30.10.2025 - Daily Cocoa Market Report

Market Overview

Cocoa futures ended Thursday slightly firmer but remained confined within the tight late-October range. New York December closed at $6,073, up $29 (+0.48%), while London December closed at £4,350, up £30 (+0.7%).

The day’s range in New York (low $5,920, high $6,091) stayed entirely within Wednesday’s broader $5,883–$6,150 band, indicating continued consolidation. Prices currently hover between the 10-day ($6,099) and 20-day ($6,046) moving averages, while Bollinger Bands have narrowed to just $683, reflecting reduced volatility. Historically, such contractions often precede larger directional moves.

Since early October, New York cocoa has traded within a horizontal range of $5,630–$6,480, where speculative funds have maintained moderate net short positions. The lack of strong follow-through buying or selling underscores market indecision as traders await fresh crop data and early November weather signals.

In London, trading participation again lagged, with volumes subdued. The March 2026 contract tested support near £4,233 before recovering to close at £4,378 (+£21). The pattern suggests light short-covering and early roll activity ahead of the December contract expiry.

Inventory / Stocks

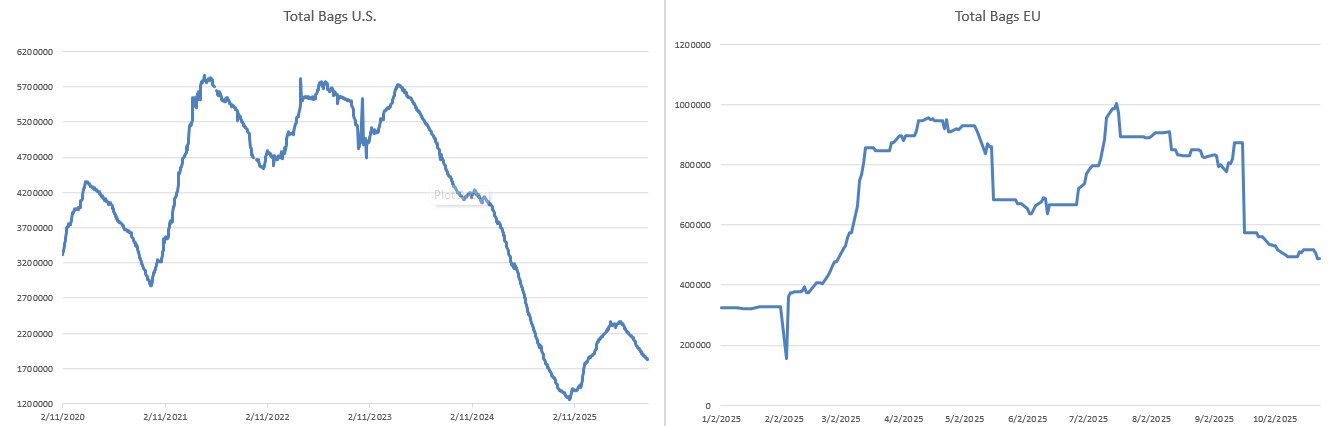

- US Certified Stocks: 1,819,808 bags (down from 1,827,670; –0.43%)

- UK Certified Stocks: 478,594 tonnes (down from 495,156; –3.34%)

Both US and UK certified stocks declined on Thursday, suggesting ongoing drawdowns from ICE warehouses. The sharper drop in UK stocks reflects higher physical offtake as European processors rebuild grind schedules following earlier supply bottlenecks. The overall stock-to-grind ratio remains tight on both sides of the Atlantic, sustaining mild bullish undertones for nearby contracts.

Futures / Market Metrics

| Market | Contract | Close (Oct 30) | Daily Change | Volume (All Contracts) | Range | Previous Close | Weekly Move (vs Oct 24) |

|---|---|---|---|---|---|---|---|

| New York (US) | Dec-25 | $6,073 | +29 (+0.48%) | 21,661 | $5,920 – $6,091 | $6,044 | –3.9% |

| London (UK) | Dec-25 | £4,350 | +30 (+0.7%) | 17,863 | £4,258 – £4,350 | £4,321 | –4.6% |

Volumes in both markets stayed below seasonal norms, consistent with month-end position adjustments. March contracts now dominate trading interest, signaling a full transition of liquidity to 2026 maturities. The intraday lift appeared largely short-cover driven, with fundamentals unchanged.

US–UK Price Spread

The transatlantic spread between New York and London December cocoa contracts narrowed slightly, with US futures closing at $6,073 and UK futures at £4,350, equivalent to around $5,720 per tonne at the current exchange rate (GBP/USD 1.315). This places the New York premium near $353 per tonne, a modest contraction from last week’s levels. The smaller gap reflects steadier European buying interest and light short covering in London, while the US market remains supported by lower certified stocks and firmer nearby demand.

Weather Conditions and Crop Outlook

Rainfall in Côte d’Ivoire and Ghana has returned to seasonal norms after a volatile August–October period. CRA reports show that precipitation, once uneven and regionally concentrated, has become more evenly distributed across central cocoa zones, supporting pod development and flower set. However, localized flooding has complicated bean drying and storage.

CRA’s latest forecast highlights potential early Harmattan activity by mid-November, with dry northeasterly winds expected to strengthen progressively. Maxar observed light to moderate showers over southern Ghana and Côte d’Ivoire this week, marking a gradual shift toward the dry season.

Harmattan Risk Forecast (Early November Outlook)

Regional meteorological centers in Côte d’Ivoire and Ghana expect the Harmattan to arrive slightly early, likely by the second week of November. Current models indicate moderate-to-strong northeasterly flow potential, which could intensify by late November.

If the dry air mass strengthens, pod moisture loss could accelerate, reducing bean weight and quality for both the late main crop and early mid-crop. The risk remains moderate for now but could become price-supportive if sustained dry spells coincide with slower arrivals.

Industry and Demand Developments

The demand outlook remains cautious. Mondelez and Hershey both reported revenue growth but falling sales volumes this week. Mondelez’s revenue rose 8.2%, but volume declined 10.5%, reflecting consumer sensitivity to higher prices. Hershey raised prices 7% while volume slipped 1%, reporting third-quarter net income of $276 million versus $446 million a year earlier.

Despite these headwinds, Hershey’s results exceeded expectations, prompting a full-year outlook upgrade and projected 2025 sales growth near 3%. CEO Kirk Tanner noted that Halloween candy sales started slower than expected due to warmer weather but improved in the final days before the holiday.

The findings underscore a broader trend: high cocoa costs continue to pressure margins, yet overall demand has remained resilient around major holidays. Hershey’s share price gained modestly post-earnings, reflecting cautious optimism from investors.

Political Developments – Cameroon

Protests persisted in Douala and other cities following President Paul Biya’s contested re-election, though cocoa shipments remain unaffected. Export operations at major ports have continued normally, but traders remain alert to potential disruptions if unrest escalates in producing regions.

Outlook

Cocoa prices remain range-bound, awaiting a decisive catalyst. Key influences in the coming sessions include:

- Early November arrivals from Côte d’Ivoire and Ghana.

- Post-Halloween confectionery sales data.

- The onset and strength of Harmattan conditions across West Africa.

Prices are expected to stay between $5,600–$6,100 in New York and £4,250–£4,400 in London. A sustained break above the upper bound would likely require confirmation of weaker arrivals or early-season dryness.

Weekly Summary Box (vs Friday, October 24)

| Indicator | This Week | Last Week | Weekly Change |

|---|---|---|---|

| US Certified Stocks | 1,819,808 | 1,843,721 | –1.3% |

| UK Certified Stocks | 478,594 | 489,531 | –2.2% |

| New York (Dec) | $6,073 | $6,319 | –3.9% |

| London (Dec) | £4,350 | £4,561 | –4.6% |

| Total Daily Volume (All Contracts) | 39,524 | 42,505 | –7.0% |

| Stock-to-Grind Ratio | Slightly lower | Stable | Mildly bullish |

Interpretation:

Both ICE inventories and cocoa futures prices eased this week as improved rainfall in West Africa balanced earlier supply concerns. The continued drawdown in certified stocks signals steady physical demand, but the overall tone remains consolidative. Short-covering and weather-related speculation may sustain moderate upward pressure into early November if arrivals data disappoints.