4.11.2025 - Daily Cocoa Market Report

Cocoa futures closed with modest gains on Tuesday as traders adopted a cautious stance ahead of Barry Callebaut’s quarterly results, expected the following day. The market consolidated after Monday’s sharp rally, with participants balancing expectations of a potential slowdown in industrial demand against ongoing supply constraints in West Africa. Traders kept an eye on escalating political tensions in Cameroon and renewed U.S. rhetoric toward Nigeria, both of which have added a regional risk premium to West African supply chains.

Market Overview

On November 4, New York December cocoa settled at $6,586, up $33 from the previous close of $6,553. In London, December cocoa rose to £4,762, up £70 from £4,692, marking its strongest close since late September.

At an exchange rate of £1 ≈ $1.315, London’s close equals approximately $6,265/ton, leaving the U.S. contract at a premium of about $321/ton. The trans-Atlantic spread remains wide but has narrowed slightly from early-October peaks, reflecting tighter nearby supply and stronger speculative positioning in New York versus somewhat more comfortable deliverable availability in London.

Certified Stocks

|

Location |

Nov 4 2025 |

Nov 3 2025 |

Oct 31 2025 (Fri) |

Change Fri→Wed |

% Change Fri→Wed |

|

U.S. (NY) |

1,810,657 bags |

1,820,247 bags |

1,815,627 bags |

–4,970 |

–0.27 % |

|

U.K. (London) |

495,313 bags |

489,219 bags |

473,750 bags |

+21,563 |

+4.55 % |

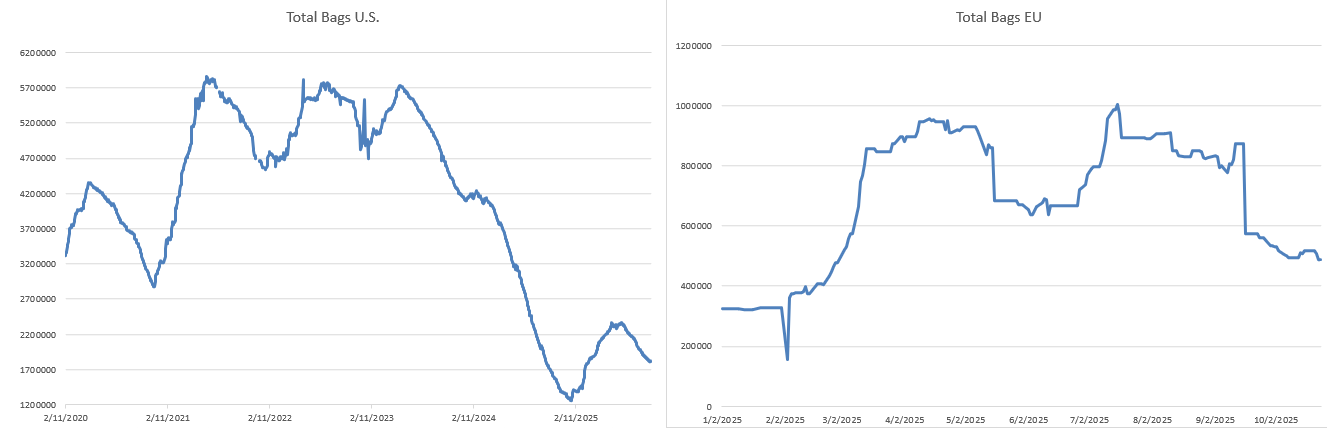

Certified stock patterns remain regionally divergent.

New York registered a mild drawdown—evidence of tight nearby availability—while London’s certified stock build offers limited relief to European deliverable supply.

Combined global exchange stocks stand near 2.31 million bags (≈ 173,000 tons), historically low in the context of global grind.

Industry Focus – Barry Callebaut and Demand Outlook

The highlight for today is Barry Callebaut’s full-year earnings report, which added a new dimension to the demand narrative.

The world’s leading industrial chocolate supplier reported that sales volumes fell 6.8% year-on-year to 2.1 million tonnes, and forecast a mid-single-digit decline in the new financial year as the sector continues to grapple with record cocoa prices.

Barry Callebaut’s management said that several large chocolate manufacturers—some with in-house production—have prioritized internal capacity amid temporarily weaker demand. This shift suggests that part of the grinding slowdown in recent quarters stems not just from high costs but from strategic capacity reallocation within the chocolate industry.

The company’s comments mirror the weaker European and North American grindings reported in recent ICCO data and align with guidance from Mondelez in October, which cited “challenging consumer spending conditions” and “high cocoa input costs.”

Taken together, these indicators reinforce the view that industrial demand recovery remains fragile, even as raw-bean prices remain historically elevated.

Analytical takeaway:

Barry Callebaut’s performance is often seen as a proxy for global grind trends. Its outlook implies that Q4 grind figures may stay subdued, particularly in mature consumer markets.

Some stabilization could come from Asian processing hubs, which have maintained higher utilization rates due to proximity to origin and lower logistical costs, but global grind growth overall appears capped for now.

West Africa Supply and Weather

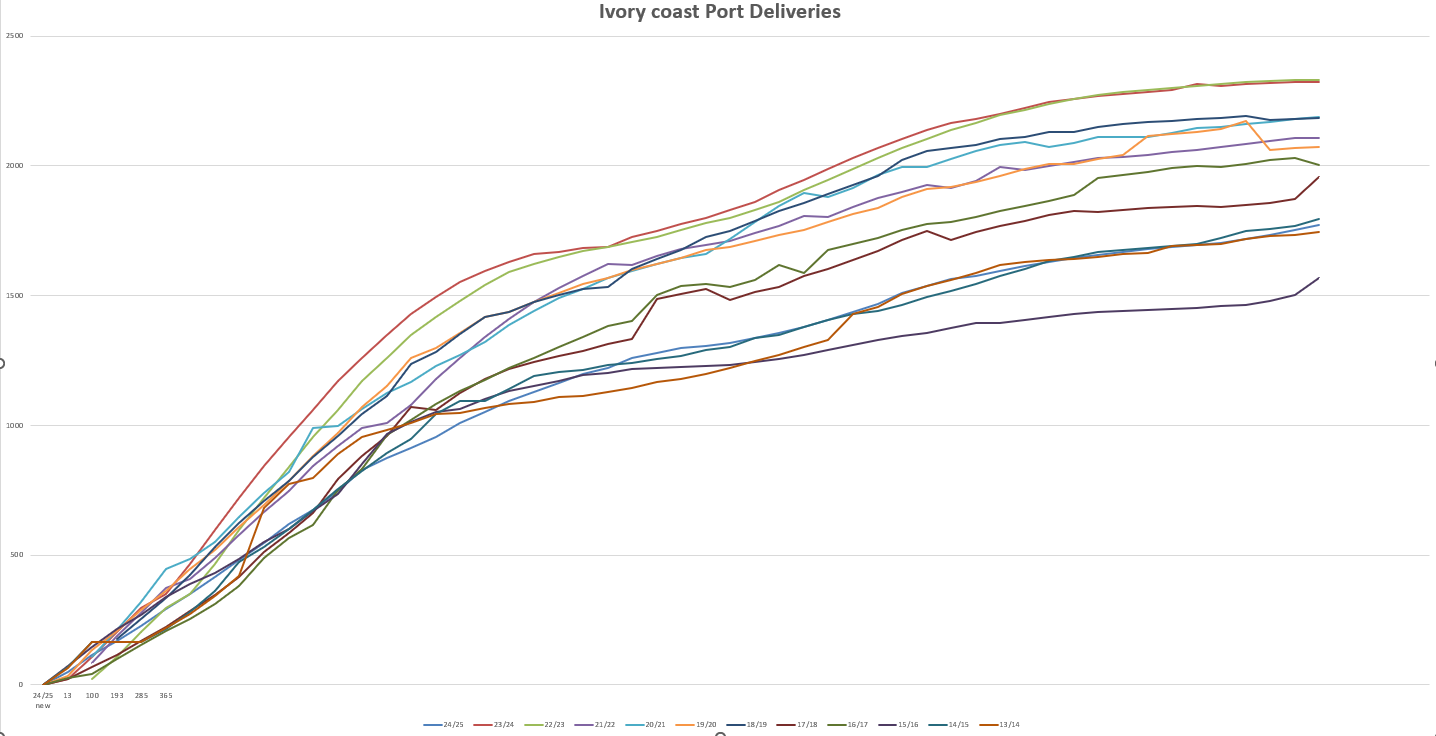

Fresh port data show Ivory Coast arrivals at ~90,000 t for the week ended Nov 2, up from 82,000 t the previous week and the highest for early November in five years.

Cumulative arrivals since Oct 1 total ~304,000 t, lagging last year’s 365,000 t and the five-year average (~363,600 t).

Rainfall across southern Côte d’Ivoire and Ghana remains light to moderate, with scattered thunderstorms improving soil moisture and aiding pod development.

Meteorologists expect the Harmattan dry season to begin in mid-November; early intensity readings will be critical for pod fill and bean quality.

A new Harmattan risk section will be introduced in reports starting mid-month.

Political Risk – Cameroon and Nigeria

Cameroon:

Post-election unrest continues following President Paul Biya’s declared re-election on Oct 12. Opposition groups dispute the result and have organized rolling protests and lockdowns in Douala and Yaoundé.

UN sources report at least 48 fatalities amid clashes between demonstrators and security forces. The opposition’s call for nationwide business closures this week adds uncertainty to trade routes in the region.

While Cameroon accounts for a smaller share of global cocoa exports, sustained unrest threatens logistics and investor sentiment across West Africa.

Nigeria:

Regional tensions also remain high after U.S. President Donald Trump warned that Washington may suspend aid or take military action if Nigeria fails to curb Islamist attacks on Christian communities.

Abuja rejected the threat, calling it “an infringement on sovereignty.”

While Nigeria’s cocoa volumes are modest relative to Côte d’Ivoire or Ghana, heightened political rhetoric and security deployments contribute to the region’s overall risk premium—already priced into cocoa futures.

Term Structure – Contango vs. Backwardation

| Market | Dec 25 | Mar 26 | May 26 | Jul 26 | Structure |

|---|---|---|---|---|---|

| NY (CC) | $6,586 | $6,676 | $6,700 | $6,694 | Mild Contango |

| Ldn (LCC) | £4,762 | £4,849 | £4,845 | £4,825 | Mild Contango / Flat Curve |

The cocoa forward curve remains in mild contango, with deferred contracts trading slightly above nearby months.

This structure typically reflects carry costs and risk premiums, not surplus supply. In current tight market conditions, such mild contango suggests that traders expect future premiums to remain firm or widen, consistent with low certified stocks and lingering supply risks in West Africa.

True backwardation—where nearby contracts trade above deferred ones—usually signals acute supply stress. The absence of backwardation here indicates that while the market is tight, participants still foresee manageable short-term supply, albeit with elevated cost and risk forward due to the Harmattan season and political instability in parts of West Africa.

Weekly Summary Box

| Indicator | 4 Nov 2025 (Tue) | 31 Oct 2025 (Fri) | Change | % Change |

|---|---|---|---|---|

| U.S. Dec Close | $6,586 | $6,151 | +$435 | +7.1% |

| U.K. Dec Close | £4,762 | £4,424 | +£338 | +7.6% |

| U.S. Certified Stocks | 1,810,657 bags | 1,815,627 bags | –4,970 | –0.27% |

| U.K. Certified Stocks | 495,313 bags | 473,750 bags | +21,563 | +4.55% |

| U.S. Total Volume | 36,313 | 41,856 | –5,543 | –13.2% |

| U.K. Total Volume | 29,788 | 23,769 | +6,019 | +25.3% |

| Open Interest (U.S.) | 121,729 | 121,151 | +578 | +0.48% |

| Open Interest (U.K.) | 163,576 | 164,192 | –616 | –0.38% |

| Transatlantic Spread (Dec) | $6,586 – £4,762 @ 1.315 ≈ $322 premium | — | — | — |

Outlook

Cocoa maintains a firm-to-cautiously bullish bias as macro-fundamentals pull in opposite directions. On the supportive side, declining U.S. certified stocks, a historically low stock-to-grind ratio, and expectations of index-linked fund inflows continue to underpin the market. However, demand-side softness and improving early-season arrivals in Côte d’Ivoire are tempering further gains. Price action remains largely driven by short-covering and light speculative positioning rather than new fund accumulation. Sustained upside will likely depend on the pace of index reallocation or potential weather disruptions during the Harmattan season.

Market Interpretation Note

The term structure’s mild contango reflects expectations of near-term tightness without immediate scarcity. The persistent U.S.–U.K. spread underscores localized inventory shortages, while political instability in Cameroon and Nigeria adds a modest geopolitical risk premium. Although industrial demand is soft, physical supply fragility and approaching seasonal weather risks keep funds selectively engaged. Market volatility should remain elevated through mid-November, with a cautiously supportive tone prevailing.