6.11.2025 - Daily Cocoa Market Report

Market Overview

Cocoa futures extended their decline on Thursday following two days of heavy liquidation. New York December cocoa settled at $6,185, down $149, while London December cocoa fell £127 to £4,434. Converted at £1 ≈ $1.315, London’s close equates to about $5,826/ton, placing the U.S. premium near $359/ton—a sign that tightness remains greater in U.S. deliverable stocks despite easing physical tension in Europe.

Thursday’s selloff followed a steep two-day correction from Tuesday’s highs ($6,586 in New York, £4,762 in London). Price weakness was accompanied by steady volume (35,346 lots in New York and 33,480 lots in London) and a further drop in open interest, reinforcing that the recent move continues to be dominated by long liquidation and profit-taking, not fresh selling.

The December contract in New York remains above key short-term support near $6,080, while resistance lies around $6,390–$6,420. In London, nearby support emerges at £4,370, followed by stronger support near £4,300.

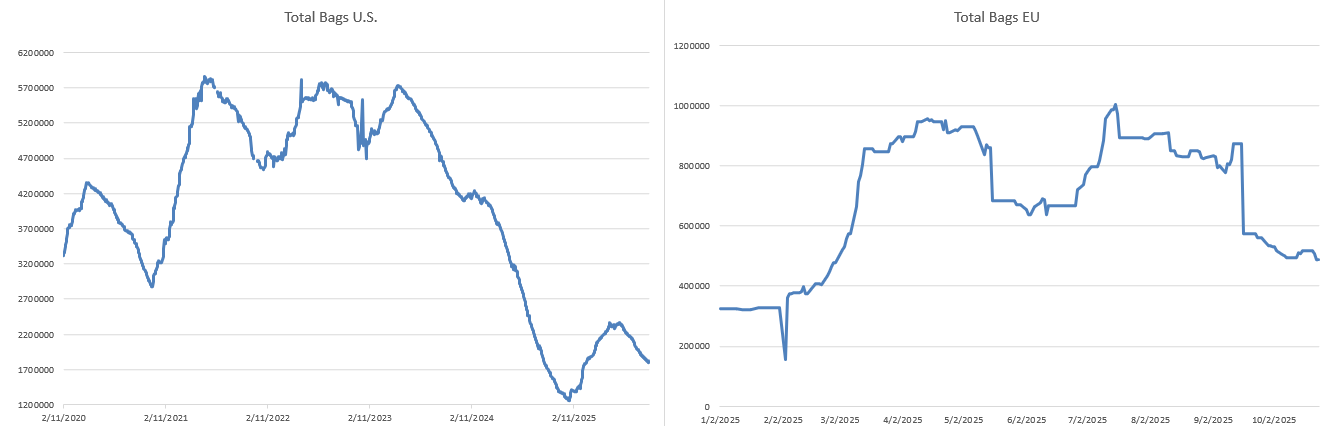

Certified Stocks

ICE data show a continued reduction in certified inventories:

- U.S. certified stocks: 1,793,757 bags, down from 1,806,797.

- U.K. certified stocks: 485,469 bags, down from 486,719.

Combined, this represents approximately 146,563 metric tons, a decline of roughly 1.2% week-on-week, continuing the slow drawdown trend from late October. The draw underscores ongoing tightness in certified supply, though it has not yet provided enough bullish momentum to counteract weakening demand sentiment.

Futures / Market Metrics

| Market | Dec 25 | Mar 26 | May 26 | Jul 26 | Daily Change | Volume | OI Trend |

|---|---|---|---|---|---|---|---|

| New York (CC) | 6,185 | 6,277 | 6,273 | 6,273 | ↓149 | 35,346 | ↓ |

| London (LCC) | 4,434 | 4,370 | 4,517 | 4,497 | ↓127 | 33,480 | ↓ |

The curve remains mildly upward-sloping (contango), suggesting stable forward supply expectations but little near-term scarcity.

Volume, Price & Open Interest Analysis

Trading volumes remained robust on Thursday, with the March 2026 contracts surpassing the December positions as the primary liquidity point in both exchanges. The transition to March dominance indicates that many traders are rolling out of December rather than opening fresh positions—consistent with short-term liquidation and spread adjustment activity.

Open interest continues to fall, confirming that the market is consolidating after October’s sharp rebound. In New York, open interest has fallen from over 121,700 to around 121,300; in London, from 161,000 to near 160,000. This steady contraction typically signals a lack of new speculative appetite amid mixed fundamentals.

Ivory Coast & Ghana – Supply & Weather

Improved rainfall patterns have recently eased dryness in parts of southern Ghana and western Côte d’Ivoire, helping flowering and pod development for the main crop. However, excessive rain in certain central and western zones is raising the risk of black pod disease, prompting regulators to warn of possible localized yield losses.

According to LSEG Insights, “Wet weather may delay cocoa harvesting across southern Ghana and western Ivory Coast, while drier weather may favor Nigeria’s and Cameroon’s key crop areas.”

Overall, conditions have shifted from drought risk to disease risk, and analysts see potential for slower harvesting but better mid-crop flowering if rainfall normalizes.

Regional Risk Notes – Cameroon and Nigeria

Tensions remain elevated in Cameroon as post-election youth demonstrations persist in key producing areas, although no significant disruption to cocoa flows has been reported. In Nigeria, the security situation remains fragile amid renewed militant activity warnings.

The U.S. administration continues to signal a stronger counterterrorism posture in West Africa, with discussions around increased U.S. military coordination with Nigerian forces to contain Islamist groups. While such developments are not yet market-moving, heightened regional risk could support risk premiums if logistics or exports are affected during peak shipping months.

Industry Developments

Barry Callebaut (BC):

The company’s full-year report showed 6.8% lower sales volumes but 49% revenue growth, driven by higher cocoa-linked pricing. BC entered a long-term partnership with Planet A Foods to scale “ChoViva,” a cocoa-free chocolate alternative made from sunflower-based ingredients. While cocoa remains central to BC’s portfolio, the diversification underscores a strategic pivot toward resilience amid cocoa volatility.

BC projects further mid-single-digit volume declines in 2026 and has revised its cocoa price forecast down to £4,400/ton by end-2025 (from £5,700), signaling expectations for price normalization.

JP Morgan meanwhile raised its target price for Barry Callebaut to CHF 1,200 (from CHF 1,100), reflecting confidence in the company’s adaptation strategy.

Hershey:

Despite weaker-than-expected Halloween sales, Hershey raised its 2025 net sales growth outlook to 3% (from at least 2%), maintaining optimism in premium and snacking segments.

However, the company’s Q3 results revealed a sharp 850 bps margin contraction and lower EPS ($1.30 vs $2.34) due to elevated cocoa and tariff costs. The firm expects tariff expenses of $160–170 million for 2025, reinforcing its message that margin recovery will be gradual, even as pricing power holds.

Industry takeaway:

Global confectioners are signaling a plateau in cocoa demand and an expectation of price moderation into 2026 as improved weather bolsters supply. Still, structural risks—aging trees, disease, and political instability—remain strong counterweights.

Term Structure – Contango vs. Backwardation

| Market | Dec 2025 (Close) | Mar 2026 (Close) | May 2026 (Close) | Jul 2026 (Close) | Structure |

|---|---|---|---|---|---|

| New York (CC) | $6,185 | $6,290 | $6,312 | $6,280 | Mild Contango / Flattening Curve |

| London (LCC) | £4,445 | £4,545 | £4,526 | £4,492 | Mild Contango / Flat |

The cocoa forward curve remains in mild contango, with deferred contracts trading slightly above the nearby months.

This structure reflects carry costs and risk hedging rather than an abundance of physical supply.

The gentle flattening beyond May suggests that traders expect moderate easing of tightness later in the 2025/26 season, but not a full return to surplus conditions.

In essence, the market remains structurally tight, yet with early signs of normalization — consistent with improving weather reports and short-term demand softness.

Weekly Summary Box

| Metric | Nov 6 | Nov 5 | Weekly Change |

|---|---|---|---|

| US Certified Stocks (bags) | 1,793,757 | 1,806,797 | −13,040 |

| UK Certified Stocks (bags) | 485,469 | 486,719 | −1,250 |

| NY Dec Futures ($/t) | 6,185 | 6,334 | −149 |

| Ldn Dec Futures (£/t) | 4,434 | 4,561 | −127 |

| Total NY Volume (lots) | 35,346 | 31,278 | +4,068 |

| Total Ldn Volume (lots) | 33,480 | 25,603 | +7,877 |

Interpretation:

The week marked a corrective phase following early-week rallies. Volume expanded even as prices retreated, implying active profit-taking and roll activity rather than panic selling. The concurrent stock draw indicates persistent tightness in physical supply, though demand headwinds continue to weigh on sentiment.

Market Interpretation Note

The cocoa market remains caught between structural supply risk and short-term demand softness. Falling open interest alongside rising volume points to volatile range-bound trading, dominated by liquidations rather than new directional bets.

Improved rainfall in West Africa and lower grind data have tempered near-term bullishness, but long-term constraints—aging farms, disease, and limited farmer margins—keep the market underpinned. Price action suggests temporary bearish momentum, not a full reversal of the longer-term uptrend.

Harmattan Outlook – Historical Context and Current Risk

The Harmattan, the dry, dusty northeasterly flow from the Sahara, typically affects West Africa’s cocoa belt from mid-December through February, with impact peaking late December–January. Historically, its market relevance comes from three channels:

- Moisture Stress & Bean Size

- In Côte d’Ivoire and Ghana, a strong, early Harmattan sharply lowers relative humidity, accelerates pod and bean drying, and can cut bean weight and count.

- When trees are already stressed (ageing, disease, limited inputs), yield losses have historically ranged from 3–10% in affected zones in strong years, and more in localized hot spots.

- Quality & Defects

- Excessive dryness and hot winds increase the share of shriveled, smoky or smoky-tainted beans, leading to higher rejection rates or discounts and effectively tightening “good quality” supply even when gross tonnage is similar.

- Harvest & Logistics Timing

- Strong Harmattan episodes often pull forward drying/evacuation, but can also disrupt inland transport and port operations through dust and haze, temporarily tightening nearby availability.

Current setup vs historical patterns

- Soil moisture across key Ivorian and Ghanaian regions has recently improved thanks to late rains, giving the main crop a better starting cushion than during some of the worst recent years.

- At the same time, the tree stock is structurally weak (ageing, swollen shoot, under-fertilization), so tolerance to climatic shocks is lower than a decade ago.

- With certified stocks still historically low and funds sensitive to any weather headline, the market is primed to react disproportionately to Harmattan signals.

Scenario-based view (drawing on historical behavior, not a real-time forecast)

- Base Case – Mild / Normal Harmattan (Probability ~50–60%)

- Onset mid-December, intermittent intensity.

- Slight downward pressure on bean size offset by good pod set from recent rains.

- Net effect: no major new deficit, supportive of the current consolidation / gentle softening narrative into Q1 2026. Prices remain elevated vs history but without a fresh spike.

- Bullish Case – Early & Strong Harmattan (Probability ~20–25%)

- Sustained low humidity and strong winds from late November or very early December.

- Potential 5–10% reduction in exportable main-crop output across sensitive belts, worse quality profile, and renewed fears about the mid-crop.

- With exchange stocks thin, this would likely reignite a weather risk premium, triggering fund buying and short-covering: a retest of $7,000+ NY / £4,800+ Ldn becomes plausible.

- Bearish / Comfort Case – Late, Weak Harmattan (Probability ~20–25%)

- Onset delayed into January and less intense than average.

- Combined with the production rebound narrative (ICCO surplus expectations, better Ecuador/LatAm output), this could validate trade-house and confectioner forecasts for normalization, encouraging further downside toward $5,500–5,800 if demand remains soft.

My read for now

Given:

- healthier late-rainfall profile versus prior drought years,

- but structurally fragile West African orchards and low certified stocks,

- plus how quickly algorithmic and index flows respond to weather headlines,

the most likely path is a “mildly supportive” Harmattan: not catastrophic, but strong enough that any indication of above-normal dryness or dust will be seized upon by the market. In other words, the Harmattan skew keeps upside risk alive, even as near-term fundamentals (weak grind, stabilization narratives from Hershey/Mondelez, BC’s lower price expectations) lean modestly bearish.

For risk management, both producers and consumers should treat early-season Harmattan updates as high-impact triggers: a few weeks of stronger-than-normal conditions could flip sentiment from today’s corrective mood back into a weather-driven rally very quickly.