near 7%.

- Exposure versus branded peers.

- Barry Callebaut (BC) is a B2B grinder and industrial chocolate supplier that prices largely on a cost-plus basis with a time lag. That makes reported revenue mechanically sensitive to cocoa price level, but margins and cash-flow are more sensitive to volatility, hedging costs, and working-capital swings.

- Mondelez and Lindt are branded consumer companies; their P&L sensitivity is more about demand elasticity and pricing power. They face slower pass-through and promotion costs but are less exposed to hedge/working-capital shocks from cocoa spikes.

- Translation: when cocoa is volatile and elevated, BC’s volumes and margins can be pressured even if its headline sales hold up via pass-through; branded peers see volumes/demand pressure but are cushioned by mix and brand pricing power.

- Balance sheet lens. Sell-side chatter suggests leverage moderating but still high; some analysts looked for net debt around ~5.2x EBITDA (vs. higher mid-year) as cocoa prices eased off extremes late in the fiscal year.

- Our back-of-envelope Q4 revenue scenario (clearly labeled as an internal estimate, not guidance).

- Assumptions: Jun–Aug volumes –9% y/y; average cocoa level still high but easing late-quarter; cost-plus pass-through with a lag; modest negative mix.

- Indicative range: CHF 2.0–2.1bn Q4 revenue (roughly flat to –3% y/y) with EBIT margin still compressed on hedging/volatility costs.

- Risks: deeper-than-expected European demand weakness, working-capital strain from elevated inventories, and ongoing price volatility could pull margins below that simple pass-through view. Upside would come from faster volume normalization and smoother hedge unwind.

Why this matters for futures: BC is a bellwether for grind and industrial demand. Confirmation of weak volumes keeps the near-term demand impulse soft; however, if management signals stabilization into Q1-Q2 and lower cocoa volatility reduces hedge costs, grinders’ forward cover could rebuild—supportive for structure and differentials even if flat price chops.

Colombia Cocoa Production

Colombia’s cocoa output for the January–September 2025 period remained up 1.04 % year-on-year at 44,158 tonnes. Fedecacao expects total 2025 production near 58,800 tonnes, slightly below last year but still indicating steady recovery in Latin American fine-flavor supply.

Nigeria / Regional Risk Notes

Tensions in West Africa intensified following recent political and security developments in Nigeria. Former U.S. President Donald Trump directed the Department of Defense to prepare for a possible intervention, citing alleged large-scale killings of Christians. The Nigerian government swiftly rejected the claims, asserting that the violence affects both Christians and Muslims and emphasizing that any foreign military action would breach its sovereignty.

Although a U.S. military deployment remains unlikely, the rhetoric has increased geopolitical uncertainty in the region, already strained by post-election unrest in Cameroon. Together, Nigeria and Cameroon account for roughly 715,000 metric tons of annual cocoa production, meaning any escalation in political instability could disrupt trade flows or transport logistics.

While no direct interruptions to cocoa shipments have been reported, the heightened regional tension has reinforced risk premiums across the cocoa market. Traders note that precautionary buying and short covering are being sustained not only by technical and index-related factors, but also by these emerging regional security risks that could affect West African supply chains during the critical harvest period.

Cameroon / regional risk notes

Tensions remain elevated in Cameroon following the disputed election. Street actions and the opposition’s calls for shutdowns keep a tail-risk bid in the market given Cameroon’s role in regional flows. Separately, U.S. signaling on counter-insurgency support in West Africa keeps Nigeria risk on the radar. CRA’s current country crop view for Cameroon plus Nigeria is about 715k tons combined; any prolonged unrest or logistics disruption would skew risks tighter.

Weather Conditions

Rainfall data from CRA and Maxar show adequate precipitation mixed with sunny intervals across the Ivorian cocoa belt. Regions such as Soubre, Divo, and Daloa reported above-average rainfall last week, improving soil moisture and supporting bean development. The weather pattern is viewed as favorable for a good-quality late main crop, provided the early dry season remains moderate.

Farmers report increased deliveries of sound, well-fermented beans to cooperatives, while pod disease incidence remains limited thanks to intermittent sunshine aiding drying.

Harmattan Risk Forecast

The latest meteorological projections indicate a moderate Harmattan expected to begin between mid-November and early December. Dust concentration forecasts remain below historical averages, suggesting limited impact on humidity and pod integrity. However, traders caution that a sudden intensification could accelerate pod drying and reduce bean weight during December. At present, weather models do not suggest a strong or prolonged event.

Commitment of Traders (COT)

The most recent ICE Futures Europe report (28 October) showed Managed Money maintaining large net shorts (8,183 long vs 22,670 short). Heavy short exposure amplified Monday’s rally as funds began rapid covering after the index inclusion news. The US COT remains unavailable due to the government shutdown.

Outlook

Monday’s surge confirmed a decisive breakout from the October range, supported by strong technical momentum and a powerful structural catalyst. As passive inflows continue and fundamentals remain tight, traders expect prices to consolidate near current highs before testing new resistance zones above $6,600 and £4,780.

With certified stocks low, the Harmattan approaching, and index funds preparing for large allocations, the overall tone remains bullish. However, short-term volatility may rise as markets adjust to the pace of speculative repositioning.

Weekly Summary Box

| Indicator | 3 Nov 2025 | 31 Oct 2025 | Change | % Change |

|---|---|---|---|---|

| US Dec Close | $6,559 | $6,141 | +$418 | +6.8 % |

| UK Dec Close | £4,709 | £4,413 | +£296 | +6.7 % |

| US Certified Stocks | 1,820,247 bags | 1,815,627 bags | +4,620 | +0.3 % |

| UK Certified Stocks | 489,219 tonnes | 473,750 tonnes | +15,469 | +3.3 % |

| US Total Volume (Mon) | 39,946 | 41,856 | –1,910 | –4.6 % |

| UK Total Volume (Mon) | 28,244 | 23,769 | +4,475 | +18.8 % |

| Open Interest (US) | N/A | 122,104 | — | — |

| Open Interest (UK) | 163,321 | 163,321 | 0 | 0 % |

| Transatlantic Spread (Dec) | $6,559 – £4,709 @ 1.315 ≈ $366 premium | — | — | — |

Market Interpretation Note

The combination of structural demand from passive funds, modest stock recovery, and stable weather created a unique alignment of bullish drivers. Monday’s breakout underscores how index-linked buying can overwhelm short-term fundamentals, forcing large speculative shorts to cover quickly.

While physical arrivals in Côte d’Ivoire are improving, overall supply remains fragile, and the Harmattan’s approach adds uncertainty. Traders anticipate continued two-way volatility as commercial hedgers sell into fund buying, but the underlying momentum favors further gains. With global grinders awaiting Barry Callebaut’s update mid-week, sentiment remains firmly constructive heading into November’s first full trading week.