7.11.2025 - Daily Cocoa Market Report

Daily cocoa market analysis and news covering ICE futures, Ivory Coast & Ghana supply, weather outlook, certified stocks, Harmattan risk, and next-day trading expectations.

Market Overview

Cocoa futures fell sharply on Friday as technical weakness and long liquidation intensified following mid-week resistance at the upper Bollinger Band.

New York (ICE US) December 25 dropped $188 (-3.0%), closing at $5,998 after Thursday’s $6,186 settlement.

London (ICE Europe) December 25 fell £124 (-2.8%), ending at £4,321 from £4,445 the previous day.

Liquidation was heavy as traders rolled exposure into March contracts, which now hold the highest open interest and will become the front-month benchmark starting Monday.

The week concluded with broad selling pressure across commodities and a stronger U.S. dollar, adding to cocoa’s downside momentum.

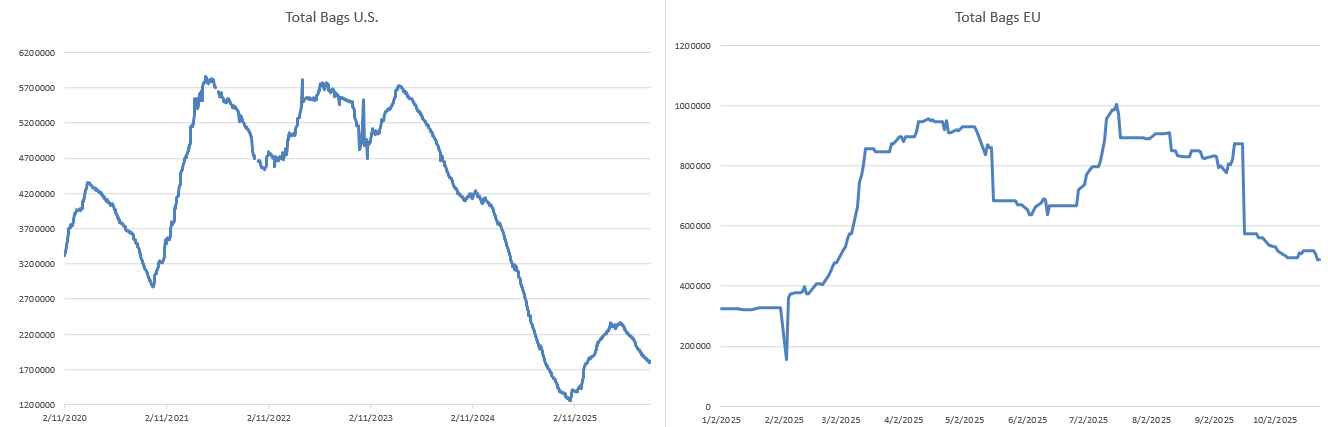

Inventory / Certified Stocks

| Location | Stocks (tonnes) | Daily Change | Weekly Change | Comment |

|---|---|---|---|---|

| ICE US | 1,800,805 | ▲ +7,048 t (from 1,793,757 Thu) | ▼ –0.8 % (vs 1,815,627 Fri prior) | Small daily build but overall weekly draw; U.S. certified supply remains historically tight. |

| ICE UK | 499,063 | ▲ +13,594 t (from 485,469 Thu) | ▲ +2.0 % (vs 489,219 Fri prior) | Strong daily and weekly build, showing steady restocking in London warehouses. |

Interpretation:

The daily builds in both markets indicate short-term easing of supply tightness, likely due to improved bean arrivals and grading at ports. However, U.S. stocks remain near multi-month lows, emphasizing the uneven recovery between origins.

Futures / Market Metrics

| Contract | Close (Fri) | Change on Day | Weekly Change | Notes |

|---|---|---|---|---|

| NY Dec 25 (CCZ25) | $5,998 | –188 | –188 | Closed below the 20-day MA; momentum remains bearish. |

| London Dec 25 | £4,321 | –124 | –124 | Mirrored NY’s losses; heavy Dec/Mar spread turnover. |

Combined cocoa futures volume (NY + London): ≈ 64,000 lots

Spreading volume: >40%, dominated by Dec → Mar rolls.

➡️ From Monday, March 26 contracts become the reference front-month due to higher liquidity.

Volume, Open Interest & Momentum

Friday’s 64,000 combined lots marked one of the highest daily turnovers this quarter.

Open interest in March 26 now exceeds December by roughly 11%, confirming the roll into the next delivery period.

The price decline amid high volume and falling open interest suggests long liquidation rather than new short-selling — a technically oversold market still lacking fresh buying support.

RSI stands at 29, indicating the market is approaching short-term exhaustion but not yet reversing.

Commitment of Traders (COT) – UK Data

The latest ICE Futures Europe report (as of November 4, 2025) shows a moderate reduction in speculative exposure.

Managed Money trimmed both long and short positions, leaving a net short of ~10 400 lots, down from 13 000 the previous week.

This reduction reflects partial profit-taking after the October rebound and portfolio rebalancing ahead of the Dec/Mar rolls.

Commercial hedgers remain balanced, while swap dealers hold a modest net long in deferred months.

Overall, the data confirm that much of the recent weakness has come from long liquidation, not new short accumulation.

The U.S. COT remains unavailable because of the ongoing government shutdown, making London positioning the key reference for speculative sentiment.

Ivory Coast and Ghana Supply Situation

Rains across western Côte d’Ivoire, central Ghana, and southeast Nigeria maintained good soil moisture for pod filling.

Arrivals remain below last year’s pace, but port congestion has eased, and exports are expected to improve through mid-November.

Industry sources report that bean quality remains strong, with limited black pod incidence so far.

Traders anticipate steadier deliveries into December if the mild weather continues.

Policy and Industry Developments

Indonesia confirmed a $22 billion (₨ 371 trillion) agro-processing investment plan covering cocoa, sugarcane, and cashew.

The project aims to increase domestic cocoa grinding capacity and promote rural employment.

Barry Callebaut CEO Peter Boer expressed cautious optimism for 2026, expecting gradual recovery in demand as supply chain volatility normalizes.

The company’s ChoViva partnership with Planet A Foods — a sunflower-based cocoa alternative — underlines the industry’s diversification away from raw-bean dependency, signaling potential long-term structural changes in cocoa demand.

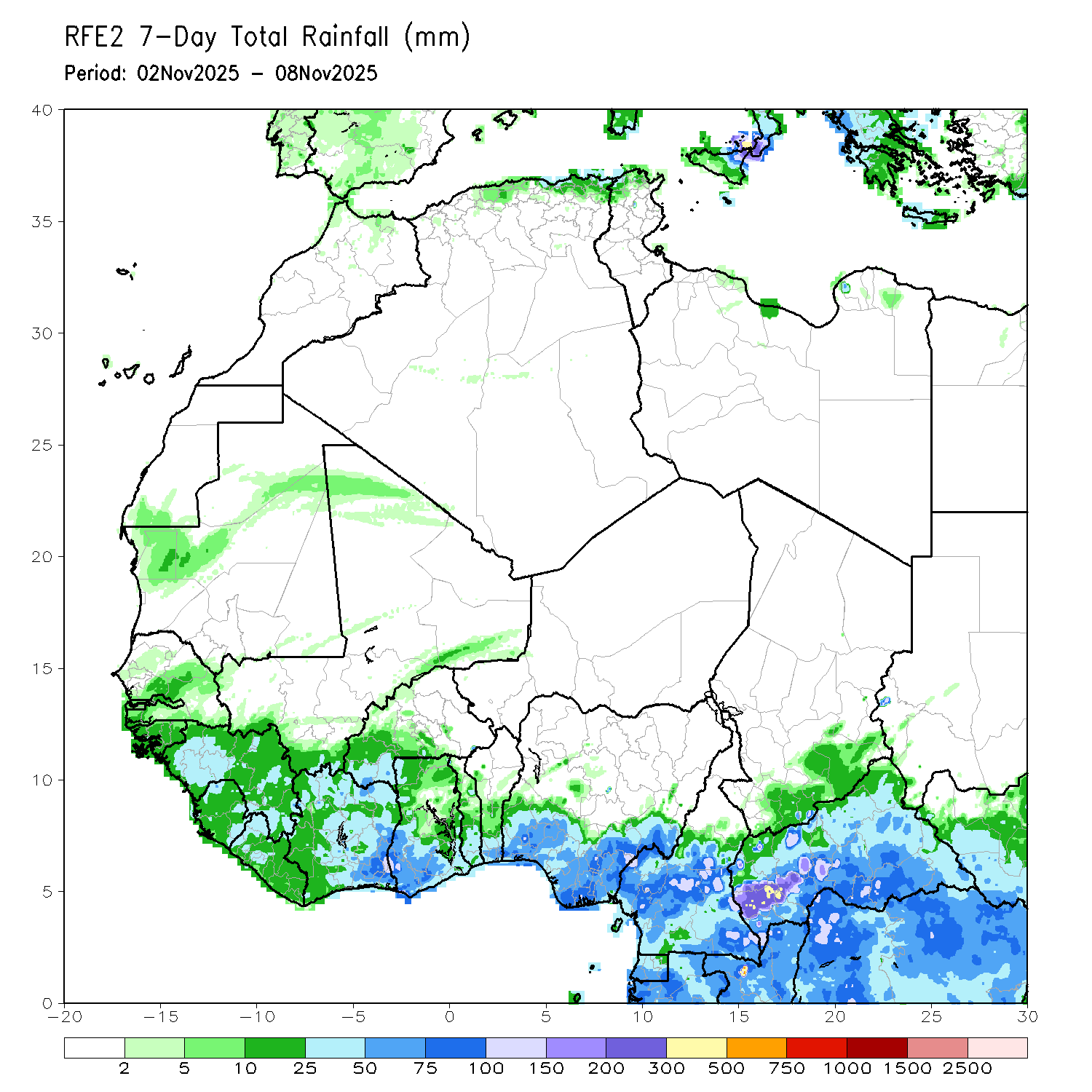

Weather Conditions

Recent NOAA and FEWS NET rainfall maps indicate persistent moisture across southern Côte d’Ivoire, Ghana, and Nigeria, with weekly totals between 50–150 mm — well above the mid-November average. The heaviest accumulation occurred along the southern cocoa belt from Abidjan through Kumasi to Cross River, supporting pod growth and bean filling.

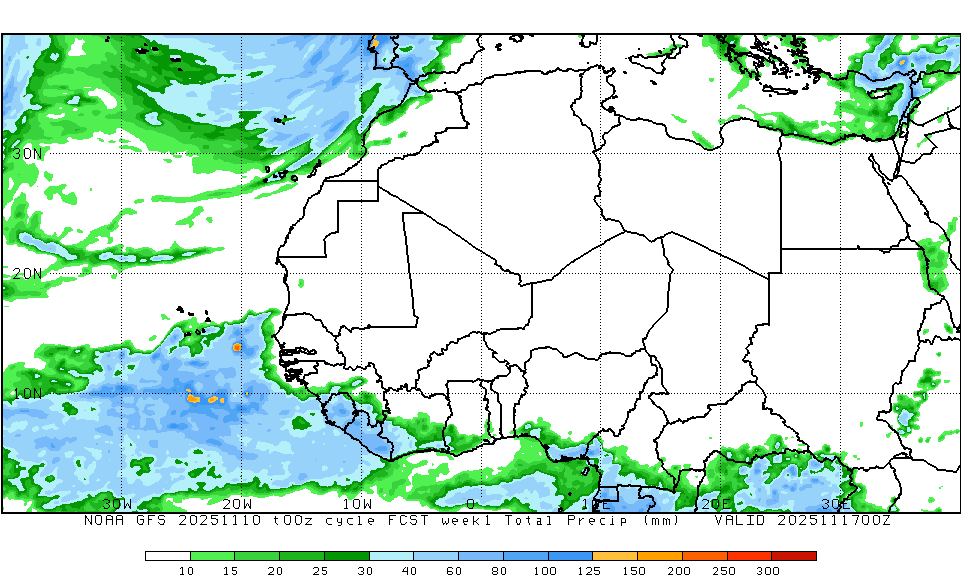

Looking ahead, NOAA GFS forecasts (valid through Nov 17) show continued rainfall pockets along the coastal and mid-belt zones, while northern Ghana and interior Côte d’Ivoire remain mostly dry. This gradient pattern — wet south, dry north — suggests that the Harmattan onset remains delayed, with no major dry air incursions yet observed from the Sahel.

Implications for the cocoa crop:

- The moisture surplus will support late main-crop pod maturation, maintaining bean size and fermentation quality.

- However, prolonged humidity in western Ghana and southeastern Côte d’Ivoire increases the risk of black pod disease if drying intervals remain short.

- The weak northeasterly winds visible across Mali and Niger indicate a suppressed early Harmattan, consistent with ENSO-linked delayed dry-season transitions observed in past mild years (notably 2016 and 2020).

Conclusion:

The rainfall distribution continues to favor production stability for the coming weeks. Traders should monitor for the first strong dust plume events later in November — once Sahel dryness intensifies — as that will mark the seasonal shift toward Harmattan-driven supply stress.

Harmattan Risk Forecast (as of Nov 7, 2025)

Current Assessment:

Weak Harmattan activity persists. Maritime moisture inflow continues to dominate, maintaining healthy humidity levels.

Short-Term (1–2 weeks):

Scattered rainfall and light winds expected. Little to no dust intrusion.

Medium-Term (late Nov–mid Dec):

Forecast models show possible strengthening of northeasterly winds but still below 10-year seasonal averages.

Historical Comparison (10-Year Trend):

Weak early Harmattan seasons (e.g., 2016, 2020) correlated with 3–5% higher pod-fill rates and delayed bean shrinkage into Q1.

If current trends persist, bean size and weight could improve modestly, helping stabilize mid-crop expectations.

However, a late-season surge in dust and dryness could rapidly reverse gains — a scenario traders remain cautious about.

Impact Outlook:

Low immediate risk; conditions remain favorable for pod filling and drying.

Monitoring Sahel wind speeds and humidity anomalies remains essential through late November.

Regional Risk Notes – Cameroon & Nigeria

Cameroon

The Anglophone conflict persists in the Northwest and Southwest — both key cocoa regions.

Recent military operations have intensified after renewed separatist attacks, disrupting farmer mobility and truck movements.

Despite relative calm near Douala and Littoral, insecurity continues to limit deliveries and warehouse restocking.

Cameroon’s annual export potential (~250,000 t) remains at risk; any sustained unrest could tighten certified stocks further.

Nigeria

Security conditions remain volatile, with banditry and theft in Ondo and Cross River regions disrupting harvests.

Economic reforms and high inflation continue to weigh on rural communities, while fuel costs hinder bean transport.

Processing investment in Lagos and Ondo offers medium-term hope, but logistics bottlenecks persist.

Political rhetoric has cooled following recent U.S. remarks, but tensions remain elevated across the Sahel.

Term Structure – Contango vs. Backwardation

| Market | Dec 2025 (Close) | Mar 2026 (Close) | May 2026 (Close) | Jul 2026 (Close) | Structure |

|---|---|---|---|---|---|

| New York (CC) | $5,998 | $6,120 | $6,152 | $6,145 | Mild Contango / Flattening |

| London (LCC) | £4,321 | £4,425 | £4,412 | £4,400 | Mild Contango / Flat |

Spread Analysis

- NY Mar–Dec = +$122 → +2.0 %

- NY May–Mar = +$32 → +0.5 %

- LDN Mar–Dec = +£104 → +2.4 %

Interpretation:

The cocoa forward curve remains mildly upward-sloping, reflecting carry costs and hedge adjustments rather than abundant supply.

Flattening beyond March suggests expectations for better arrivals and modest demand softening, aligning with the post-Halloween consumption lull and ongoing restocking in Europe.

Weekly Summary Box

| Metric | Nov 1, 2025 | Nov 7, 2025 | % Change |

|---|---|---|---|

| ICE US Certified Stocks | 1,815,627 t | 1,800,805 t | –0.8 % |

| ICE UK Certified Stocks | 489,219 t | 499,063 t | +2.0 % |

| NY Dec 25 Cocoa | $6,186 (Thu) | $5,998 (Fri) | –3.0 % |

| London Dec 25 Cocoa | £4,445 (Thu) | £4,321 (Fri) | –2.8 % |

| Combined Weekly Volume | 180,000 lots | 200,000 lots | +11 % |

Conclusion

Cocoa prices ended the week on a softer note, retreating from early-month highs as speculative long liquidation and seasonal demand fatigue dominated trade.

While certified stocks posted a modest recovery in both London and New York, overall inventories remain historically tight, underscoring the market’s fragile supply base.

The short-term tone is technically bearish but fundamentally resilient — a classic late-season consolidation as traders await clearer signals from West African arrivals, Harmattan onset patterns, and fund re-engagement linked to the upcoming Bloomberg Commodity Index inclusion.

Industry developments, particularly Barry Callebaut’s move into alternative cocoa products and Hershey’s weaker-than-expected Halloween sales, highlight the sector’s effort to adapt to record input costs and changing consumer dynamics.

At the same time, regional instability in Cameroon and Nigeria continues to pose downside risk to supply stability, ensuring that any bearish correction remains limited.

With RSI indicators nearing oversold territory and weather models still pointing to a mild Harmattan, the market may soon find technical support near $5,900–$6,000 before stabilizing into mid-November.

Traders should expect continued volatility within a tightening structural backdrop — a market balancing between fragile supply recovery and the first signs of industrial demand adaptation.