5.11.2025 - Daily Cocoa Market Report

Market Overview

Cocoa futures reversed sharply lower on Wednesday as traders took profits following two strong sessions and awaited Barry Callebaut’s earnings release.

New York December cocoa closed $252 lower at $6,334 per ton, while London December cocoa fell £201 to £4,561 per ton. The retreat followed Monday and Tuesday’s rallies, which had lifted prices to five-week highs.

At £1 ≈ $1.315, London’s settlement equals about $5,968 per ton, leaving New York at a $366 premium. The spread narrowed slightly as speculative longs reduced positions.

Trading was led by March 2026 contracts, reflecting active roll movement from December positions. Despite Wednesday’s correction, the broader uptrend remains intact amid persistent supply tightness.

Term Structure – Contango vs. Backwardation

| Market | Dec 25 | Mar 26 | May 26 | Structure |

|---|---|---|---|---|

| NY (CC) | $6,334 | $6,390 | $6,412 | Mild Contango |

| Ldn (LCC) | £4,561 | £4,679 | £4,675 | Mild Contango / Nearly Flat |

The cocoa forward curves remain in mild contango, signaling that traders expect near-term tightness to ease slightly into early 2026 as new crop arrivals accelerate.

The narrow spreads — just $78/ton in New York and £114/ton in London between December and May — suggest that while the market is no longer in steep backwardation, structural scarcity continues to underpin deferred pricing rather than reflecting surplus expectations.

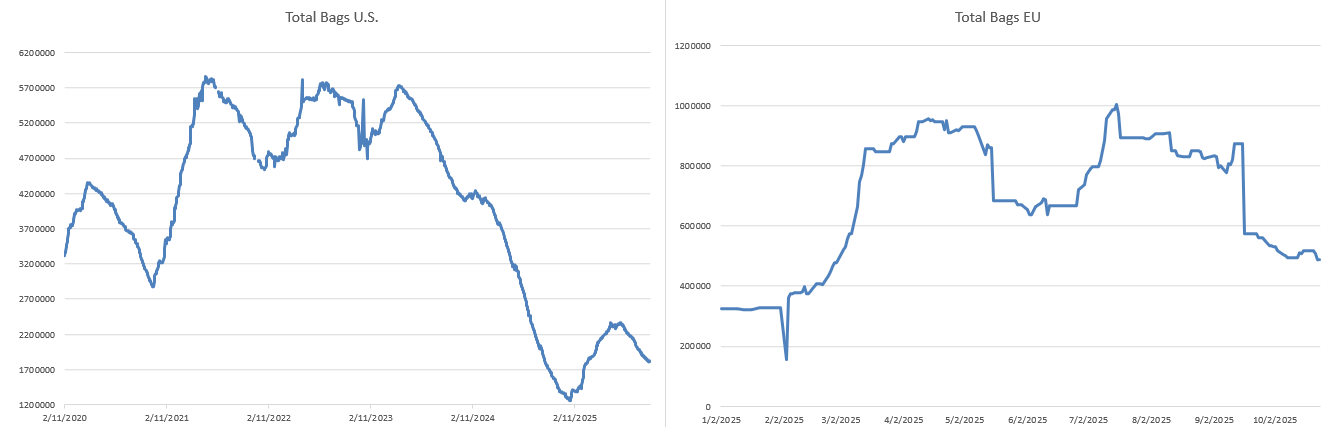

Certified Stocks

| Location | Nov 5 | Nov 4 | Change (bags) | Tons (64 kg) | % Change |

|---|---|---|---|---|---|

| U.S. (NY) | 1,806,797 | 1,810,657 | −3,860 | −247 t | −0.21 % |

| U.K. (Ldn) | 486,719 | 495,313 | −8,594 | −550 t | −1.7 % |

Combined certified stocks: ≈ 146,000 t, the lowest in over a decade.

Both exchanges reported draws, underscoring tight nearby supply despite demand-side headwinds.

Industry Focus – Barry Callebaut & Market Dynamics

Barry Callebaut’s full-year report reinforced the weak demand narrative that capped this week’s rally.

- FY 2024/25 sales volumes fell 6.8 % y/y to 2.1 million t.

- Global Chocolate −5.3 %, Global Cocoa −12.8 %.

- Revenue +49 % (local currencies) to CHF 14.8 bn ($18.2 bn), helped by bean price pass-through.

- Net profit −35.9 % due to financing costs and weaker sales.

Management projects another mid-single-digit volume decline in 2026, citing cost pressures and sluggish demand.

Callebaut also cut its cocoa-price forecast to £4,400 by end-2025 (from £5,700) and held £5,150 for 2026.

The firm announced a strategic partnership with Planet A Foods to commercialize ChoViva, a cocoa-free chocolate made from sunflower seeds. This initiative reflects an effort to hedge against cocoa volatility while expanding sustainable product lines.

“Through this partnership, Barry Callebaut is embracing technology to enhance resilience to today’s cocoa-market volatility,” said Christian Hansen, Head of Global Strategy.

Consumer & Confectionery Industry Outlook

According to The Wall Street Journal, candy companies foresee relief ahead:

- Mondelez CFO Luca Zaramella: expects prices to stabilize in 2026, easing the need for further retail hikes.

- Hershey CFO Steven Voskuil: “I would hope as we get deeper into 2026, we’d start to see some deflation.”

- Wells Fargo Agri-Food Institute projects a swing from a 500 kt deficit last season to a 150 kt surplus, citing better weather and improved yields.

Improved West African and Ecuadorian conditions are raising optimism, though the ICCO cautions that recovery remains weather-dependent.

West Africa Supply & Weather

In Côte d’Ivoire, port arrivals for the week ending 2 November were around 90,000 tons, up ~10 % from the previous week, but cumulative arrivals (304,000 t) remain ~17 % below last year.

In Ghana, authorities launched a crackdown on cocoa smuggling into Côte d’Ivoire (Swissinfo), as price disparities encourage cross-border trade. Fairtrade International announced new programs to help West African farmers adapt to volatile markets and comply with sustainability standards.

“Wet weather may delay cocoa harvesting across southern Ghana and western Ivory Coast, while dry conditions may favor Nigeria and Cameroon’s key crop areas,” LSEG Research noted Wednesday.

Forecasts suggest the Harmattan could begin around mid-November, with its intensity crucial for pod fill and bean quality.

Heavy precipitation in Cameroon’s southwest has worsened black-pod disease, threatening yields.

Regional Risk Notes – Cameroon and Nigeria

Cameroon’s post-election tension and continued separatist disturbances in the Anglophone southwest remain a key logistics risk. Port congestion and insecurity have limited field access, adding to crop-quality uncertainty.

In Nigeria, tensions rose after U.S. President Donald Trump ordered U.S. military readiness operations, citing Islamist-related violence against Christians — a move Abuja condemned as interference while accepting limited U.S. cooperation on counter-terrorism.

While Nigeria’s cocoa volumes are small (~5 % of global output), escalating political rhetoric and higher insurance premia contribute to the West African risk premium embedded in cocoa futures.

Weekly Summary Box

| Indicator | 31 Oct (Fri) | 5 Nov (Wed) | Change | % Change |

|---|---|---|---|---|

| U.S. Dec Close | $6,141 | $6,334 | +193 | +3.1 % |

| U.K. Dec Close | £4,413 | £4,561 | +148 | +3.4 % |

| U.S. Stocks | 1,815,627 | 1,806,797 | −8,830 | −0.49 % |

| U.K. Stocks | 473,750 | 486,719 | +12,969 | +2.7 % |

| U.S. Volume | 41,856 | 31,278 | −10,578 | −25 % |

| U.K. Volume | 23,769 | 25,603 | +1,834 | +7.7 % |

| U.S.–U.K. Spread (Dec) | ≈ $366 | ≈ $333 | −33 | −9 % |

Market Interpretation

Wednesday’s steep decline reflected broad profit-taking and concern over Barry Callebaut’s guidance rather than a structural change.

While consumer demand may cool temporarily, tight certified stocks and regional risk factors continue to anchor prices near multi-decade highs.

The partnership shift toward alternative ingredients (like ChoViva) underscores the industry’s search for long-term supply resilience.