What Really Happened to Cocoa Prices: A Complete Breakdown of the 2023–2025 Boom and Collapse

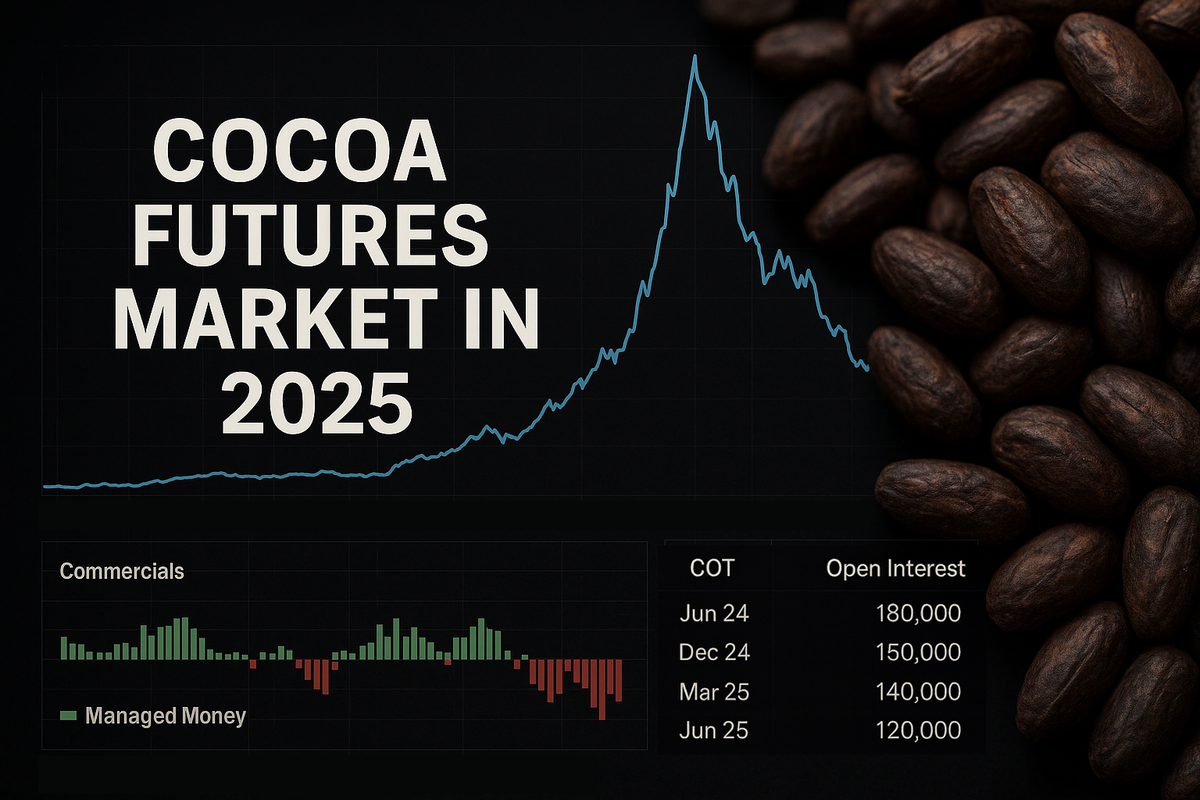

Cocoa spent most of 2023 trading quietly around $2,500 per ton, a level aligned with long-standing supply and demand equilibria. That calm ended as structural weakness in West Africa, the region responsible for over 70% of global output, began to surface simultaneously. Untreated swollen-shoot disease, exhausted soil, and aging trees collided with erratic rainfall patterns, turning what looked like another routine production deficit into a multi-year structural shortfall. By early 2024, New York cocoa futures surged past $7,000 per ton, reflecting not merely a crop failure but the erosion of resilience across the entire cultivation system. On 26 March 2024, the market breached the unprecedented $10,000/ton threshold, later touching above $12,000, driven by the tightest physical availability seen since the 1970s.

The repricing, however, did not hold. By mid-2025, cocoa had fallen back toward $5,000, erasing roughly half the rally and marking an extraordinary boom and bust sequence. The fundamentals that ignited the price surge, including weak farm investment, depleted inventories, destructive weather, and systemic under-capacity in replanting programs, were genuine. But the extraordinary shape of the price curve, the almost vertical ascent followed by an equally forceful reversal, came from the financial architecture surrounding cocoa futures rather than purely from the physical market.

For decades, cocoa futures were anchored by hedgers: grinders, merchants, and industrial buyers who provided depth and behaved predictably. But volatility in 2024 altered the valuation framework for these participants. Hedge ratios that once stabilized earnings suddenly multiplied balance-sheet risk. The contract’s value-at-risk no longer resembled an input hedge; it behaved like leveraged exposure that could destabilize quarterly financials. Risk officers raised internal capital charges. Treasury departments demanded additional liquidity buffers. Firms that had reliably provided two-sided flow began reducing activity, not out of speculation but out of defensive repositioning.

As these traditional players recalibrated, algorithmic funds, CTAs, and macro programs became the dominant marginal price-setters. Their motivations were unconnected to physical demand, crop cycles, or processing margins. They traded signals such as breakouts, moving averages, and volatility regimes, and executed flows in a market engineered for a far smaller audience. Models treated cocoa like any other asset: when price exceeded long-term resistance, they expanded exposure; when realized volatility changed state, they resized mechanically. These automated strategies absorbed liquidity, but they did not create it. Their impact magnified because they competed against one another rather than against commercial hedgers with offsetting needs.

The reconfiguration of the order book accelerated as new entrants, including retail traders, short-term prop desks, and opportunistic speculators, joined in. They increased headline turnover but offered little depth. Many used broker platforms that routed orders through smart-order systems optimized for equities, not for fragile agricultural contracts. These tools fragmented executions into micro-lots that still moved prices due to the thin resting liquidity. The result was an environment where 20-lot orders could shift benchmarks, and intraday swings of 5 to 10% reflected mechanical behavior rather than changes in crop expectations.

The first major inflection came in late 2023 and early 2024, when widespread production failures in Ghana and Côte d’Ivoire converged with bullish analyst projections. Trading models registered multi-month breakouts, while discretionary commodity funds framed cocoa as the most asymmetric long in the softs complex. The combination produced layered buying: directional CTAs adding length, macro programs rotating into commodities as an inflation hedge, and volatility-targeting systems increasing exposure during the initial price advance. None of these strategies required knowledge of port arrivals or grind margins; the signal was purely statistical, and it triggered uniformly.

In Q1 to Q2 2024, the risk environment changed abruptly. Realized volatility exploded, prompting exchanges, brokers, and risk committees to raise collateral requirements. This sparked a chain reaction: participants who could previously maintain large directional positions found themselves forced to reduce size, not because their views changed but because capital became the binding constraint. The resulting deleveraging did not discriminate. Systematic funds, discretionary traders, and even structured commodity vehicles reduced exposure. Cross-asset spreads tightened as clearinghouses demanded more initial and variation margin from everything correlated with cocoa. Each forced adjustment translated into additional selling pressure, compressing open interest to levels not seen for a decade.

As 2024 progressed, marginal improvements in West African production forecasts lifted some of the fear premium. Demand data also began to break: chocolate manufacturers reported weak grind numbers in Europe and Southeast Asia, with price-sensitive consumers shifting toward lower-cocoa formulations. These developments, normally manageable for the market, became catalytic because they arrived in the aftermath of heavy position compression. Models that had turned long during the breakout now detected trend decay; others registered volatility spikes that mandated position cuts. The subsequent wave of systematic selling pushed cocoa into a new regime where small shifts in supply expectations produced outsized mechanical reactions.

Execution technology compounded the fragility. Many large funds employed slicing algorithms optimized for deep markets like crude oil or equity index futures. In cocoa, these algorithms interacted poorly with sparse liquidity. They distributed orders linearly in time rather than adapting to order-book depth, meaning a strategy designed to reduce market impact sometimes amplified it by walking through thin layers of bids or offers. At the same time, options dealers managing their gamma exposure contributed to destabilizing flows: when cocoa burst through major psychological levels, dealers hedged dynamically, accelerating both upward extensions and downward cascades.

Position concentration added another distortion. While not repeated in public disclosures, industry analyses indicated that several major systematic funds held exposures large relative to average daily volume. Their presence created asymmetric tail risks: any coordinated reduction, even if unintentional, translated into significant directional pressure. Meanwhile, parts of the physical market were navigating a different crisis altogether. Ghana’s forward marketing mechanism broke down, disrupting delivery reliability and casting uncertainty over the benchmark contract’s alignment with the underlying commodity. As trust in the contract weakened, some merchants shifted to bilateral agreements, reducing transparent price discovery even further.

By 2025, major chocolate manufacturers reassessed their hedging architecture. They had already locked in higher input costs and passed them through to consumers via shrinkflation and reformulation. Once prices retreated, procurement teams faced a different dilemma: hedging through futures now required committing capital at levels unfamiliar to an industry accustomed to stable soft-commodity volatility. Internal audit teams revised exposure policies. Boards demanded risk frameworks that limited reliance on a contract deemed structurally unstable. Many firms turned to longer-dated physical supply agreements, private forward deals, or diversified sourcing strategies instead of reengaging with ICE cocoa futures.

The outcome was a futures market trading near $5,000 but functioning without its historical stabilizers. Open interest remained low, depth insufficient, and price formation more sensitive to algorithmic behavior than to grinding margins or farmer incomes. The market increasingly resembled a volatility laboratory: a place where mechanical strategies interacted with thin liquidity, producing exaggerated reactions to otherwise routine data.

The consequences extended across the value chain. Farmers saw little benefit from the 2024 price explosion; government-controlled farmgate systems insulated them from global benchmarks, and structural issues such as disease, limited fertilizer availability, and inadequate financing remained unresolved. Manufacturers dealt with chaotic input costs, broken correlations between hedges and physical exposure, and complexity in forecasting demand. Consumers absorbed permanent price increases. The beneficiaries were those positioned early enough to exit before the parabolic phase inverted, and trading firms capable of exploiting intraday volatility through speed and precision rather than directional conviction.

Repairing the cocoa market requires redesigning its institutional scaffolding. Regulators must implement position frameworks calibrated to market depth rather than nominal notional exposure. Clearinghouses should modernize margin methodologies to distinguish between hedges backed by physical flows and speculative leverage insensitive to underlying fundamentals. Exchanges must reconsider contract specifications, settlement mechanisms, and delivery reliability to rebuild confidence. Increased transparency around participant categories and concentration metrics would help prevent structural imbalances from forming unnoticed. And before cocoa re-enters major commodity indices, policymakers must evaluate whether the market’s liquidity can absorb passive flows without distorting price discovery.

Cocoa’s recent history is not an indictment of any single group. It is the predictable outcome of systematic strategies operating inside a market whose design belongs to an earlier era. The lesson for traders is straightforward: understand the forces that actually move prices. Monitor positioning transitions, volatility states, and margin frameworks. Track the behavior of liquidity rather than assuming it exists. And above all, recognize that in markets with fragile microstructure, the decisive factor in extreme conditions is not fundamentals; it is flow.